- Austria

- /

- Electric Utilities

- /

- WBAG:VER

European Dividend Stocks To Consider In November 2025

Reviewed by Simply Wall St

As the European market experiences mixed performance, with the pan-European STOXX Europe 600 Index recently pulling back after reaching a new high, investors are closely watching for opportunities amid shifting interest rate expectations and steady inflation rates. In this environment, dividend stocks can offer stability and income potential, making them an attractive consideration for those looking to navigate the current economic landscape.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.46% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.76% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.86% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.42% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.04% | ★★★★★★ |

| Evolution (OM:EVO) | 4.88% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.24% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.63% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.24% | ★★★★★☆ |

| Bravida Holding (OM:BRAV) | 4.75% | ★★★★★★ |

Click here to see the full list of 230 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

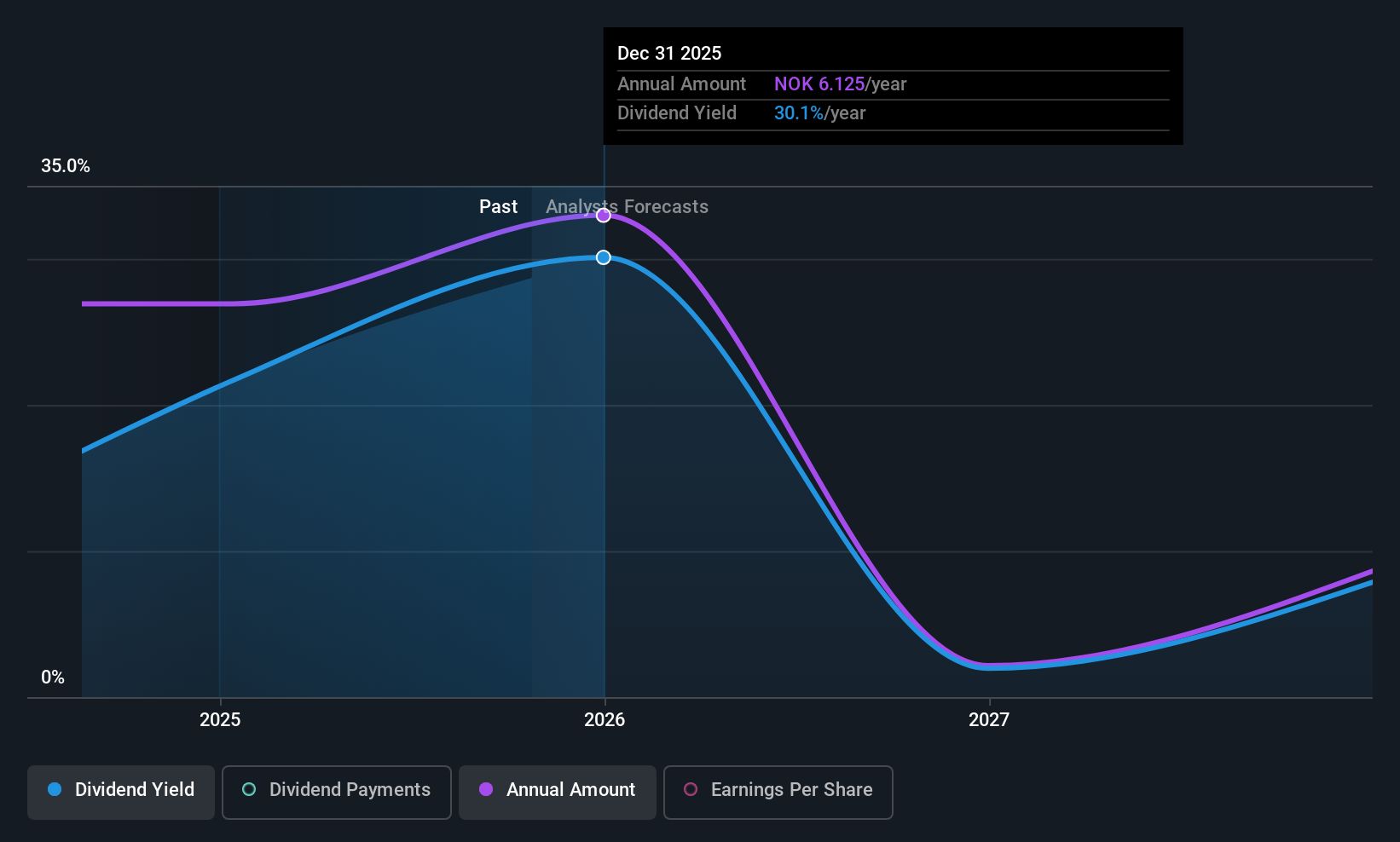

Sea1 Offshore (OB:SEA1)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sea1 Offshore Inc., along with its subsidiaries, owns and operates offshore support vessels serving the offshore energy service industry, with a market cap of NOK3.14 billion.

Operations: Sea1 Offshore Inc. generates revenue by owning and operating offshore support vessels for the energy service sector.

Dividend Yield: 21.7%

Sea1 Offshore's dividend payments are well covered by earnings and cash flows, with a payout ratio of 39.9% and a cash payout ratio of 31.9%. Despite having only two years of dividend history, the dividends have been stable but not growing. The company faces challenges with declining revenues and earnings forecasts, alongside high debt levels. However, it trades at good value compared to peers and analysts expect a price increase. Recent contract awards bolster its backlog to $743 million.

- Navigate through the intricacies of Sea1 Offshore with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Sea1 Offshore is priced lower than what may be justified by its financials.

