Three Undiscovered Gems with Strong Potential for Your Portfolio

Reviewed by Simply Wall St

Amidst a backdrop of mixed returns in global markets, small-cap and value shares have been outpacing their large-cap growth counterparts. As investors navigate this evolving landscape, identifying stocks with strong fundamentals and growth potential becomes crucial for optimizing portfolio performance. In this article, we explore three undiscovered gems that exhibit promising characteristics such as robust financial health, innovative business models, and favorable market positioning—key attributes that could thrive in the current economic environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Mobile Telecommunications | NA | 3.85% | -0.40% | ★★★★★★ |

| Chilanga Cement | NA | 12.53% | 25.20% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret | 15.94% | 57.67% | 80.04% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 8.04% | -3.72% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Cita Mineral Investindo (IDX:CITA)

Simply Wall St Value Rating: ★★★★★★

Overview: PT Cita Mineral Investindo Tbk engages in bauxite mining activities in Indonesia and has a market cap of IDR9.39 trillion.

Operations: Revenue streams for PT Cita Mineral Investindo Tbk primarily come from bauxite mining activities. The company has a market cap of IDR9.39 trillion.

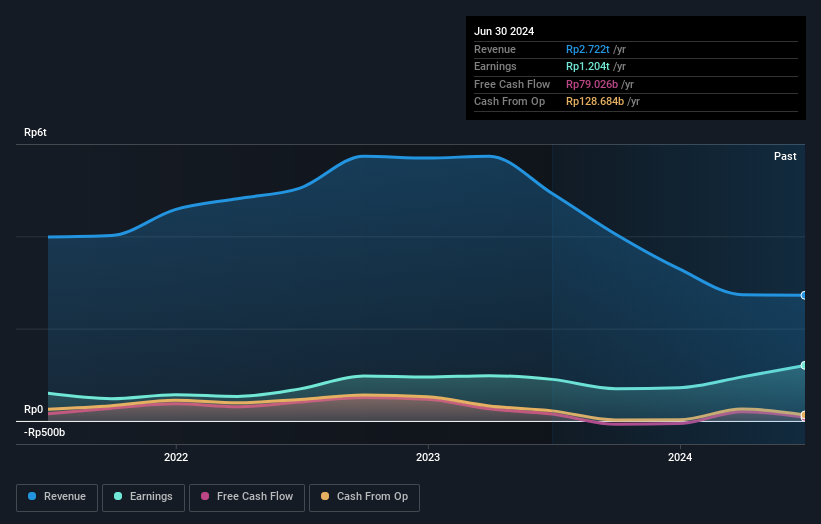

Cita Mineral Investindo, a promising player in the metals and mining sector, has shown remarkable financial health with no debt currently compared to a 61.3% debt-to-equity ratio five years ago. Their earnings growth of 65.7% over the past year outpaced the industry’s -12.1%. Recent half-year results reported net income of IDR 866,280 million against IDR 381,086 million last year. With a price-to-earnings ratio of 7.2x below the market average of 14.8x, it appears undervalued.

- Click to explore a detailed breakdown of our findings in Cita Mineral Investindo's health report.

Understand Cita Mineral Investindo's track record by examining our Past report.

Fauji Fertilizer (KASE:FFC)

Simply Wall St Value Rating: ★★★★★★

Overview: Fauji Fertilizer Company Limited, along with its subsidiaries, manufactures, purchases, and markets fertilizers and chemicals in Pakistan, with a market cap of PKR238.33 billion.

Operations: Fauji Fertilizer generates revenue primarily from the sale of fertilizers and chemicals. The company has a market cap of PKR238.33 billion, reflecting its significant presence in the Pakistani market.

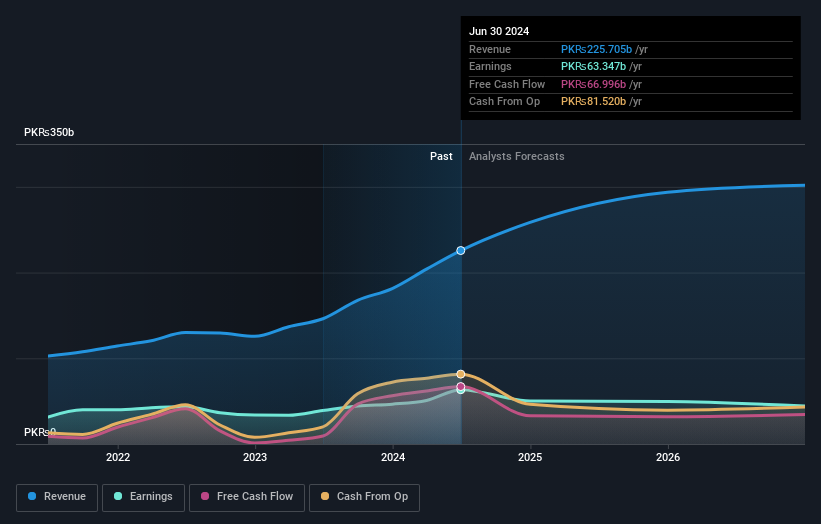

Fauji Fertilizer’s earnings surged by 62.5% over the past year, outpacing the Chemicals industry’s 36.4%. Trading at 25.4% below its estimated fair value, FFC seems undervalued. The company has reduced its debt-to-equity ratio from 60.9% to 15.8% in five years, indicating improved financial health. With high-quality earnings and more cash than total debt, FFC is well-positioned for future growth, supported by a forecasted revenue increase of 11.03% annually.

