- Sweden

- /

- Food and Staples Retail

- /

- OM:AXFO

European Market: 3 Stocks That Could Be Trading Below Fair Value

Reviewed by Simply Wall St

In recent weeks, the European market has experienced mixed performances across major stock indexes, with the pan-European STOXX Europe 600 Index declining slightly as expectations for further interest rate cuts from the European Central Bank diminished. Amid this backdrop of cautious monetary policy and steady inflation rates near target levels, investors are increasingly on the lookout for stocks that may be trading below their fair value, offering potential opportunities in a market characterized by both challenges and resilience.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vinext (BIT:VNXT) | €3.38 | €6.60 | 48.8% |

| Roche Bobois (ENXTPA:RBO) | €35.60 | €70.35 | 49.4% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.49 | €4.91 | 49.3% |

| NEUCA (WSE:NEU) | PLN792.00 | PLN1569.73 | 49.5% |

| Nagarro (XTRA:NA9) | €46.28 | €90.35 | 48.8% |

| KB Components (OM:KBC) | SEK40.90 | SEK81.69 | 49.9% |

| eDreams ODIGEO (BME:EDR) | €7.18 | €14.30 | 49.8% |

| doValue (BIT:DOV) | €2.61 | €5.18 | 49.6% |

| B&S Group (ENXTAM:BSGR) | €5.94 | €11.87 | 50% |

| Atea (OB:ATEA) | NOK150.60 | NOK299.40 | 49.7% |

Let's explore several standout options from the results in the screener.

Axfood (OM:AXFO)

Overview: Axfood AB (publ) operates in the food retail and wholesale sectors primarily in Sweden, with a market cap of SEK56.46 billion.

Operations: The company's revenue is derived from several segments: Dagab (SEK79.66 billion), Willys (SEK47.97 billion), Hemköp (SEK8.24 billion), and Snabbgross (SEK5.77 billion).

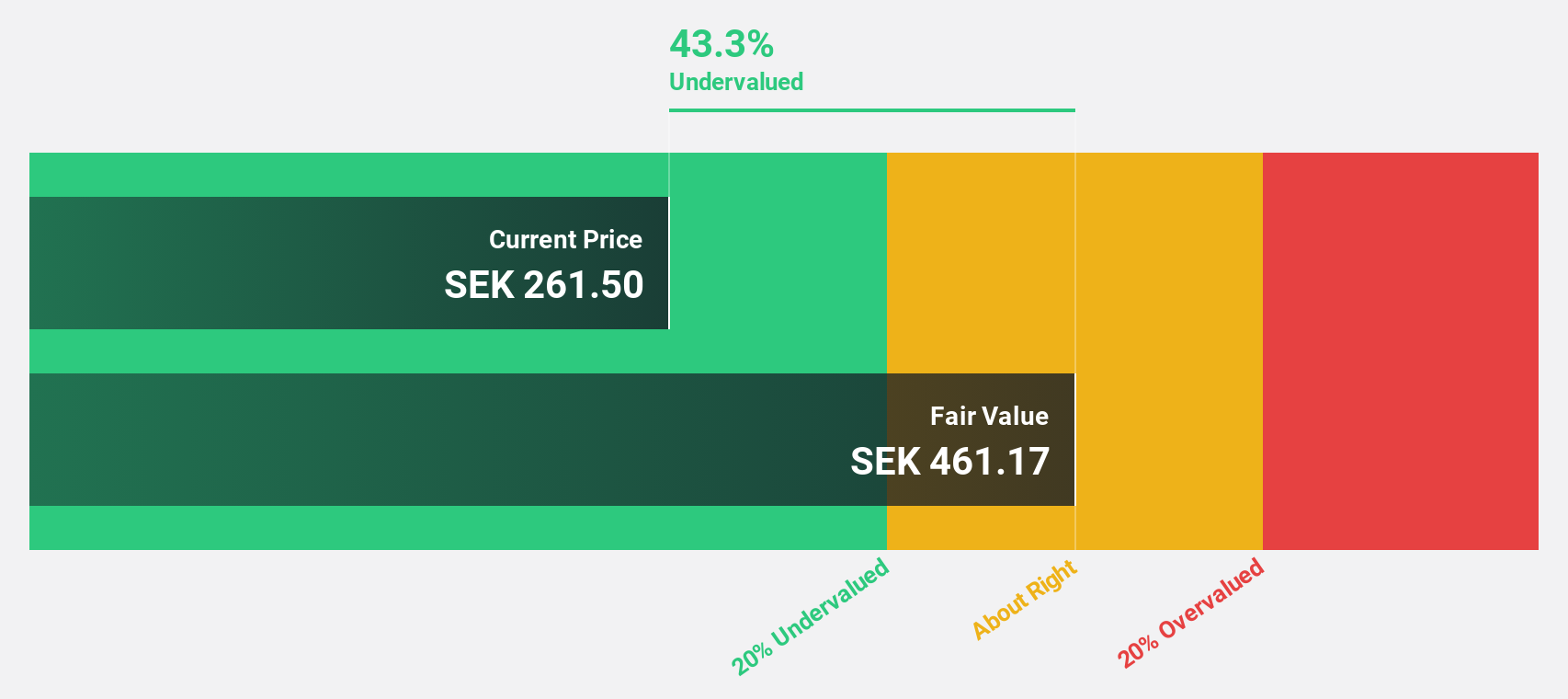

Estimated Discount To Fair Value: 43.3%

Axfood is trading at SEK261.5, significantly below its estimated fair value of SEK461.17, indicating potential undervaluation based on cash flows. The company's revenue is forecast to grow at 4.6% annually, outpacing the Swedish market's 3.7%. Recent earnings show stable performance with slight sales growth year-over-year for Q3 2025 and plans for a new logistics center could enhance future efficiency and capacity in southern Sweden, supporting long-term growth prospects.

- In light of our recent growth report, it seems possible that Axfood's financial performance will exceed current levels.

- Take a closer look at Axfood's balance sheet health here in our report.

NEUCA (WSE:NEU)

Overview: NEUCA S.A. operates in the wholesale distribution of pharmaceuticals in Poland, with a market cap of PLN3.55 billion.

Operations: The company's revenue segments include Pharmaceutical Wholesale (Including Marketing Services) at PLN11.98 billion, Medical Operator at PLN488.29 million, Clinical Studies at PLN456.74 million, Insurance Business at PLN204.71 million, and Pharmaceutical Manufacturing at PLN379.86 million.

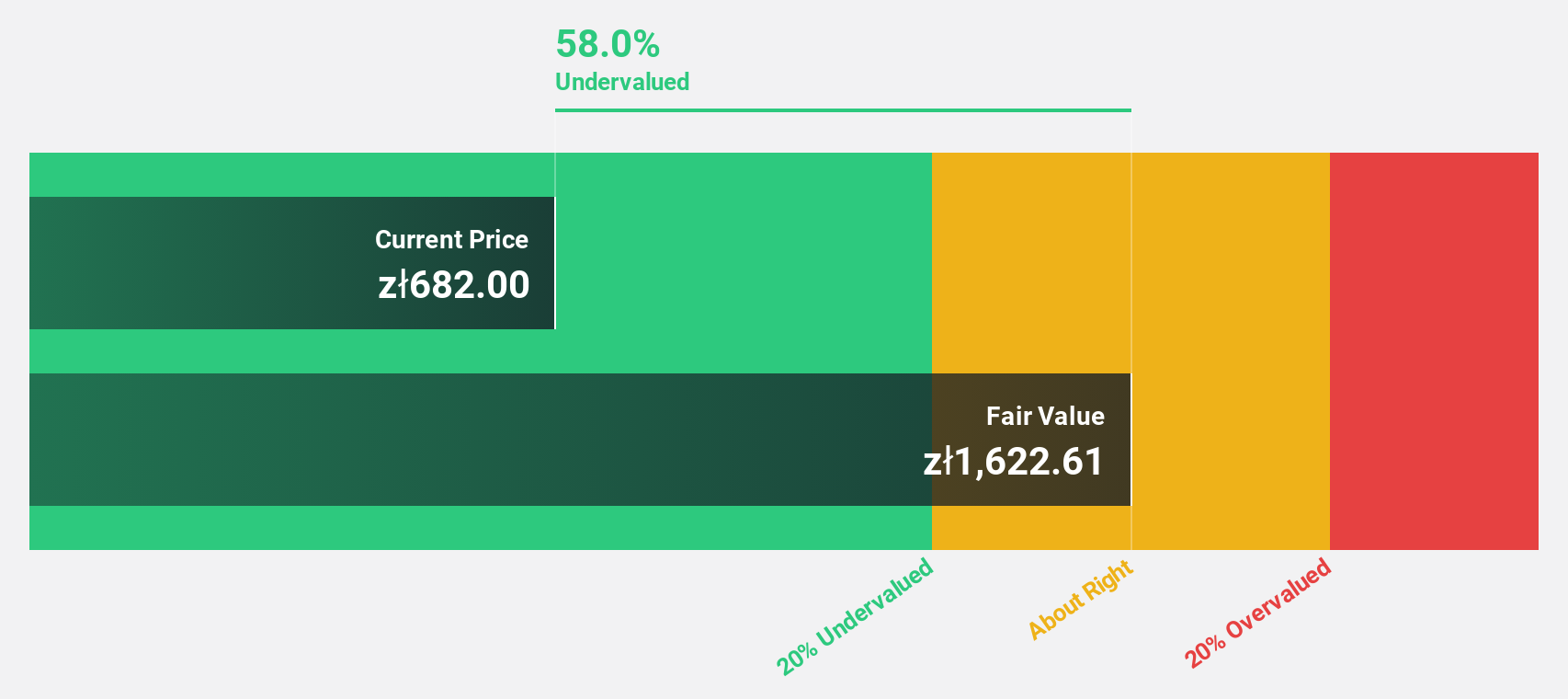

Estimated Discount To Fair Value: 49.5%

NEUCA is trading at PLN792, significantly below its estimated fair value of PLN1569.73, suggesting it is undervalued based on cash flows. The company's earnings are forecast to grow at 22.6% annually, outpacing the Polish market's 15.8%, although revenue growth of 4.8% per year is modestly higher than the market average of 4.4%. Despite a low return on equity forecasted at 15.4%, NEUCA's valuation remains attractive due to its substantial discount from fair value estimates.

- Upon reviewing our latest growth report, NEUCA's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of NEUCA.

Nordex (XTRA:NDX1)

Overview: Nordex SE, with a market cap of €6.34 billion, develops, manufactures, and distributes multi-megawatt onshore wind turbines globally through its subsidiaries.

Operations: Revenue Segments (in millions of €): The company generates revenue primarily through the development, manufacturing, and distribution of multi-megawatt onshore wind turbines worldwide.

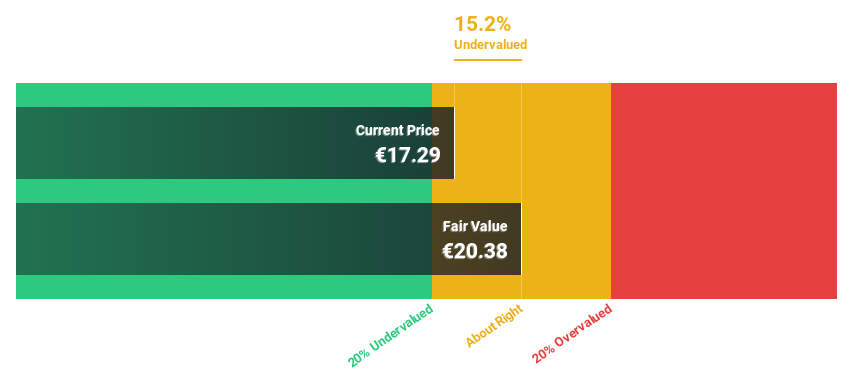

Estimated Discount To Fair Value: 35.8%

Nordex is trading at €26.82, considerably below its estimated fair value of €41.79, indicating it is undervalued based on cash flows. The company's earnings are projected to grow significantly at 33.68% annually, surpassing the German market's 16.9%. Recent financials show a turnaround with net income reaching €90.73 million from a prior loss, and revenue increasing to €5.21 billion for the nine months ended September 2025, reflecting strong operational performance despite recent share price volatility.

- Our earnings growth report unveils the potential for significant increases in Nordex's future results.

- Get an in-depth perspective on Nordex's balance sheet by reading our health report here.

Where To Now?

- Click here to access our complete index of 196 Undervalued European Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:AXFO

Axfood

Engages in the food retail and wholesale businesses primarily in Sweden.

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives