- Poland

- /

- Oil and Gas

- /

- WSE:LWB

Would Shareholders Who Purchased Lubelski Wegiel Bogdanka's (WSE:LWB) Stock Three Years Be Happy With The Share price Today?

As every investor would know, not every swing hits the sweet spot. But you have a problem if you face massive losses more than once in a while. So take a moment to sympathize with the long term shareholders of Lubelski Wegiel Bogdanka S.A. (WSE:LWB), who have seen the share price tank a massive 72% over a three year period. That would be a disturbing experience. The more recent news is of little comfort, with the share price down 47% in a year.

See our latest analysis for Lubelski Wegiel Bogdanka

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

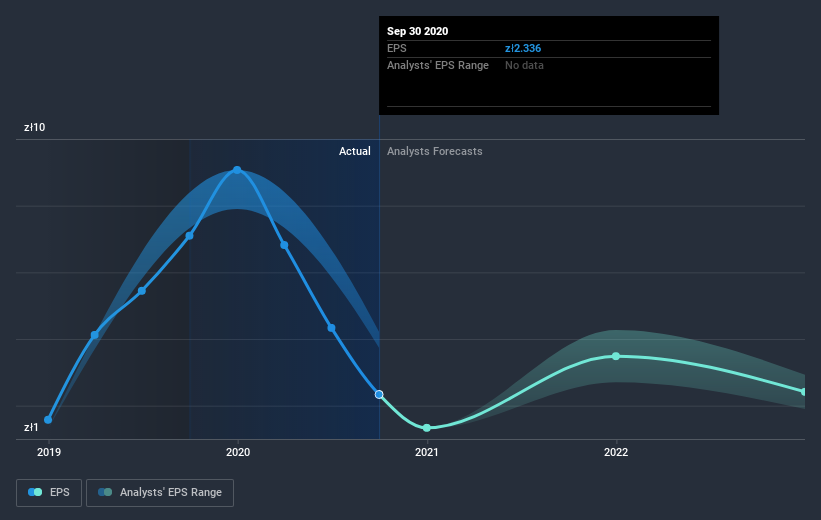

Lubelski Wegiel Bogdanka saw its EPS decline at a compound rate of 27% per year, over the last three years. The share price decline of 34% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past. The less favorable sentiment is reflected in its current P/E ratio of 8.22.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

While the broader market lost about 1.2% in the twelve months, Lubelski Wegiel Bogdanka shareholders did even worse, losing 47%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 6% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Lubelski Wegiel Bogdanka is showing 2 warning signs in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

When trading Lubelski Wegiel Bogdanka or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:LWB

Lubelski Wegiel Bogdanka

Engages in the hard coal mining business in Poland.

Flawless balance sheet, good value and pays a dividend.