- Delve into the full analysis health report here for a deeper understanding of Fauji Fertilizer.

Examine Fauji Fertilizer's past performance report to understand how it has performed in the past.

Apex Dynamics (TWSE:4583)

Simply Wall St Value Rating: ★★★★★★

Overview: Apex Dynamics, Inc. (TWSE:4583) specializes in producing robots for plastics injection molding machines and has a market cap of NT$26.94 billion.

Operations: Apex Dynamics, Inc. generates revenue by producing robots for plastics injection molding machines. The company has a market cap of NT$26.94 billion and reported total revenue segments in millions of NT$.

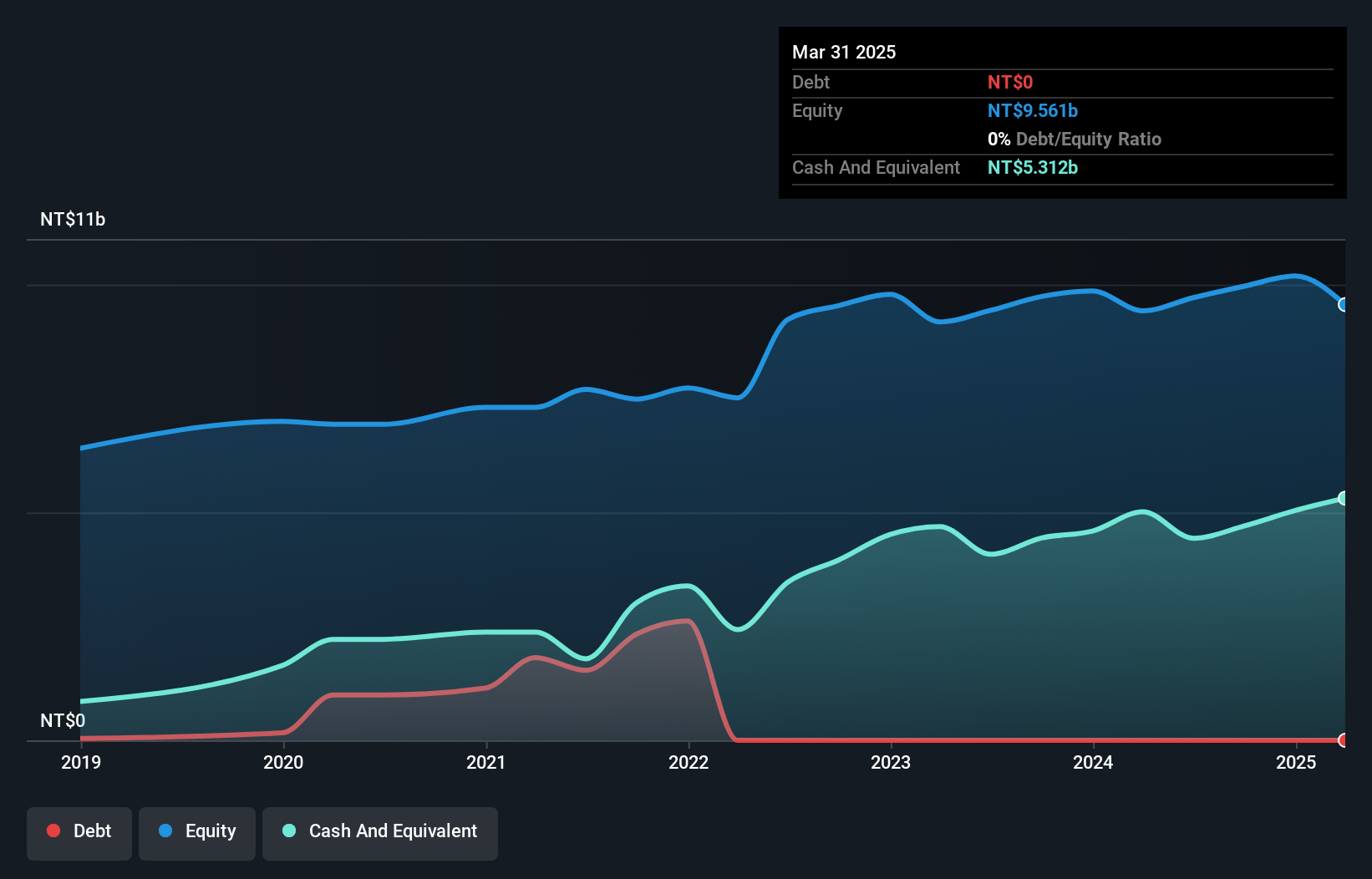

Apex Dynamics has shown robust performance, with earnings growing by 8.5% over the past year, outpacing the Machinery industry’s 7.1%. The company reported second-quarter sales of TWD 748.84 million and net income of TWD 289.51 million, reflecting strong operational efficiency. Additionally, Apex Dynamics' basic earnings per share from continuing operations increased to TWD 3.61 from TWD 3.18 a year ago, indicating solid profitability and shareholder value enhancement in recent quarters.

- Click here and access our complete health analysis report to understand the dynamics of Apex Dynamics.

Evaluate Apex Dynamics' historical performance by accessing our past performance report.

Make It Happen

- Explore the 4821 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4583

Flawless balance sheet with proven track record.