- Sweden

- /

- Diversified Financial

- /

- NGM:FRILAN

3 European Penny Stocks With Market Caps Below €20M To Consider

Reviewed by Simply Wall St

As the European markets navigate mixed signals, with major indexes showing varied performances, investors are keenly observing opportunities that may arise from smaller-cap companies. Penny stocks, though an older term, still highlight the potential of lesser-known or emerging companies that can offer significant value. By focusing on those with strong financial foundations and growth potential, investors might uncover promising opportunities in this often-overlooked segment of the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.95 | €1.37B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.08 | €16.04M | ✅ 4 ⚠️ 5 View Analysis > |

| Maps (BIT:MAPS) | €3.30 | €43.83M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €2.01 | €27.77M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €221.96M | ✅ 2 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.42 | SEK208.07M | ✅ 2 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.954 | €76.98M | ✅ 2 ⚠️ 4 View Analysis > |

| High (ENXTPA:HCO) | €3.85 | €75.31M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.015 | €278.51M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 281 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Invoicery Group (NGM:FRILAN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Invoicery Group AB, based in Uppsala, Sweden and incorporated in 2014, operates in the invoicing solutions sector with a market cap of approximately SEK137.68 million.

Operations: The company generates revenue from two main segments: Self-Employment, contributing SEK1.52 billion, and Workforce Management, which accounts for SEK315.64 million.

Market Cap: SEK137.68M

Invoicery Group AB, with a market cap of SEK137.68 million, operates in the invoicing solutions sector and demonstrates some strengths typical of penny stocks. The company is debt-free, which can be appealing to risk-averse investors, and its earnings growth of 33.2% over the past year outpaced the industry average significantly. However, its Return on Equity remains low at 19%, and despite stable weekly volatility over the past year, it still experiences higher fluctuations than most Swedish stocks. Recent earnings reports show modest revenue growth but declining net income compared to previous periods, highlighting profitability challenges amidst expansion efforts.

- Click to explore a detailed breakdown of our findings in Invoicery Group's financial health report.

- Examine Invoicery Group's past performance report to understand how it has performed in prior years.

Ocean Sun (OB:OSUN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ocean Sun AS develops floating power systems with solar panels and has a market cap of NOK59.12 million.

Operations: The company's revenue is derived entirely from its heavy construction segment, totaling NOK3.92 million.

Market Cap: NOK59.12M

Ocean Sun AS, with a market cap of NOK59.12 million, is characterized by its debt-free status and lack of long-term liabilities, which may appeal to investors seeking stability in penny stocks. However, the company remains pre-revenue with less than US$1 million in revenue and has been unprofitable over the past five years. The management team's average tenure is 1.1 years, indicating recent leadership changes. Despite having short-term assets exceeding liabilities (NOK24.3M vs NOK6M), Ocean Sun's cash runway is less than a year if current free cash flow trends continue, reflecting potential liquidity concerns amidst high share price volatility.

- Jump into the full analysis health report here for a deeper understanding of Ocean Sun.

- Understand Ocean Sun's track record by examining our performance history report.

IPOPEMA Securities (WSE:IPE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: IPOPEMA Securities S.A. operates in Poland offering brokerage, company analysis, and investment banking services, with a market cap of PLN95.80 million.

Operations: IPOPEMA Securities generates revenue primarily from managing investment funds and portfolios of brokerage financial instruments (PLN153.77 million), followed by brokerage and related services (PLN77.86 million), and advisory services (PLN33.98 million).

Market Cap: PLN95.8M

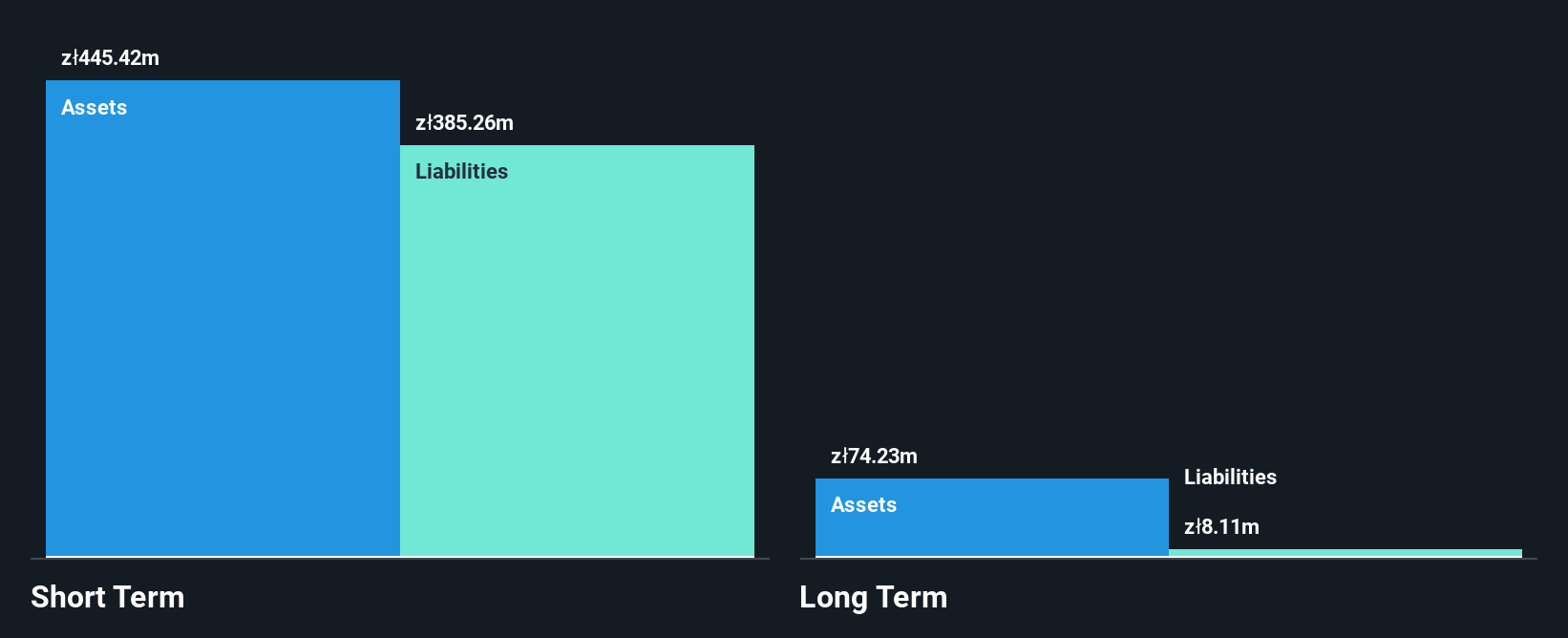

IPOPEMA Securities S.A., with a market cap of PLN95.80 million, presents a mixed profile for penny stock investors in Europe. The company reported net income of PLN5.53 million for the first half of 2025, slightly down from the previous year, and its profit margins have decreased to 3.2%. Despite stable weekly volatility and satisfactory short-term asset coverage over liabilities (PLN445.4M vs PLN385.3M), IPOPEMA's earnings have declined by an average of 15.6% annually over five years, with recent negative growth outpacing industry averages. The seasoned management team offers stability amidst these challenges, while debt levels remain manageable with strong operating cash flow coverage (187.9%).

- Unlock comprehensive insights into our analysis of IPOPEMA Securities stock in this financial health report.

- Evaluate IPOPEMA Securities' historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 278 European Penny Stocks now.

- Searching for a Fresh Perspective? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NGM:FRILAN

Invoicery Group

Invoicery Group AB was incorporated in 2014 and is based in Uppsala, Sweden.

Flawless balance sheet and fair value.

Market Insights

Community Narratives