Grzegorz Pinkosz is the CEO of TOYA S.A. (WSE:TOA), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for TOYA

Comparing TOYA S.A.'s CEO Compensation With the industry

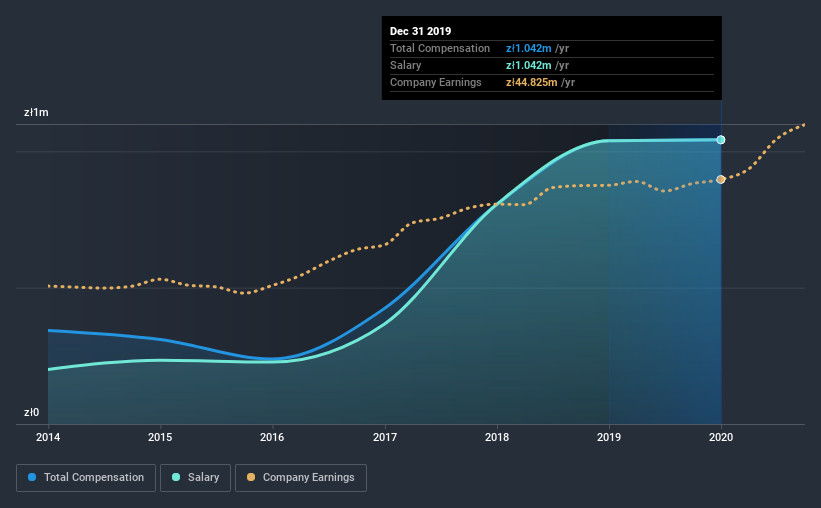

At the time of writing, our data shows that TOYA S.A. has a market capitalization of zł443m, and reported total annual CEO compensation of zł1.0m for the year to December 2019. That's mostly flat as compared to the prior year's compensation. It is worth noting that the CEO compensation consists entirely of the salary, worth zł1.0m.

For comparison, other companies in the industry with market capitalizations below zł741m, reported a median total CEO compensation of zł810k. This suggests that TOYA remunerates its CEO largely in line with the industry average. Furthermore, Grzegorz Pinkosz directly owns zł852k worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | zł1.0m | zł1.0m | 100% |

| Other | - | - | - |

| Total Compensation | zł1.0m | zł1.0m | 100% |

Speaking on an industry level, nearly 47% of total compensation represents salary, while the remainder of 53% is other remuneration. At the company level, TOYA pays Grzegorz Pinkosz solely through a salary, preferring to go down a conventional route. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at TOYA S.A.'s Growth Numbers

TOYA S.A.'s earnings per share (EPS) grew 13% per year over the last three years. Its revenue is up 17% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has TOYA S.A. Been A Good Investment?

With a three year total loss of 38% for the shareholders, TOYA S.A. would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

TOYA rewards its CEO solely through a salary, ignoring non-salary benefits completely. As we touched on above, TOYA S.A. is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. On the other hand, the company has logged negative shareholder returns over the previous three years. But EPS growth is moving in a favorable direction, certainly a positive sign. Considering positive EPS growth, we'd say compensation is fair, but shareholders may be wary of a bump in pay before the company logs positive returns.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for TOYA that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade TOYA, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TOYA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:TOA

TOYA

Produces hand and power tools, professional gastronomy, and home equipment in Poland and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives