- Poland

- /

- Construction

- /

- WSE:ATR

Further Upside For Atrem S.A. (WSE:ATR) Shares Could Introduce Price Risks After 25% Bounce

Atrem S.A. (WSE:ATR) shares have had a really impressive month, gaining 25% after a shaky period beforehand. The last month tops off a massive increase of 117% in the last year.

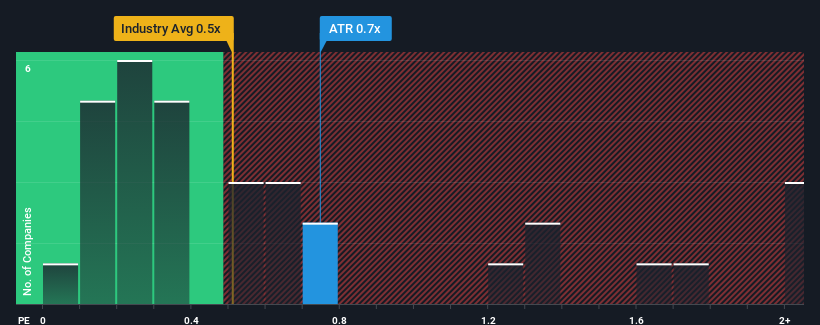

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Atrem's P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Construction industry in Poland is also close to 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Atrem

What Does Atrem's Recent Performance Look Like?

Atrem certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Atrem will help you uncover what's on the horizon.How Is Atrem's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Atrem's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 49% last year. The latest three year period has also seen an excellent 66% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 40% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 16%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Atrem's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Atrem appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Atrem's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

It is also worth noting that we have found 4 warning signs for Atrem that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:ATR

Atrem

Provides engineering support services for large infrastructure and construction projects in Poland.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives