- Spain

- /

- Communications

- /

- BME:AMP

3 European Stocks Estimated To Be Trading At Discounts Up To 49.9%

Reviewed by Simply Wall St

As European markets experience a mixed sentiment influenced by global economic factors and cooling enthusiasm around artificial intelligence, investors are increasingly seeking opportunities in undervalued stocks. Identifying stocks that are trading at significant discounts can be a strategic move, especially when market conditions present both challenges and potential for growth.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN128.00 | PLN255.57 | 49.9% |

| STEICO (XTRA:ST5) | €20.20 | €40.18 | 49.7% |

| Mangata Holding (WSE:MGT) | PLN63.80 | PLN124.84 | 48.9% |

| Lingotes Especiales (BME:LGT) | €5.15 | €10.09 | 49% |

| KB Components (OM:KBC) | SEK41.20 | SEK81.10 | 49.2% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.392 | €0.78 | 49.9% |

| EcoUp Oyj (HLSE:ECOUP) | €1.36 | €2.66 | 48.9% |

| Bonesupport Holding (OM:BONEX) | SEK198.20 | SEK394.13 | 49.7% |

| Allcore (BIT:CORE) | €1.33 | €2.66 | 49.9% |

| Absolent Air Care Group (OM:ABSO) | SEK204.00 | SEK401.16 | 49.1% |

Let's explore several standout options from the results in the screener.

Amper (BME:AMP)

Overview: Amper, S.A. offers technological, industrial, and engineering solutions across defense, security, energy, sustainability, and telecommunications sectors both in Spain and globally with a market cap of €310.46 million.

Operations: The company's revenue is primarily derived from its Energy and Sustainability segment, which accounts for €300.94 million, followed by the Defense, Security and Telecommunications segment at €87.66 million.

