The European market has shown resilience, with the pan-European STOXX Europe 600 Index rising 1.77% amid relief over the U.S. federal government reopening, although cooling sentiment on artificial intelligence tempered gains. For investors willing to explore beyond well-known stocks, penny stocks—often representing smaller or newer companies—remain a relevant investment area despite being considered somewhat outdated. By focusing on those with robust financials and potential for growth, investors can uncover opportunities that offer both stability and upside in these lesser-known segments of the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.578 | €1.24B | ✅ 5 ⚠️ 2 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.82 | €85.6M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €1.995 | €27.57M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €245.95M | ✅ 3 ⚠️ 3 View Analysis > |

| Altri SGPS (ENXTLS:ALTR) | €4.67 | €957.96M | ✅ 3 ⚠️ 2 View Analysis > |

| Libertas 7 (BME:LIB) | €3.34 | €70.85M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.335 | €383.15M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €4.00 | €78.25M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.065 | €285.43M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 273 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Diadema Capital. Società Benefit (BIT:DIAD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Diadema Capital S.p.A. Società Benefit provides industrial consulting and strategic planning services in the agri-food and alternative and renewable energy sectors, with a market cap of €9.36 million.

Operations: The company generates revenue of €1.46 million from its asset management segment.

Market Cap: €9.36M

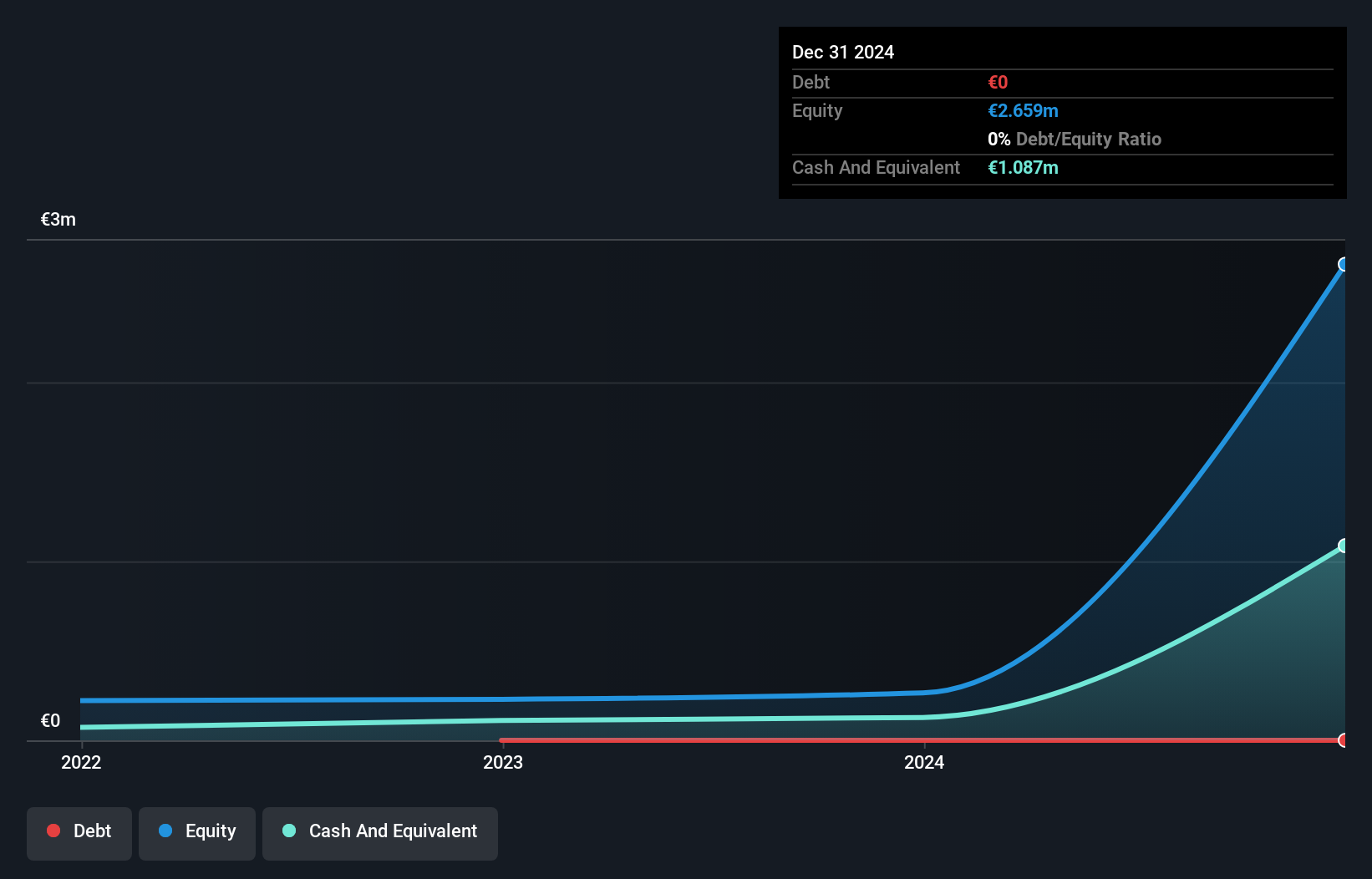

Diadema Capital S.p.A. Società Benefit, with a market cap of €9.36 million, operates without debt, alleviating concerns about interest payments. The company has shown significant earnings growth over the past year at 294%, surpassing industry averages, although its revenue remains modest at €1 million. Its net profit margin has improved to 9.6% from 3.2% last year, indicating enhanced profitability despite high share price volatility in recent months. Trading significantly below estimated fair value suggests potential undervaluation; however, the board's inexperience and limited revenue streams are points of caution for investors considering this penny stock opportunity.

- Click here to discover the nuances of Diadema Capital. Società Benefit with our detailed analytical financial health report.

- Evaluate Diadema Capital. Società Benefit's prospects by accessing our earnings growth report.

Sinteza (BVB:STZ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sinteza S.A. is involved in the production, marketing, and sale of basic organic chemical products in Romania, with a market cap of RON46.28 million.

Operations: The company's revenue is primarily derived from the manufacture of other organic basic chemicals, totaling RON0.57 million.

Market Cap: RON46.28M

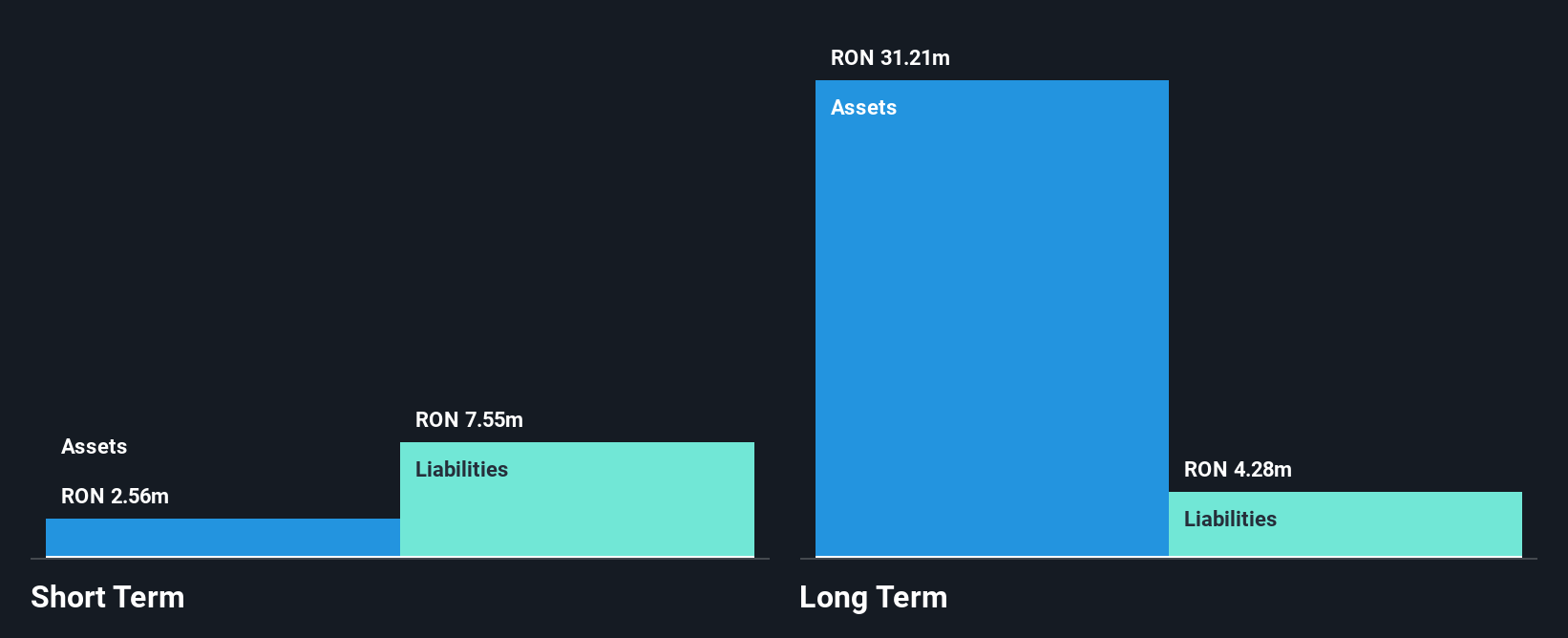

Sinteza S.A., with a market cap of RON46.28 million, is pre-revenue, generating less than US$1 million in revenue. Despite being unprofitable, the company maintains a satisfactory net debt to equity ratio of 10.1%, and its debt level has decreased over the past five years. While short-term assets do not cover liabilities, Sinteza's positive free cash flow provides a cash runway exceeding three years. Weekly volatility has improved significantly over the past year from 17% to 7%. Trading at 59.2% below estimated fair value may indicate potential undervaluation; however, investors should note the company's ongoing financial challenges and lack of profitability.

- Click here and access our complete financial health analysis report to understand the dynamics of Sinteza.

- Learn about Sinteza's historical performance here.

M Food (WSE:MFD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: M Food S.A. specializes in the production and distribution of honey and bee products both in Poland and internationally, with a market cap of PLN9.52 million.

Operations: The company generates revenue from its wholesale groceries segment, amounting to PLN116.09 million.

Market Cap: PLN9.52M

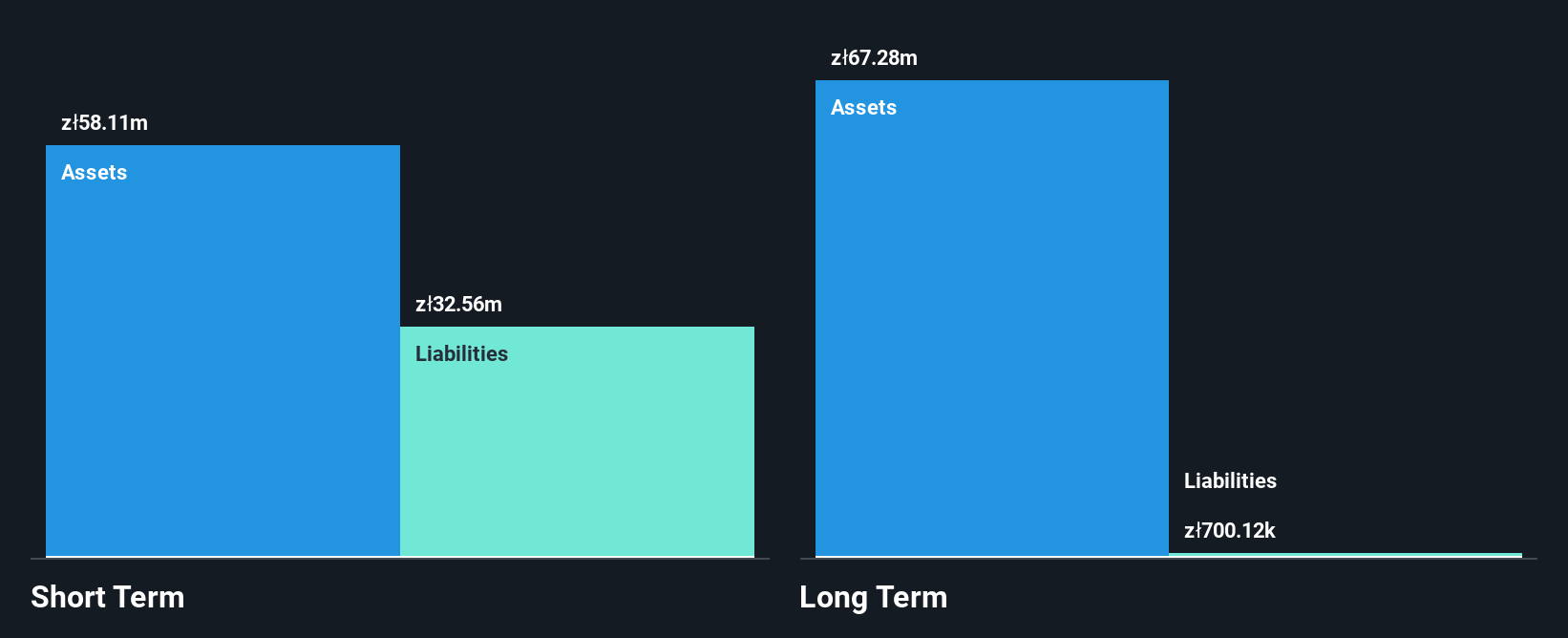

M Food S.A., with a market cap of PLN9.52 million, has recently turned profitable, although it faces challenges such as high share price volatility and low return on equity at 0.2%. The company's short-term assets of PLN56.6 million exceed both its short-term and long-term liabilities, indicating solid liquidity management. Despite a large one-off loss impacting recent financial results, M Food's debt is well covered by operating cash flow at 30.7%, and its net debt to equity ratio is satisfactory at 23.3%. Trading significantly below estimated fair value suggests potential undervaluation for investors to consider carefully.

- Click to explore a detailed breakdown of our findings in M Food's financial health report.

- Gain insights into M Food's past trends and performance with our report on the company's historical track record.

Summing It All Up

- Access the full spectrum of 273 European Penny Stocks by clicking on this link.

- Seeking Other Investments? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:MFD

Excellent balance sheet and good value.

Market Insights

Community Narratives