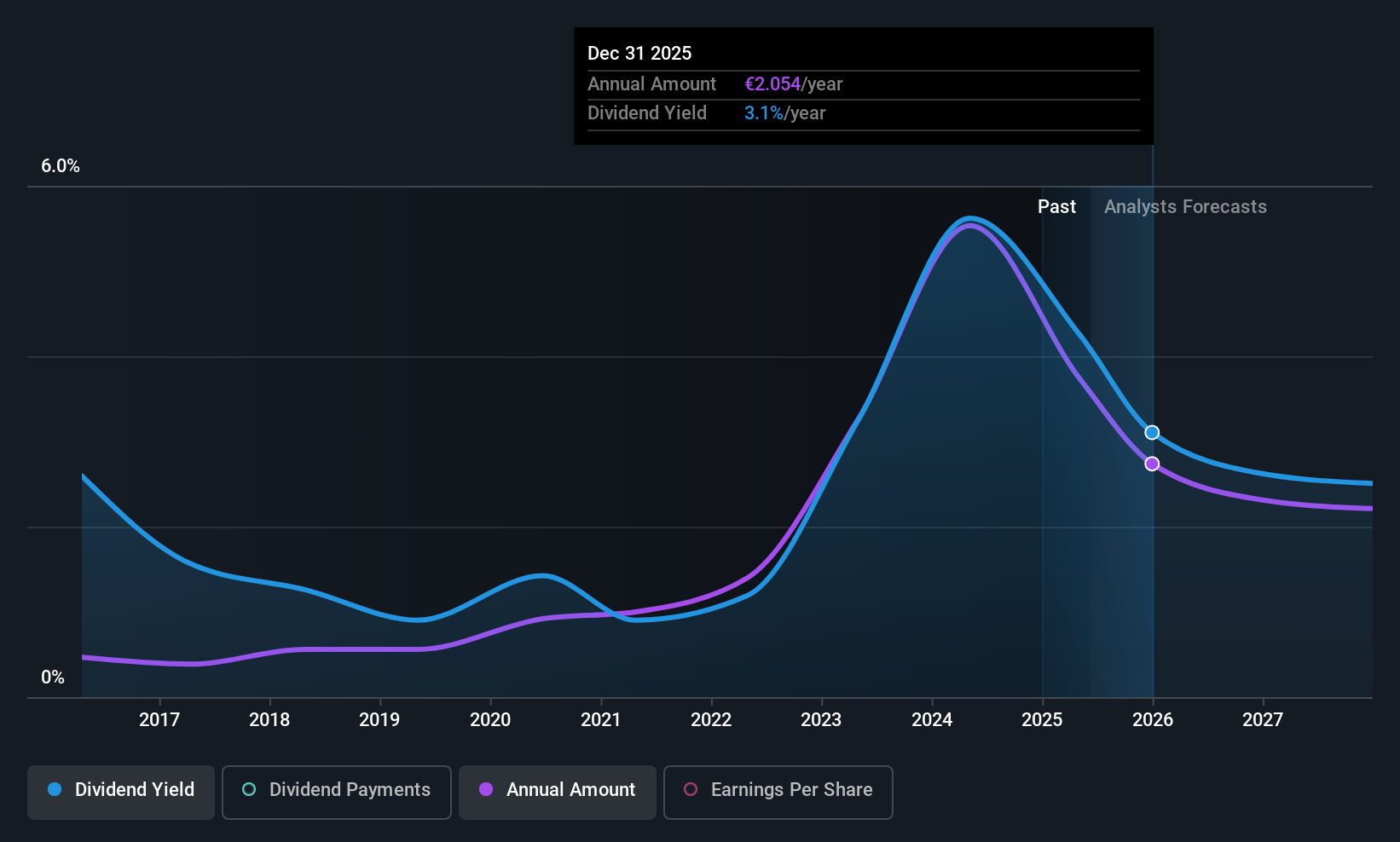

VERBUND (WBAG:VER)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: VERBUND AG, with a market cap of €23.97 billion, operates in the generation, trading and sale of electricity to various markets and customers both in Austria and internationally.

Operations: VERBUND AG's revenue segments include €1.62 billion from Grid, €3.12 billion from Hydro, €6.78 billion from Sales, and €323.30 million from New Renewables.

Dividend Yield: 4.1%

VERBUND's dividend payments are covered by earnings and cash flows, with payout ratios of 55% and 62.7%, respectively. However, the dividends have been volatile over the past decade, showing instability despite some growth. The current yield of 4.06% is below Austria's top tier for dividend payers. Earnings are projected to decline by an average of 10.9% annually over the next three years, which could impact future payouts. VERBUND trades at a discount to its estimated fair value.

- Dive into the specifics of VERBUND here with our thorough dividend report.

- The valuation report we've compiled suggests that VERBUND's current price could be inflated.

