Stock Analysis

- South Korea

- /

- Insurance

- /

- KOSE:A082640

Top Three Dividend Stocks For July 2024

Reviewed by Simply Wall St

As global markets navigate through a period of subtle shifts and key economic updates, investors are closely monitoring the landscape for opportunities that align with both growth and stability. In this context, dividend stocks often come into focus as they can offer potential income alongside capital appreciation, making them appealing during times of market uncertainty and economic recalibration.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.26% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 7.09% | ★★★★★★ |

| Globeride (TSE:7990) | 3.77% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.43% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.61% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 5.83% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.46% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.35% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.07% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.42% | ★★★★★★ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

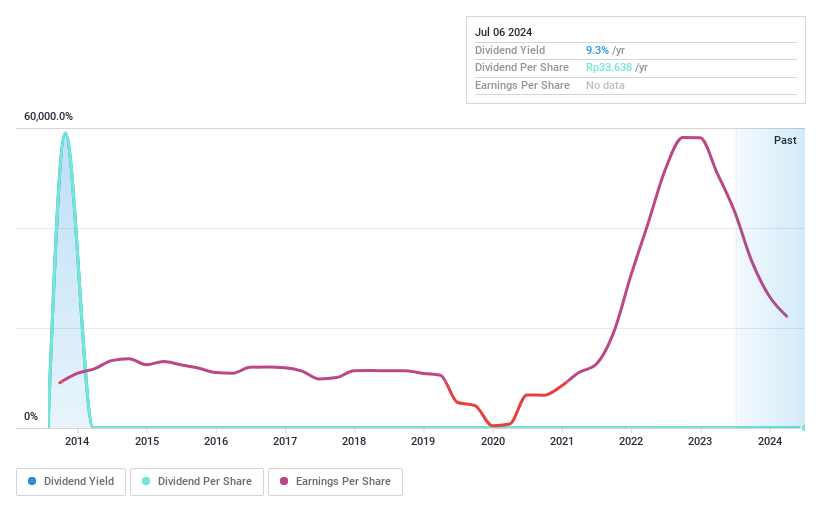

Samudera Indonesia (IDX:SMDR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PT Samudera Indonesia Tbk operates in cargo transportation and integrated logistics, serving regions including Southeast Asia, the Middle East, and India, with a market capitalization of approximately IDR 6.09 trillion.

Operations: PT Samudera Indonesia Tbk generates revenue primarily through its Shipping and Agency Services, which brought in $565.13 million, and its Logistics and Ports Services, contributing $160.92 million.

Dividend Yield: 9.1%

Samudera Indonesia's dividend attractiveness is mixed. Despite a high yield of 9.1%, which places it in the top 25% of Indonesian dividend payers, its sustainability is questionable. Dividend coverage by earnings and cash flow is weak, with a cash payout ratio exceeding 100%. Additionally, historical dividend payments have shown significant volatility and unreliability over the past decade. Recent financials reveal a substantial drop in net income from US$27.44 million to US$10.16 million year-over-year, further challenging future dividend sustainability.

- Click here to discover the nuances of Samudera Indonesia with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Samudera Indonesia's current price could be quite moderate.

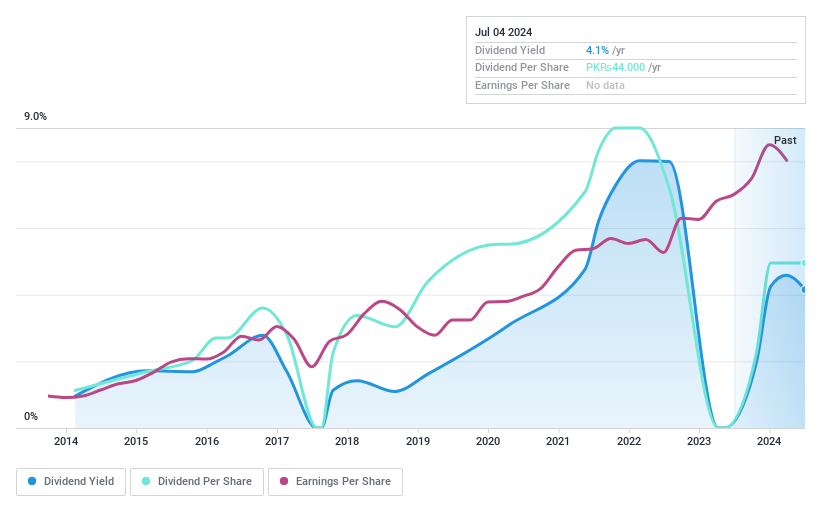

Pakistan Tobacco (KASE:PAKT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pakistan Tobacco Company Limited, engaged in manufacturing and selling cigarettes, tobacco, velo, and vuse both domestically and internationally, has a market capitalization of approximately PKR 298.71 billion.

Operations: Pakistan Tobacco Company Limited generates revenue primarily from its cigarette manufacturing segment, totaling PKR 111.25 billion.

Dividend Yield: 3.8%

Pakistan Tobacco reported a decline in Q1 2024 net income to PKR 5.14 billion from PKR 6.74 billion the previous year, despite revenue growth. Its dividend yield of 3.76% is low for the market, and dividend payments have been unstable over the past decade. However, dividends are well-covered by earnings with a payout ratio of 29.9% and by cash flows with a cash payout ratio of 69.3%. The company's P/E ratio at 10.9x remains below the industry average.

- Click to explore a detailed breakdown of our findings in Pakistan Tobacco's dividend report.

- According our valuation report, there's an indication that Pakistan Tobacco's share price might be on the expensive side.

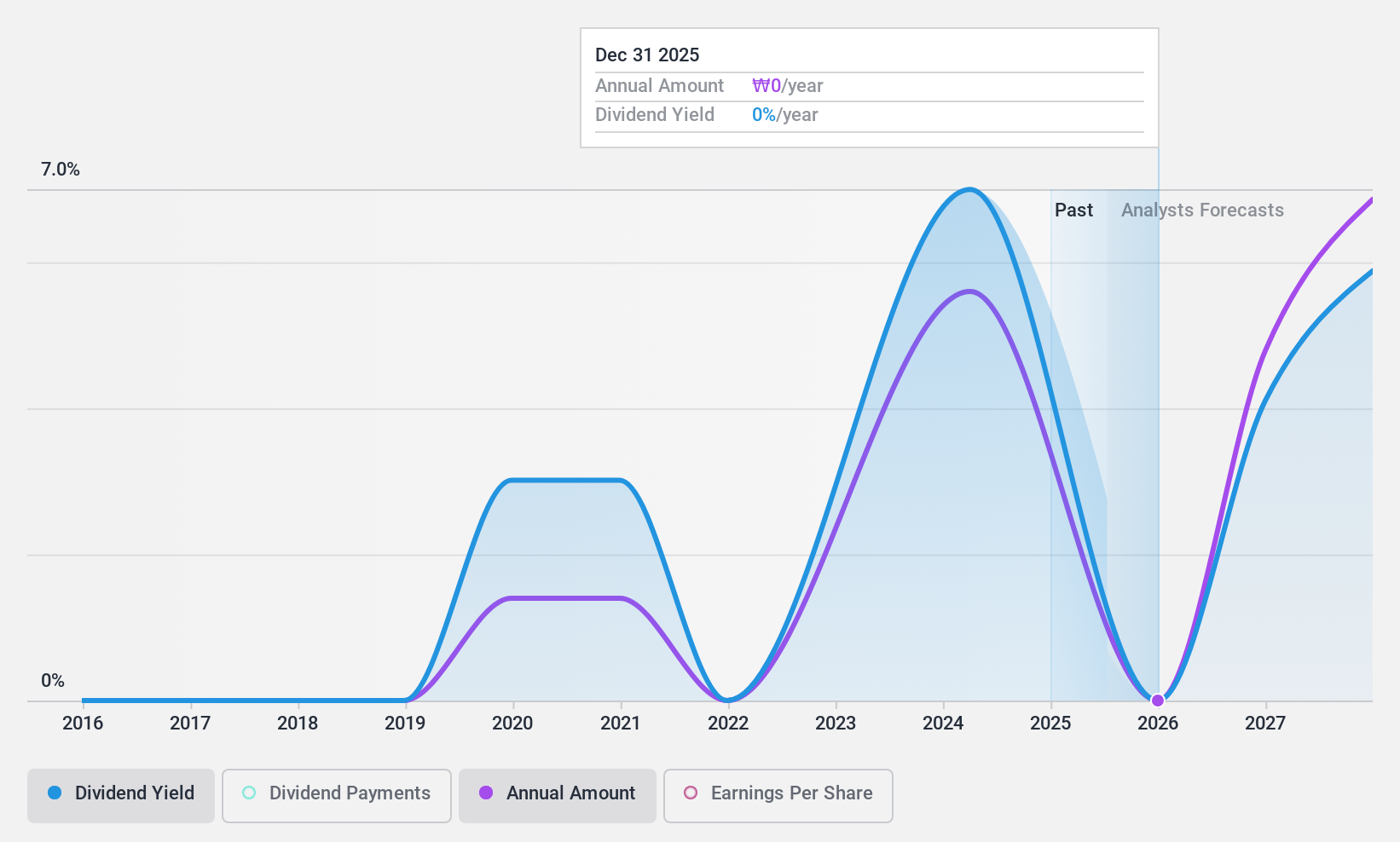

Tong Yang Life Insurance (KOSE:A082640)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tong Yang Life Insurance Co., Ltd. operates primarily in the life insurance sector within South Korea, with a market capitalization of approximately ₩1.20 trillion.

Operations: Tong Yang Life Insurance Co., Ltd. generates its revenue primarily from the life and health insurance segment, totaling approximately ₩2.90 billion.

Dividend Yield: 4.6%

Tong Yang Life Insurance experienced a significant decrease in Q1 2024 net income, earning KRW 82.67 billion compared to KRW 149.57 billion the previous year. Despite this, the company maintains a sustainable dividend with a low payout ratio of 30.6% and an even lower cash payout ratio of 3.8%. The dividend yield stands at a competitive 4.64%, higher than the market average of 3.53%. However, its history of dividend payments spans only five years, indicating potential concerns about long-term stability and reliability in its dividend policy.

- Click here and access our complete dividend analysis report to understand the dynamics of Tong Yang Life Insurance.

- Our comprehensive valuation report raises the possibility that Tong Yang Life Insurance is priced lower than what may be justified by its financials.

Key Takeaways

- Take a closer look at our Top Dividend Stocks list of 1964 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Tong Yang Life Insurance is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A082640

Tong Yang Life Insurance

Engages in the life insurance business in South Korea.

Excellent balance sheet, good value and pays a dividend.