Stock Analysis

- Poland

- /

- Metals and Mining

- /

- WSE:JSW

Investors five-year losses continue as Jastrzebska Spólka Weglowa (WSE:JSW) dips a further 4.3% this week, earnings continue to decline

Ideally, your overall portfolio should beat the market average. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Jastrzebska Spólka Weglowa S.A. (WSE:JSW) shareholders for doubting their decision to hold, with the stock down 26% over a half decade. And some of the more recent buyers are probably worried, too, with the stock falling 25% in the last year.

After losing 4.3% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Jastrzebska Spólka Weglowa

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Jastrzebska Spólka Weglowa became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

Revenue is actually up 19% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

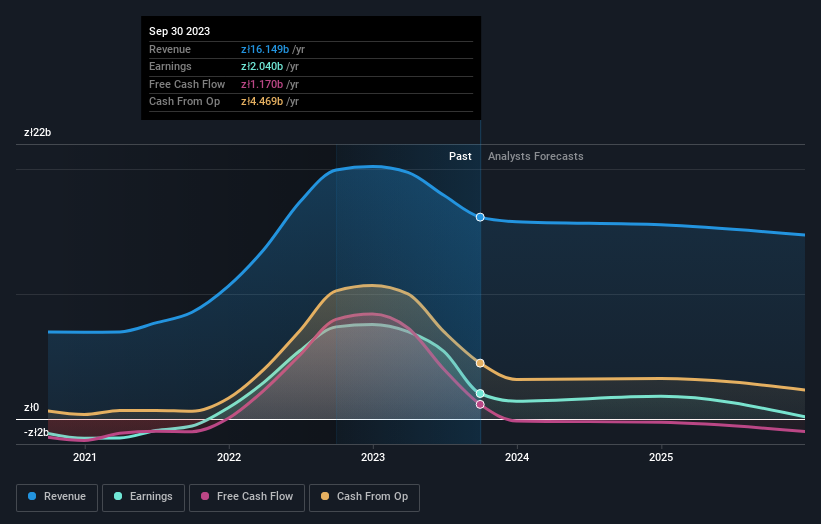

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Jastrzebska Spólka Weglowa stock, you should check out this free report showing analyst profit forecasts.

What About The Total Shareholder Return (TSR)?

We've already covered Jastrzebska Spólka Weglowa's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Jastrzebska Spólka Weglowa shareholders, and that cash payout explains why its total shareholder loss of 21%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Jastrzebska Spólka Weglowa shareholders are down 25% for the year, but the market itself is up 32%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 4% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Jastrzebska Spólka Weglowa better, we need to consider many other factors. For example, we've discovered 2 warning signs for Jastrzebska Spólka Weglowa (1 can't be ignored!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Polish exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Jastrzebska Spólka Weglowa is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:JSW

Jastrzebska Spólka Weglowa

Jastrzebska Spólka Weglowa S.A. engages in the extraction, production, and sale of coal, coke, and hydrocarbons.

Adequate balance sheet and fair value.