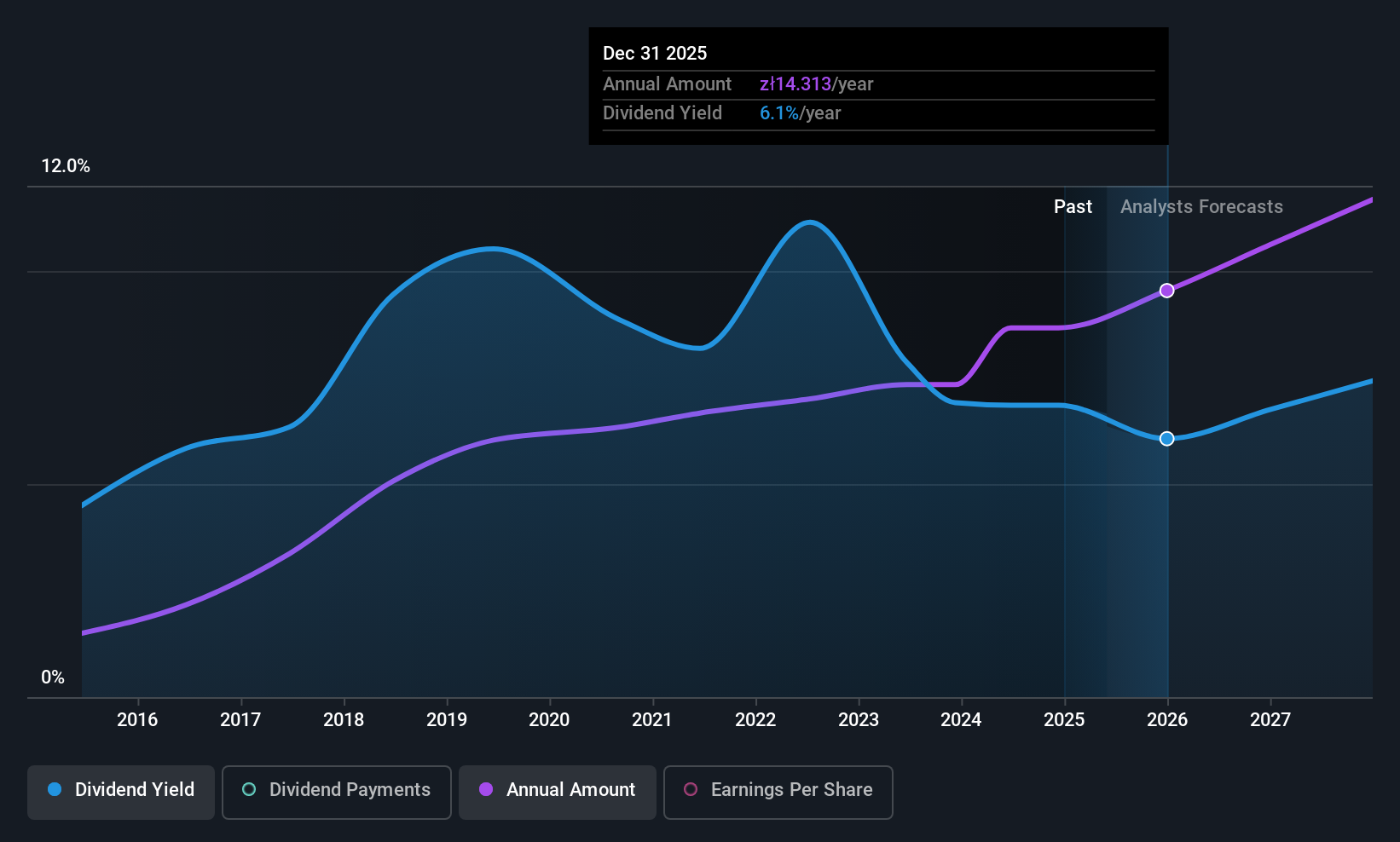

Dom Development (WSE:DOM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dom Development S.A. operates in Poland, focusing on the development and sale of residential and commercial real estate properties, with a market cap of PLN6.50 billion.

Operations: Dom Development S.A.'s revenue primarily stems from its residential and commercial home building activities, amounting to PLN3.09 billion.

Dividend Yield: 5.2%

Dom Development's dividend yield of 5.16% is below the top tier in Poland and not well supported by cash flows, with a high cash payout ratio of 113.9%. However, dividends are well covered by earnings due to a low payout ratio of 30.9%. Despite this, dividends have been stable and growing over the past decade. Recent earnings show growth with net income rising to PLN 97.28 million in Q2 2025 from PLN 93.82 million a year prior, suggesting potential for continued dividend reliability amidst fair valuation.

- Click to explore a detailed breakdown of our findings in Dom Development's dividend report.

- In light of our recent valuation report, it seems possible that Dom Development is trading behind its estimated value.

Summing It All Up

- Investigate our full lineup of 230 Top European Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:VER

VERBUND

Generates, trades in, and sells electricity to energy exchange markets, traders, electric utilities and industrial companies, and household and commercial customers in Austria and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives