- Poland

- /

- Consumer Durables

- /

- WSE:LTX

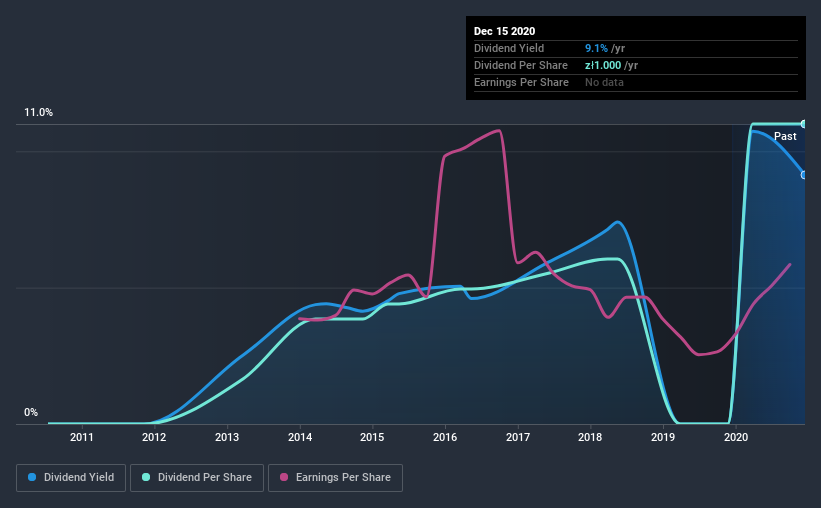

Tread With Caution Around Lentex S.A.'s (WSE:LTX) 9.1% Dividend Yield

Could Lentex S.A. (WSE:LTX) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

In this case, Lentex likely looks attractive to dividend investors, given its 9.1% dividend yield and eight-year payment history. It sure looks interesting on these metrics - but there's always more to the story. The company also bought back stock during the year, equivalent to approximately 5.3% of the company's market capitalisation at the time. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Lentex!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Lentex paid out 134% of its profit as dividends, over the trailing twelve month period. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Lentex paid out 139% of its free cash last year. Cash flows can be lumpy, but this dividend was not well covered by cash flow. Paying out more than 100% of your free cash flow in dividends is generally not a long-term, sustainable state of affairs, so we think shareholders should watch this metric closely. As Lentex's dividend was not well covered by either earnings or cash flow, we would be concerned that this dividend could be at risk over the long term.

We update our data on Lentex every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. The first recorded dividend for Lentex, in the last decade, was eight years ago. Although it has been paying a dividend for several years now, the dividend has been cut at least once, and we're cautious about the consistency of its dividend across a full economic cycle. During the past eight-year period, the first annual payment was zł0.1 in 2012, compared to zł1.0 last year. Dividends per share have grown at approximately 27% per year over this time. The dividends haven't grown at precisely 27% every year, but this is a useful way to average out the historical rate of growth.

So, its dividends have grown at a rapid rate over this time, but payments have been cut in the past. The stock may still be worth considering as part of a diversified dividend portfolio.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? Lentex has grown its earnings per share at 4.2% per annum over the past five years. Still, the company has struggled to grow its EPS, and currently pays out 134% of its earnings. As they say in finance, 'past performance is not indicative of future performance', but we are not confident a company with limited earnings growth and a high payout ratio will be a star dividend-payer over the next decade.

Conclusion

To summarise, shareholders should always check that Lentex's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. It's a concern to see that the company paid out such a high percentage of its earnings and cashflow as dividends. Unfortunately, earnings growth has also been mediocre, and the company has cut its dividend at least once in the past. Using these criteria, Lentex looks quite suboptimal from a dividend investment perspective.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 3 warning signs for Lentex (of which 1 is concerning!) you should know about.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you decide to trade Lentex, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About WSE:LTX

Lentex

Manufactures and sells flexible PVC floor coverings for residential and commercial areas, and sports facilities in Poland and internationally.

Flawless balance sheet with low risk.

Market Insights

Community Narratives