A Piece Of The Puzzle Missing From OZE Capital S.A.'s (WSE:OZE) 41% Share Price Climb

OZE Capital S.A. (WSE:OZE) shareholders are no doubt pleased to see that the share price has bounced 41% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 39% over that time.

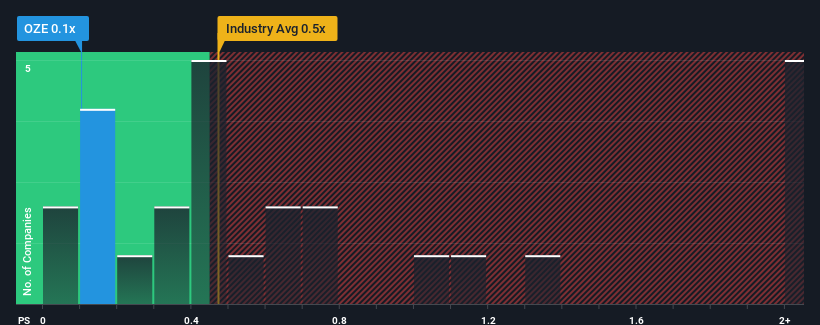

Even after such a large jump in price, there still wouldn't be many who think OZE Capital's price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S in Poland's Machinery industry is similar at about 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for OZE Capital

What Does OZE Capital's Recent Performance Look Like?

For instance, OZE Capital's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on OZE Capital's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For OZE Capital?

The only time you'd be comfortable seeing a P/S like OZE Capital's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 73%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Comparing that to the industry, which is only predicted to deliver 8.4% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it interesting that OZE Capital is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Its shares have lifted substantially and now OZE Capital's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We didn't quite envision OZE Capital's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 3 warning signs for OZE Capital that you need to take into consideration.

If you're unsure about the strength of OZE Capital's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:OZE

Excellent balance sheet with slight risk.

Market Insights

Community Narratives