- Poland

- /

- Food and Staples Retail

- /

- WSE:DNP

The Dino Polska (WSE:DNP) Share Price Has Gained 197%, So Why Not Pay It Some Attention?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For instance the Dino Polska S.A. (WSE:DNP) share price is 197% higher than it was three years ago. Most would be happy with that. The last week saw the share price soften some 1.9%.

View our latest analysis for Dino Polska

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

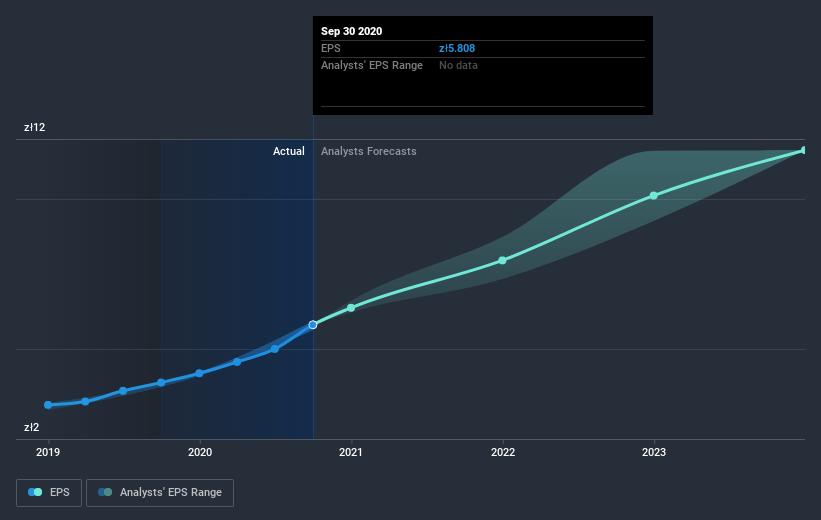

Dino Polska was able to grow its EPS at 47% per year over three years, sending the share price higher. We note that the 44% yearly (average) share price gain isn't too far from the EPS growth rate. Coincidence? Probably not. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price has approximately tracked EPS growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Dino Polska has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Dino Polska stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Pleasingly, Dino Polska's total shareholder return last year was 74%. That gain actually surpasses the 44% TSR it generated (per year) over three years. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with Dino Polska .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

When trading Dino Polska or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:DNP

Dino Polska

Operates a network of mid-sized grocery supermarkets under the Dino brand name in Poland.

Excellent balance sheet with reasonable growth potential.