To find a multi-bagger stock, what are the underlying trends we should look for in a business? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. So when we looked at TOYA (WSE:TOA), they do have a high ROCE, but we weren't exactly elated from how returns are trending.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for TOYA, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.21 = zł87m ÷ (zł536m - zł126m) (Based on the trailing twelve months to June 2023).

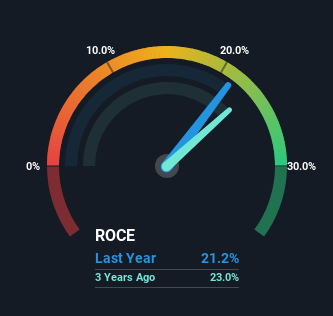

Thus, TOYA has an ROCE of 21%. That's a fantastic return and not only that, it outpaces the average of 11% earned by companies in a similar industry.

Check out our latest analysis for TOYA

Historical performance is a great place to start when researching a stock so above you can see the gauge for TOYA's ROCE against it's prior returns. If you'd like to look at how TOYA has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What Can We Tell From TOYA's ROCE Trend?

When we looked at the ROCE trend at TOYA, we didn't gain much confidence. While it's comforting that the ROCE is high, five years ago it was 32%. However it looks like TOYA might be reinvesting for long term growth because while capital employed has increased, the company's sales haven't changed much in the last 12 months. It may take some time before the company starts to see any change in earnings from these investments.

On a side note, TOYA has done well to pay down its current liabilities to 23% of total assets. That could partly explain why the ROCE has dropped. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Some would claim this reduces the business' efficiency at generating ROCE since it is now funding more of the operations with its own money.

The Bottom Line

To conclude, we've found that TOYA is reinvesting in the business, but returns have been falling. Additionally, the stock's total return to shareholders over the last five years has been flat, which isn't too surprising. In any case, the stock doesn't have these traits of a multi-bagger discussed above, so if that's what you're looking for, we think you'd have more luck elsewhere.

If you're still interested in TOYA it's worth checking out our FREE intrinsic value approximation to see if it's trading at an attractive price in other respects.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

Valuation is complex, but we're here to simplify it.

Discover if TOYA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:TOA

TOYA

Produces and sells hand and power tools, professional gastronomy equipment, and home equipment in Poland and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026