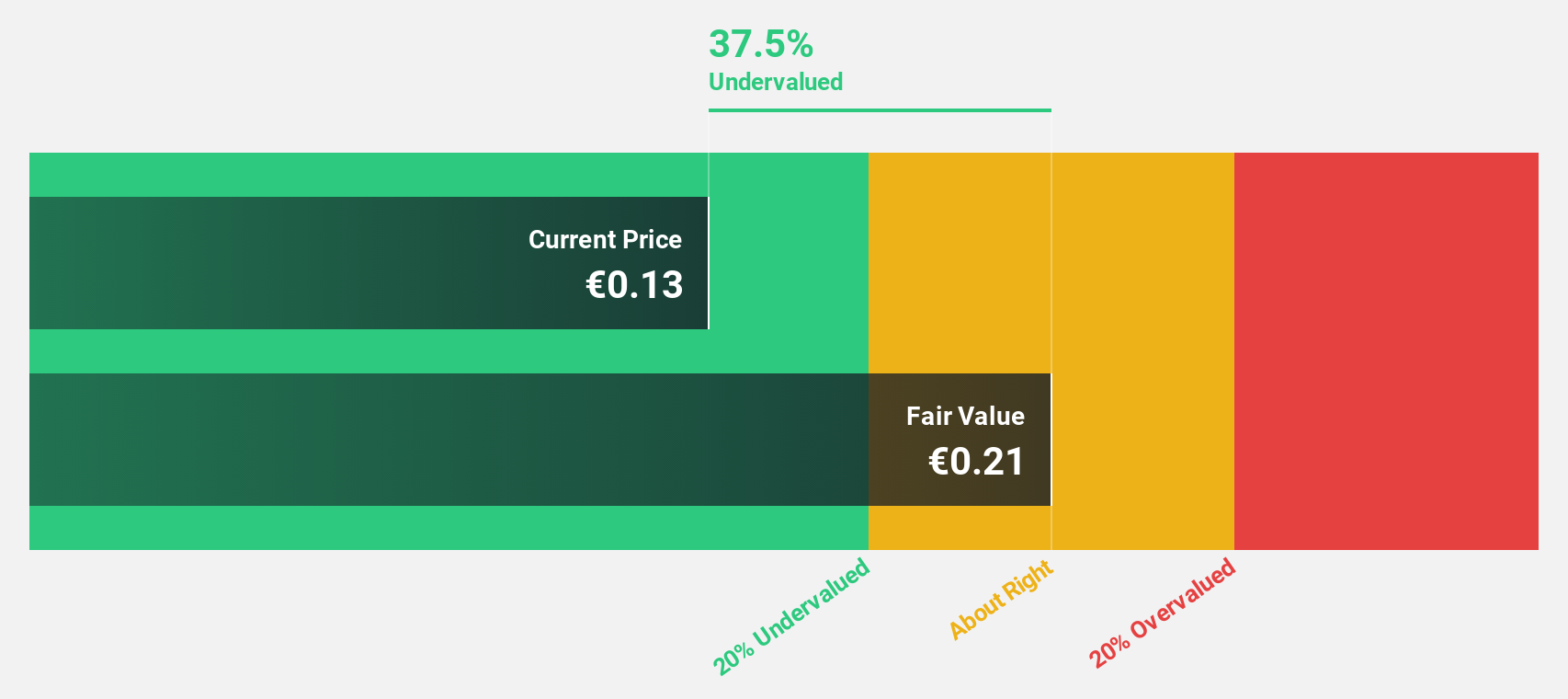

Estimated Discount To Fair Value: 36.9%

Amper is trading at €0.14, below its estimated fair value of €0.22, indicating it may be undervalued based on cash flows. Despite recent shareholder dilution and interest payments not being well covered by earnings, Amper's earnings are forecast to grow significantly at 34.5% annually, outpacing the Spanish market's 6.5%. The company became profitable this year and expects revenue growth of 12.2% per year, surpassing the Spanish market average of 4.6%.

- Insights from our recent growth report point to a promising forecast for Amper's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Amper.

Pexip Holding (OB:PEXIP)

Overview: Pexip Holding ASA is a video technology company offering an end-to-end video conferencing platform and digital infrastructure across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of NOK5.89 billion.

Operations: The company's revenue segment consists of NOK1.23 billion from the sale of collaboration services.

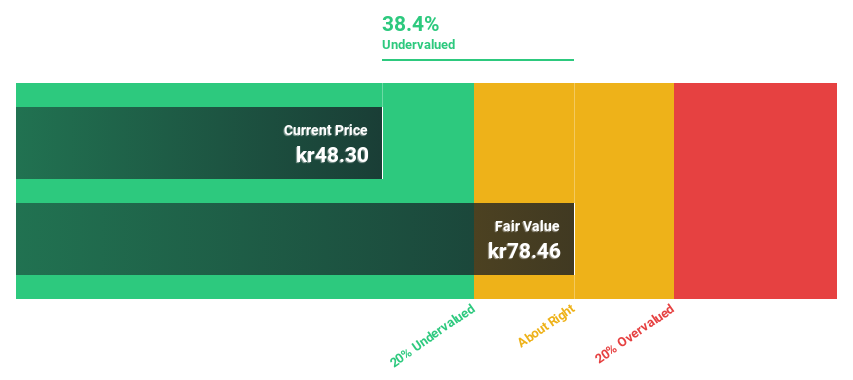

Estimated Discount To Fair Value: 28.8%

Pexip Holding is trading at NOK 57.5, below its fair value estimate of NOK 80.79, highlighting undervaluation based on cash flows. The company reported strong earnings growth with a net income increase to NOK 25.64 million in Q3 from NOK 5.8 million the previous year. Despite a dividend yield of 4.35% not being well covered by earnings, Pexip's revenue and profit are expected to grow significantly above the Norwegian market average over the next three years.

- The growth report we've compiled suggests that Pexip Holding's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Pexip Holding.

Unimot (WSE:UNT)

Overview: Unimot S.A. is an independent fuel importer involved in the wholesale and distribution of diesel oil and other liquid fuels both in Poland and internationally, with a market cap of PLN1.05 billion.

Operations: Unimot's revenue segments include the wholesale and distribution of diesel oil and other liquid fuels across domestic and international markets.

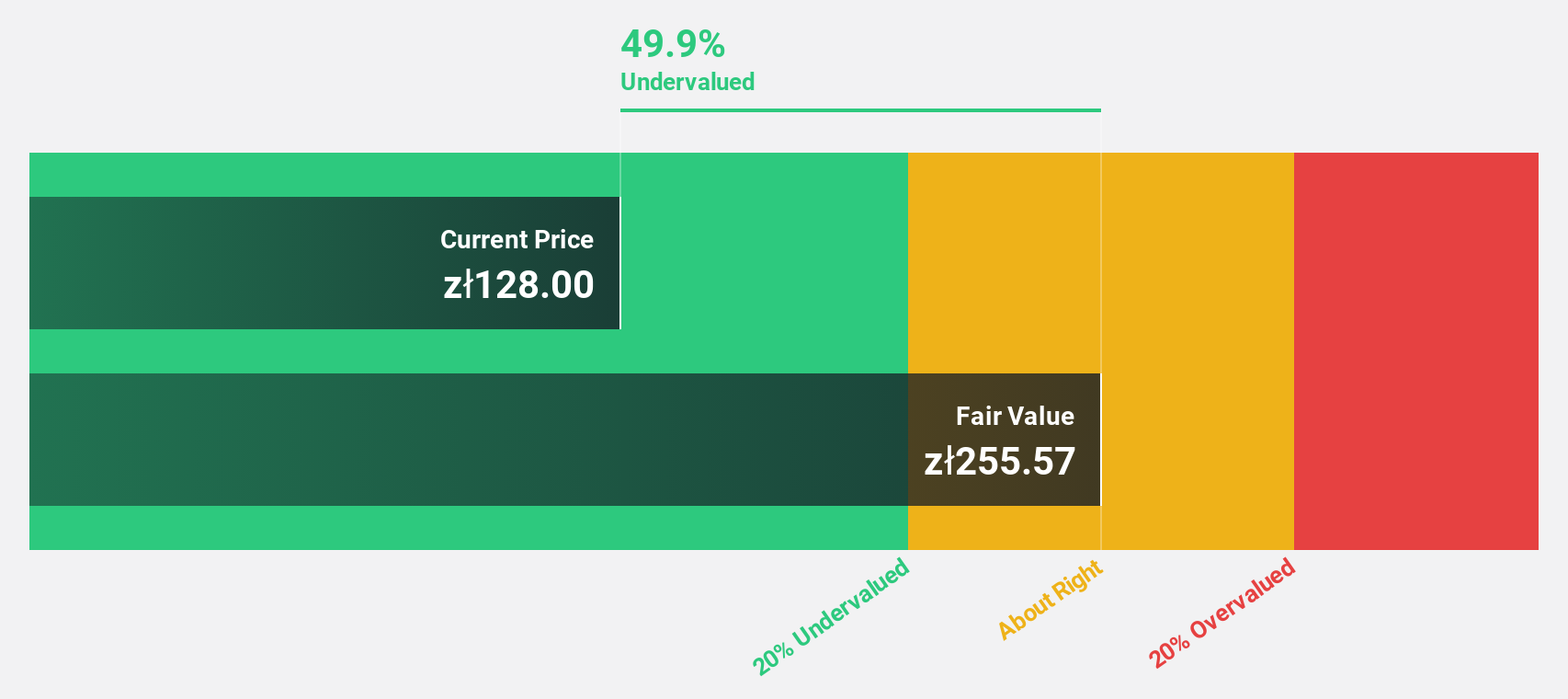

Estimated Discount To Fair Value: 49.9%

Unimot, trading at PLN 128, is significantly undervalued with a fair value estimate of PLN 255.57. Despite recent net losses for the nine months ending September 2025, the company showed improvement in Q3 with a net income of PLN 17.21 million compared to a loss last year. Forecasts indicate robust annual earnings growth of 63%, outpacing the Polish market average, although interest payments are not well covered by current earnings levels.

- Upon reviewing our latest growth report, Unimot's projected financial performance appears quite optimistic.

- Take a closer look at Unimot's balance sheet health here in our report.

Where To Now?

- Discover the full array of 201 Undervalued European Stocks Based On Cash Flows right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:AMP

Amper

Provides technological, industrial, and engineering solutions for the defense, security, energy, sustainability, and telecommunications markets in Spain and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives