- Poland

- /

- Metals and Mining

- /

- WSE:JSW

Some Shareholders Feeling Restless Over Jastrzebska Spólka Weglowa S.A.'s (WSE:JSW) P/S Ratio

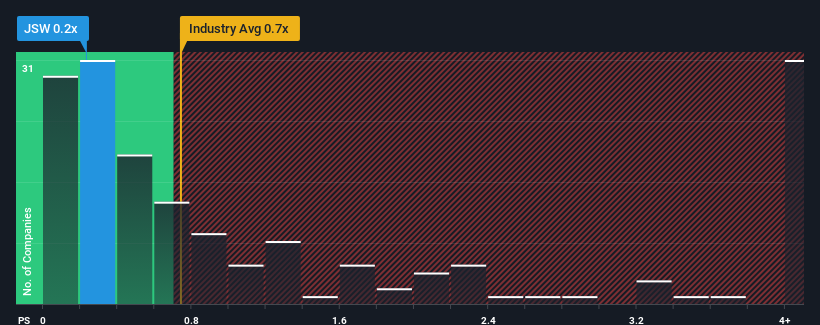

It's not a stretch to say that Jastrzebska Spólka Weglowa S.A.'s (WSE:JSW) price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" for companies in the Metals and Mining industry in Poland, where the median P/S ratio is around 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Jastrzebska Spólka Weglowa

How Jastrzebska Spólka Weglowa Has Been Performing

With revenue that's retreating more than the industry's average of late, Jastrzebska Spólka Weglowa has been very sluggish. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. You'd much rather the company improve its revenue if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on Jastrzebska Spólka Weglowa will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Jastrzebska Spólka Weglowa's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 28% decrease to the company's top line. Still, the latest three year period has seen an excellent 105% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 0.2% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 226% per annum, which is noticeably more attractive.

With this information, we find it interesting that Jastrzebska Spólka Weglowa is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Jastrzebska Spólka Weglowa's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at the analysts forecasts of Jastrzebska Spólka Weglowa's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Jastrzebska Spólka Weglowa with six simple checks.

If these risks are making you reconsider your opinion on Jastrzebska Spólka Weglowa, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:JSW

Jastrzebska Spólka Weglowa

Engages in the extraction, production, and sale of coal, coke, and hydrocarbons in Poland, Austria, the Czech Republic, Germany, Slovakia, Belgium, Spain, Norway, Switzerland, Romania, Singapore, Italy, Luxembourg, Holland, France, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success