- Poland

- /

- Metals and Mining

- /

- WSE:JSW

Further weakness as Jastrzebska Spólka Weglowa (WSE:JSW) drops 8.7% this week, taking one-year losses to 49%

The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by Jastrzebska Spólka Weglowa S.A. (WSE:JSW) shareholders over the last year, as the share price declined 49%. That's disappointing when you consider the market returned 6.2%. To make matters worse, the returns over three years have also been really disappointing (the share price is 39% lower than three years ago). Even worse, it's down 9.2% in about a month, which isn't fun at all. However, we note the price may have been impacted by the broader market, which is down 4.8% in the same time period.

Since Jastrzebska Spólka Weglowa has shed zł283m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Jastrzebska Spólka Weglowa

Given that Jastrzebska Spólka Weglowa didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Jastrzebska Spólka Weglowa's revenue didn't grow at all in the last year. In fact, it fell 28%. That's not what investors generally want to see. Shareholders have seen the share price drop 49% in that time. That seems pretty reasonable given the lack of both profits and revenue growth. We think most holders must believe revenue growth will improve, or else costs will decline.

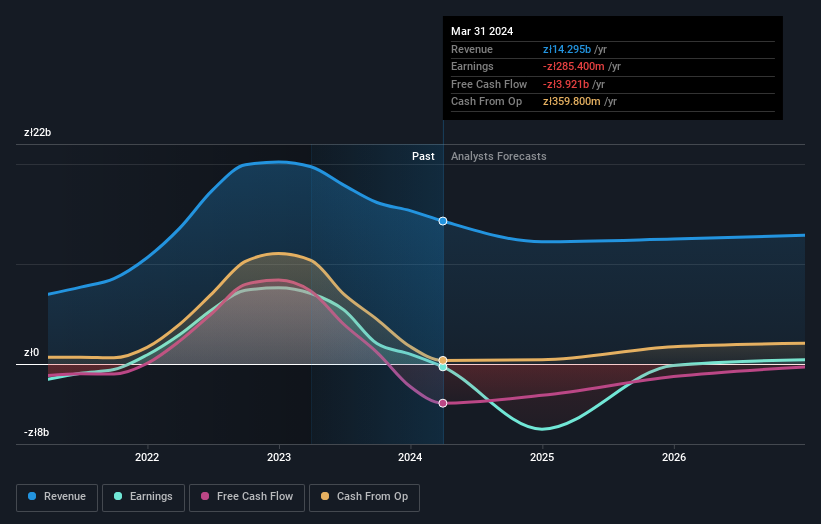

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 6.2% in the last year, Jastrzebska Spólka Weglowa shareholders lost 49%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 4% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

But note: Jastrzebska Spólka Weglowa may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Polish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:JSW

Jastrzebska Spólka Weglowa

Engages in the extraction, production, and sale of coal, coke, and hydrocarbons.

Adequate balance sheet and fair value.