- Poland

- /

- Metals and Mining

- /

- WSE:JSW

Broker Revenue Forecasts For Jastrzebska Spólka Weglowa S.A. (WSE:JSW) Are Surging Higher

Jastrzebska Spólka Weglowa S.A. (WSE:JSW) shareholders will have a reason to smile today, with the analysts making substantial upgrades to next year's statutory forecasts. The analysts have sharply increased their revenue numbers, with a view that Jastrzebska Spólka Weglowa will make substantially more sales than they'd previously expected. Investors have been pretty optimistic on Jastrzebska Spólka Weglowa too, with the stock up 71% to zł71.60 over the past week. It will be interesting to see if today's upgrade is enough to propel the stock even higher.

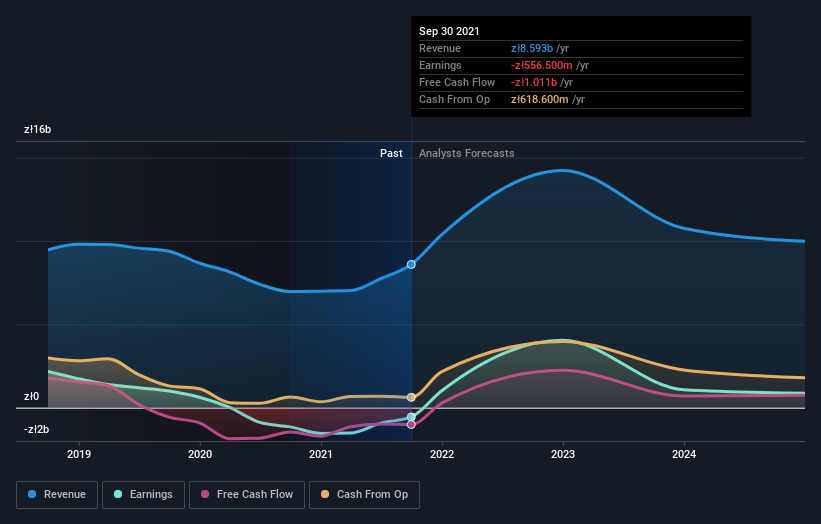

Following the upgrade, the current consensus from Jastrzebska Spólka Weglowa's five analysts is for revenues of zł16b in 2022 which - if met - would reflect a huge 83% increase on its sales over the past 12 months. Losses are expected to turn into profits real soon, with the analysts forecasting zł44.17 in per-share earnings. Prior to this update, the analysts had been forecasting revenues of zł14b and earnings per share (EPS) of zł32.34 in 2022. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

Check out our latest analysis for Jastrzebska Spólka Weglowa

It will come as no surprise to learn that the analysts have increased their price target for Jastrzebska Spólka Weglowa 35% to zł61.28 on the back of these upgrades. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Jastrzebska Spólka Weglowa, with the most bullish analyst valuing it at zł75.00 and the most bearish at zł27.90 per share. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. One thing stands out from these estimates, which is that Jastrzebska Spólka Weglowa is forecast to grow faster in the future than it has in the past, with revenues expected to display 62% annualised growth until the end of 2022. If achieved, this would be a much better result than the 0.5% annual decline over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 0.9% per year. Not only are Jastrzebska Spólka Weglowa's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for next year. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. There was also an increase in the price target, suggesting that there is more optimism baked into the forecasts than there was previously. Seeing the dramatic upgrade to next year's forecasts, it might be time to take another look at Jastrzebska Spólka Weglowa.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Jastrzebska Spólka Weglowa analysts - going out to 2024, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:JSW

Jastrzebska Spólka Weglowa

Engages in the extraction, production, and sale of coal, coke, and hydrocarbons in Poland, Austria, the Czech Republic, Germany, Slovakia, Belgium, Spain, Norway, Switzerland, Romania, Singapore, Italy, Luxembourg, Holland, France, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives