Amid renewed concerns over inflated AI stock valuations, European markets have faced downward pressure, with major indices such as the STOXX Europe 600 Index experiencing declines. Despite these challenges, eurozone business activity continues to expand steadily, providing a backdrop for investors seeking stability through dividend stocks. In this environment, selecting dividend stocks that offer consistent yields and strong fundamentals can be an effective strategy for navigating market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.41% | ★★★★★★ |

| Sonae SGPS (ENXTLS:SON) | 4.05% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.16% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.93% | ★★★★★★ |

| Evolution (OM:EVO) | 4.84% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.19% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.62% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.67% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.62% | ★★★★★☆ |

| Banca Popolare di Sondrio (BIT:BPSO) | 5.46% | ★★★★★☆ |

Click here to see the full list of 217 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

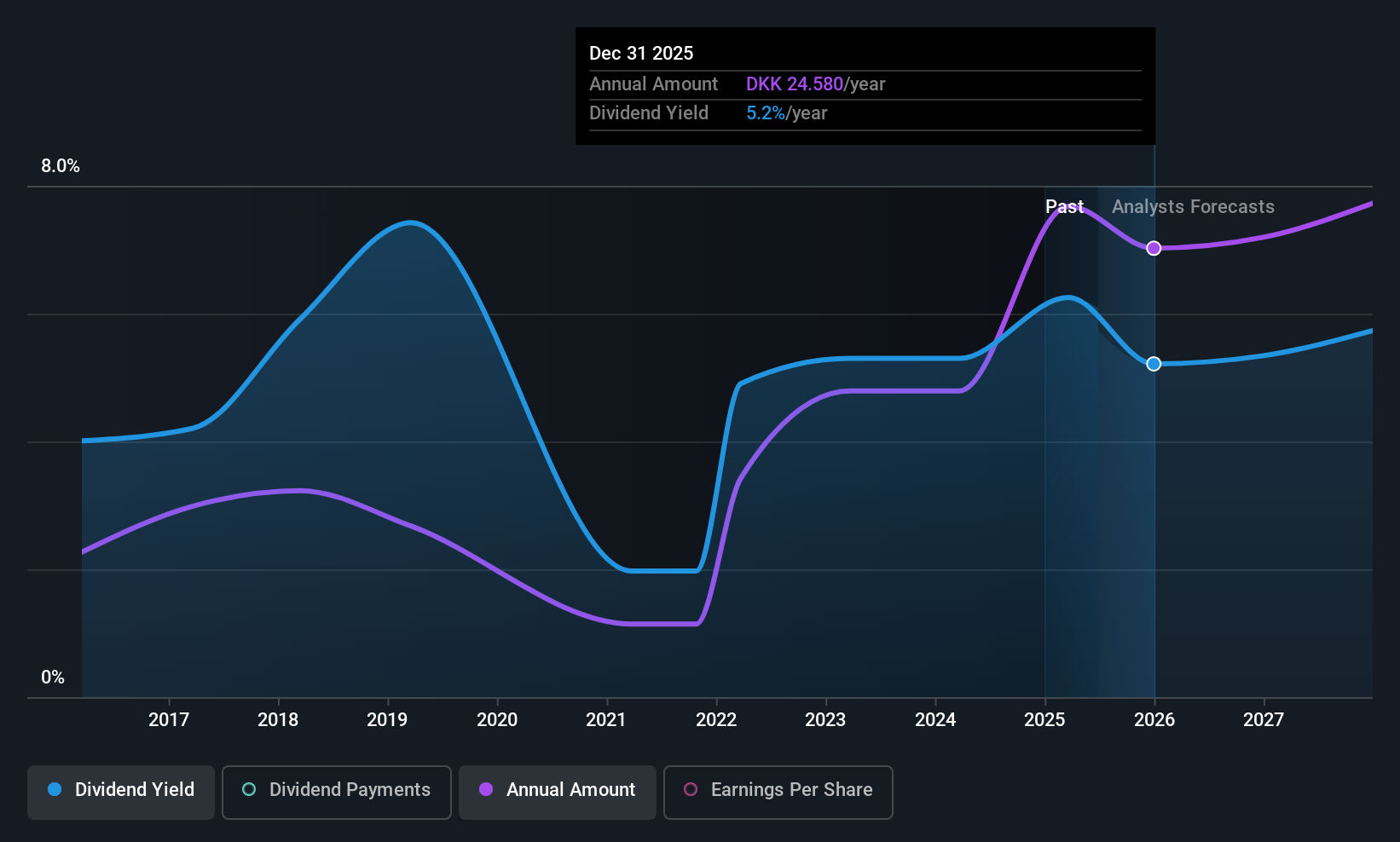

Sydbank (CPSE:SYDB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sydbank A/S, with a market cap of DKK26.89 billion, offers a range of banking products and services to corporate, private, retail, and institutional clients both in Denmark and internationally.

Operations: Sydbank A/S generates its revenue through several segments, including Banking (DKK5.51 billion), Treasury (DKK77 million), Sydbank Markets (DKK373 million), and Asset Management (DKK509 million).

Dividend Yield: 4.9%

Sydbank's dividend profile presents a mixed picture. While its dividends are covered by earnings with a payout ratio of 61.1% and expected to remain sustainable, the bank has shown volatility in its dividend payments over the past decade. Recent earnings guidance was raised, projecting profit after tax between DKK 2.4 billion and DKK 2.6 billion for 2025, indicating potential stability in future payouts despite past fluctuations in net interest income and net income figures.

- Click here to discover the nuances of Sydbank with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Sydbank is trading beyond its estimated value.

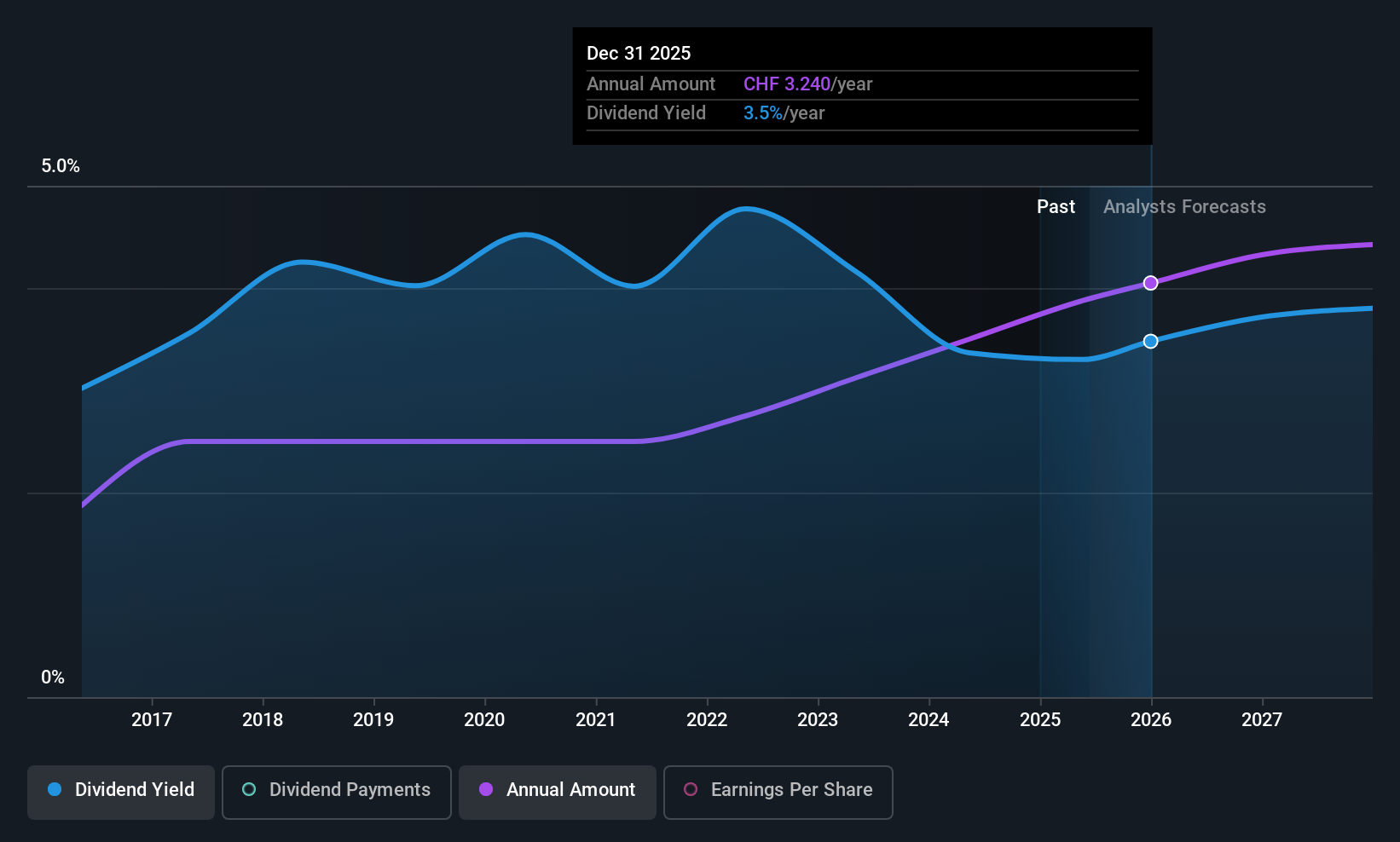

Holcim (SWX:HOLN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Holcim AG, with a market cap of CHF40.18 billion, operates globally by providing building materials and solutions through its subsidiaries.

Operations: Holcim AG generates revenue through its global provision of building materials and solutions.

Dividend Yield: 4.2%

Holcim's dividend profile is robust, with stable and growing dividends over the past decade. The company offers an attractive dividend yield of 4.16%, ranking in the top 25% within the Swiss market. Dividends are well-supported by earnings and cash flows, with payout ratios of 54.2% and 49.4%, respectively. Despite a forecasted decline in earnings over the next three years, Holcim confirmed its full-year guidance for net sales and recurring EBIT growth aligned with NextGen Growth targets.

- Dive into the specifics of Holcim here with our thorough dividend report.

- The analysis detailed in our Holcim valuation report hints at an deflated share price compared to its estimated value.

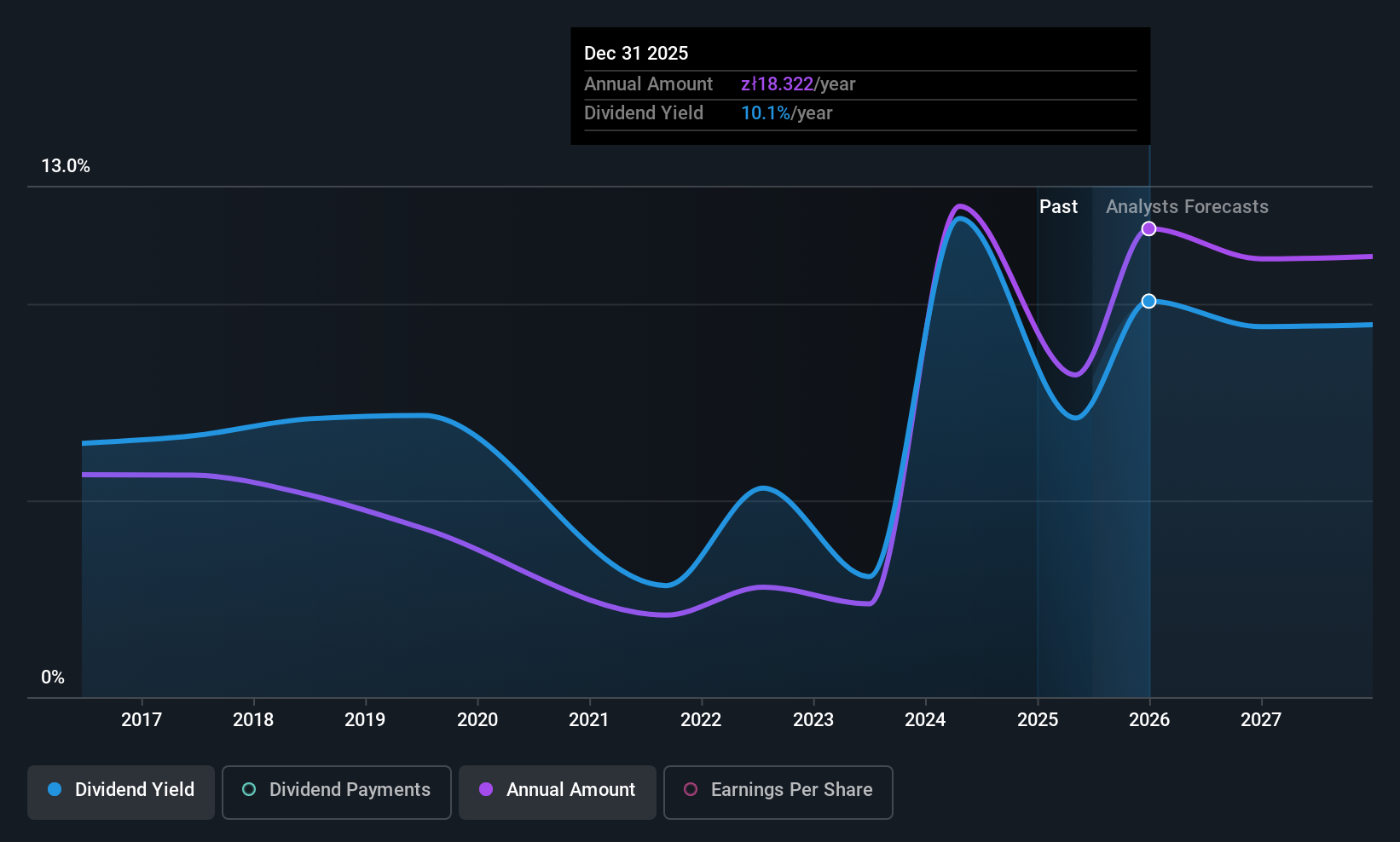

Bank Polska Kasa Opieki (WSE:PEO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank Polska Kasa Opieki S.A. is a commercial bank offering a range of banking products and services to retail and corporate clients in Poland, with a market cap of PLN52.28 billion.

Operations: Bank Polska Kasa Opieki S.A. generates revenue through its Enterprise Banking segment (PLN2.29 billion) and Corporate and Investment Banking segment (PLN2.98 billion).

Dividend Yield: 6.3%

Bank Polska Kasa Opieki's dividend payments, while increasing over the past decade, have been volatile and are currently covered by a low payout ratio of 48.6%. Despite trading below its estimated fair value and offering a dividend yield of 6.33%, which is below the top tier in Poland, concerns arise from high non-performing loans at 4.3% and a low allowance for bad loans at 79%. Recent executive changes could impact future stability.

- Get an in-depth perspective on Bank Polska Kasa Opieki's performance by reading our dividend report here.

- Our valuation report here indicates Bank Polska Kasa Opieki may be undervalued.

Where To Now?

- Click through to start exploring the rest of the 214 Top European Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank Polska Kasa Opieki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:PEO

Bank Polska Kasa Opieki

A commercial bank, provides banking products and services to retail and corporate clients in Poland.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success