- Poland

- /

- Metals and Mining

- /

- WSE:JSW

Investors Continue Waiting On Sidelines For Jastrzebska Spólka Weglowa S.A. (WSE:JSW)

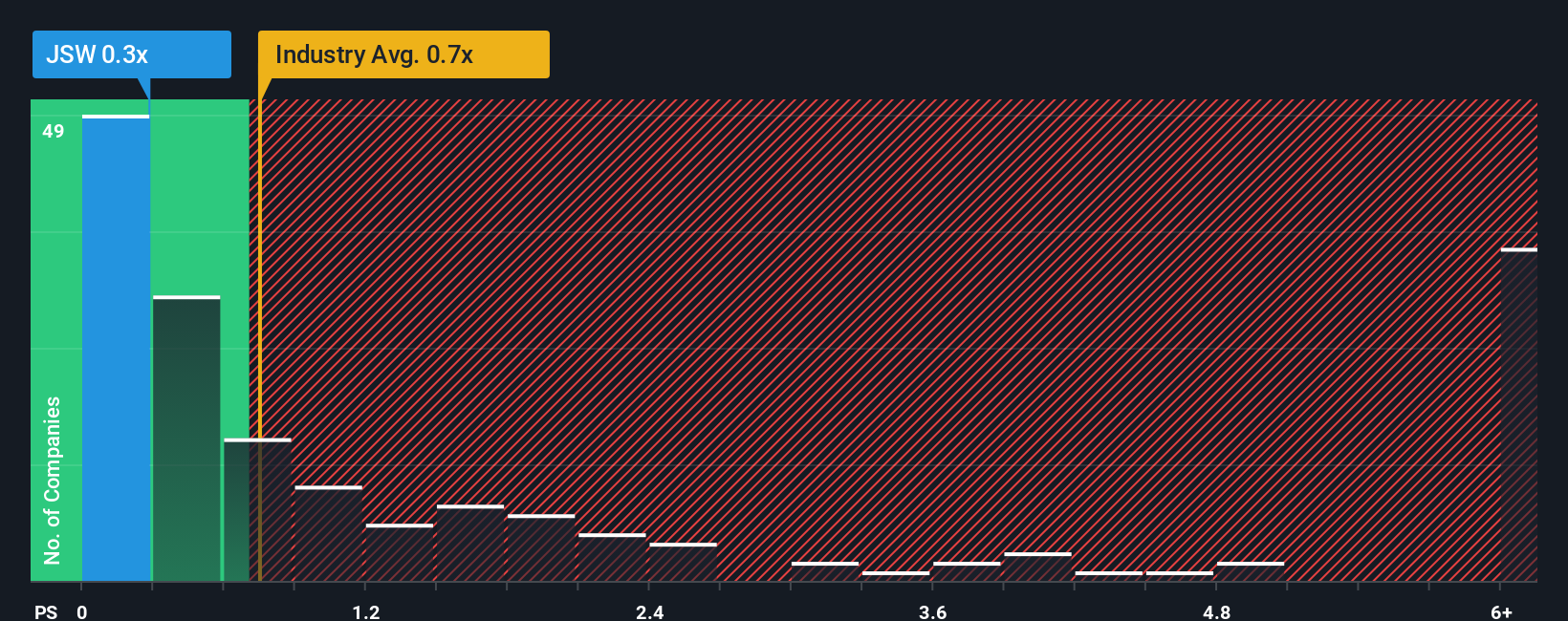

It's not a stretch to say that Jastrzebska Spólka Weglowa S.A.'s (WSE:JSW) price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" for companies in the Metals and Mining industry in Poland, where the median P/S ratio is around 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Jastrzebska Spólka Weglowa

How Has Jastrzebska Spólka Weglowa Performed Recently?

While the industry has experienced revenue growth lately, Jastrzebska Spólka Weglowa's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Jastrzebska Spólka Weglowa will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Jastrzebska Spólka Weglowa's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 28%. As a result, revenue from three years ago have also fallen 24% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 15% as estimated by the six analysts watching the company. That's shaping up to be materially higher than the 5.9% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Jastrzebska Spólka Weglowa's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Jastrzebska Spólka Weglowa currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Jastrzebska Spólka Weglowa you should know about.

If you're unsure about the strength of Jastrzebska Spólka Weglowa's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:JSW

Jastrzebska Spólka Weglowa

Engages in the extraction, production, and sale of coal, coke, and hydrocarbons in Poland, Austria, the Czech Republic, Germany, Slovakia, Belgium, Spain, Norway, Switzerland, Romania, Singapore, Italy, Luxembourg, Holland, France, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success