As the European market navigates a landscape of mixed economic signals, with the pan-European STOXX Europe 600 Index slightly down amid global growth concerns and a stronger euro, investors are keenly observing small-cap stocks for potential opportunities. In this environment, identifying promising stocks involves looking for companies that demonstrate resilience and adaptability to shifting economic conditions while maintaining strong fundamentals.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 3.60% | 33.84% | ★★★★★☆ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative (ENXTPA:CRLO)

Simply Wall St Value Rating: ★★★★☆☆

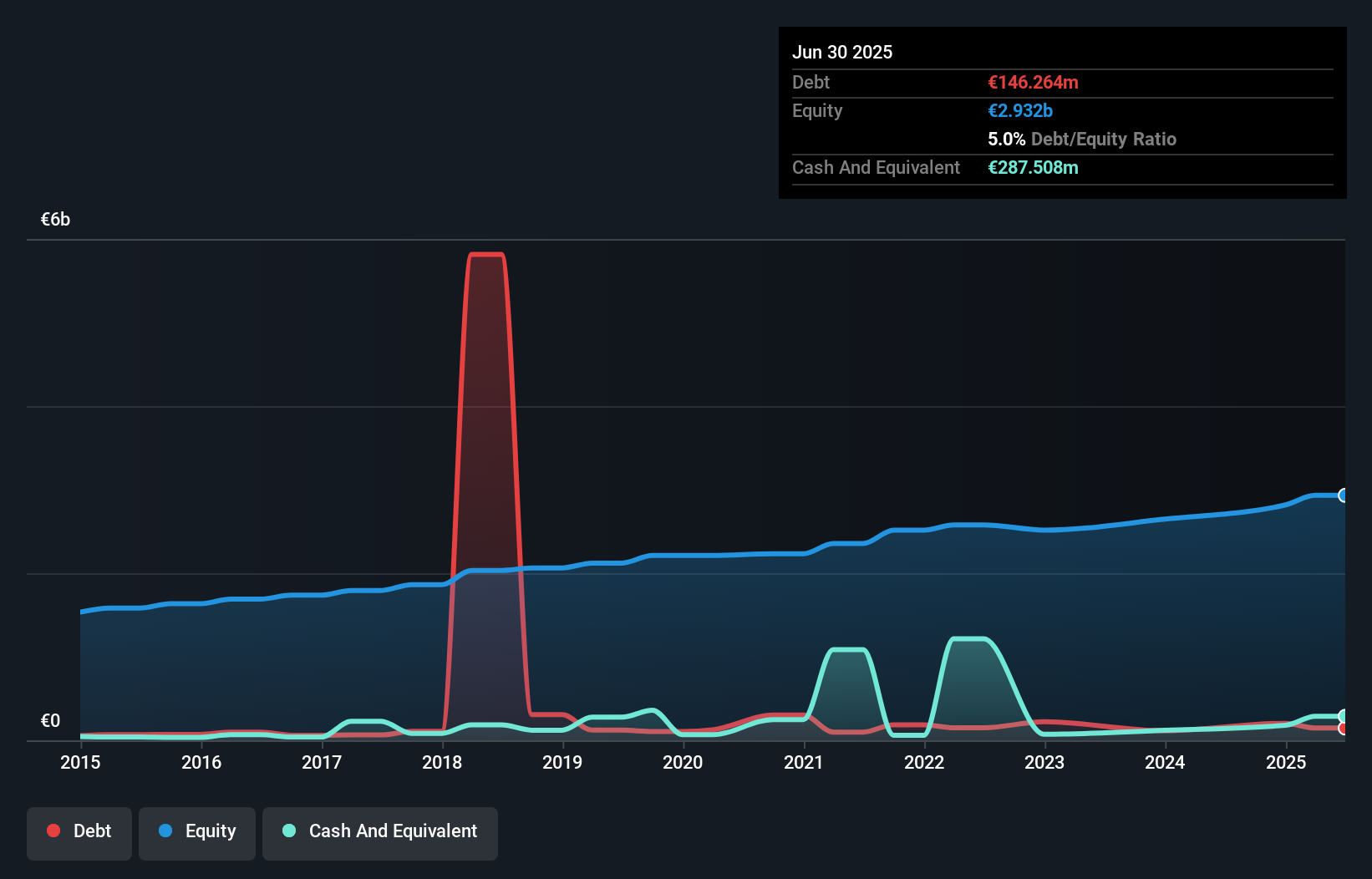

Overview: Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative offers a range of banking products and services to diverse customer segments in France, with a market capitalization of approximately €752 million.

Operations: CRLO generates revenue primarily from local banking in France (€234.80 million), leasing activity (€151.14 million), and land-related operations (€1.13 million).

With total assets of €15.2 billion and equity of €2.8 billion, CRLO stands out with a solid foundation in the banking sector. The company's earnings grew by 14.9% last year, surpassing the industry average of 3.2%. Despite having a high level of bad loans at 3.2%, CRLO benefits from primarily low-risk funding sources, with customer deposits making up 95% of liabilities, reducing external borrowing risks significantly. A price-to-earnings ratio at 9.7x further highlights its value compared to the French market's average of 15.5x, suggesting potential room for growth or improved valuation in the future.

Zinzino (OM:ZZ B)

Simply Wall St Value Rating: ★★★★★★

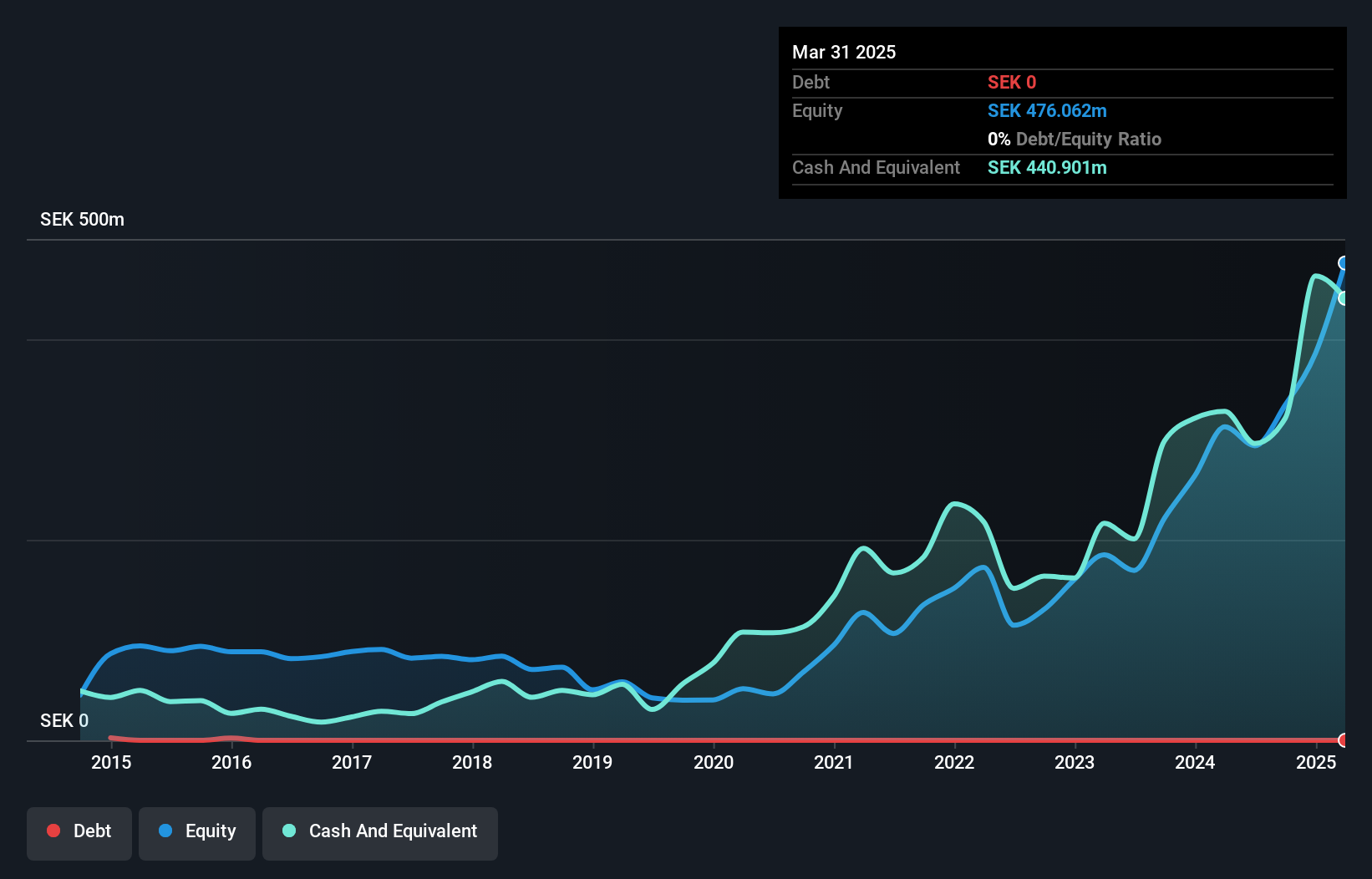

Overview: Zinzino AB (publ) is a direct sales company that offers dietary supplements and skincare products across Sweden and internationally, with a market capitalization of SEK6.32 billion.

Operations: Zinzino generates revenue primarily from its Zinzino (Incl. VMA Life) segment, which accounted for SEK2.68 billion in sales. The company also reports a smaller contribution from Faun, generating SEK177.77 million, while the Group Elimination impacts the overall figures by -SEK94.67 million.

Zinzino, a nimble player in the retail distributors sector, showcases impressive financial health with no debt and high-quality earnings. Over the past year, its earnings growth of 8.8% outpaced the industry average of 8.7%, highlighting robust performance. Recent sales announcements reveal a significant revenue surge of 55% year-to-date to SEK 2 billion compared to last year's SEK 1.3 billion, driven by strong market expansion efforts like those in the Philippines. Despite significant insider selling recently, Zinzino trades at nearly half its estimated fair value, suggesting potential undervaluation for investors seeking opportunities in this dynamic space.

- Get an in-depth perspective on Zinzino's performance by reading our health report here.

Understand Zinzino's track record by examining our Past report.

Voxel (WSE:VOX)

Simply Wall St Value Rating: ★★★★★★

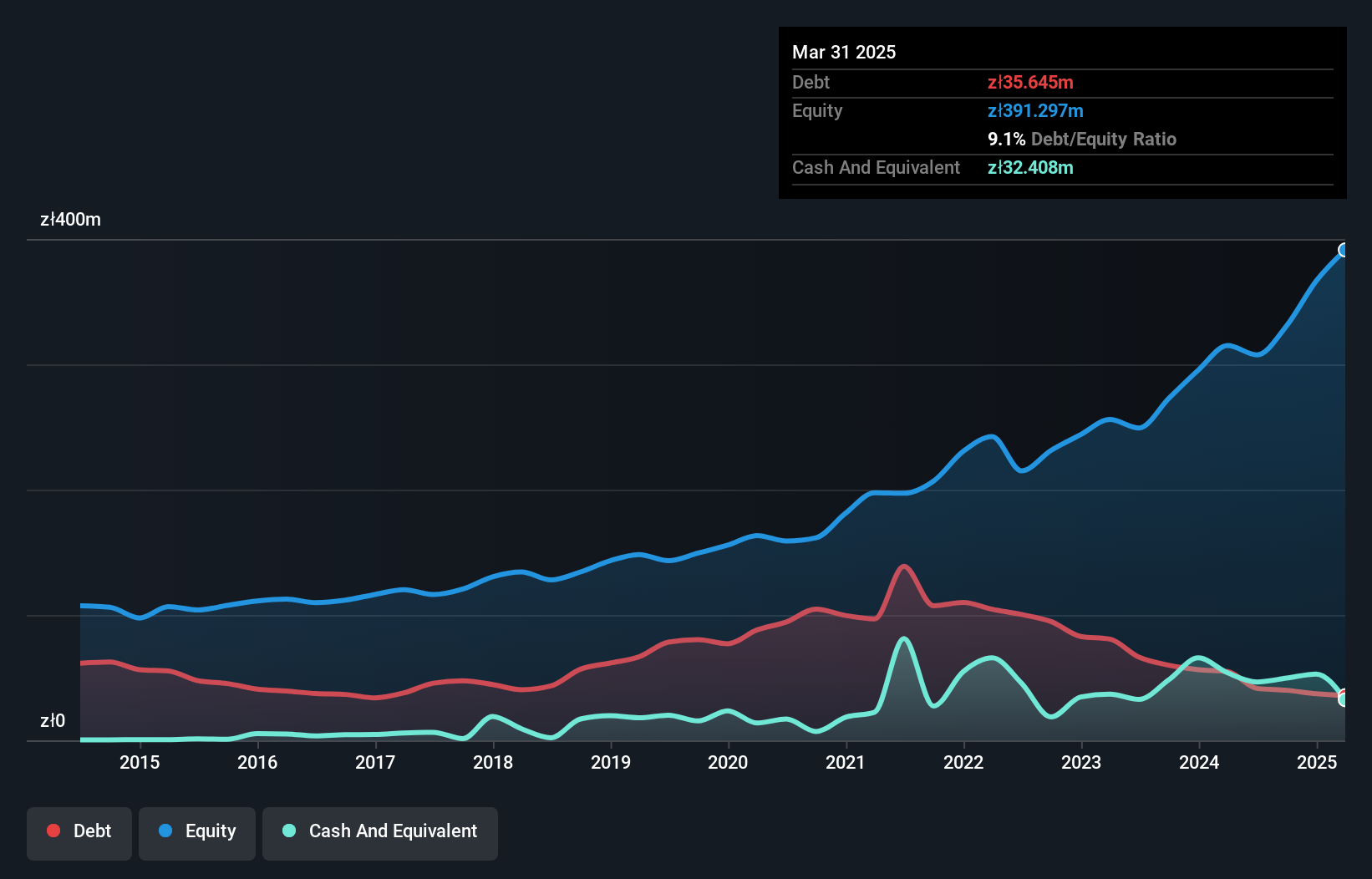

Overview: Voxel S.A. operates a network of diagnostic imaging laboratories in Poland with a market capitalization of PLN 1.84 billion.

Operations: Voxel S.A. generates revenue primarily through its network of diagnostic imaging laboratories in Poland. The company reported a market capitalization of PLN 1.84 billion.

Voxel, a nimble player in the European market, has been making strides with earnings growth of 12.7% over the past year, outpacing its industry peers. The company's financial health is underscored by a significant reduction in its debt-to-equity ratio from 59.4% to 1.6% over the last five years and having more cash than total debt, which points to prudent financial management. Recent earnings reports show sales for Q2 at PLN 127 million and net income slightly lower at PLN 21.88 million compared to last year’s figures, while six-month sales increased to PLN 285 million from PLN 233 million previously.

- Click to explore a detailed breakdown of our findings in Voxel's health report.

Explore historical data to track Voxel's performance over time in our Past section.

Make It Happen

- Click through to start exploring the rest of the 325 European Undiscovered Gems With Strong Fundamentals now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CRLO

Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative

Provides various banking products and services to individuals, professionals, farmers, business, public community and social housing, and associations in France.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives