- Philippines

- /

- Wireless Telecom

- /

- PSE:TEL

PLDT (PSE:TEL) Declares P2,437,500 Dividend And Elects New Board Members

Reviewed by Simply Wall St

PLDT (PSE:TEL) recently announced key executive and board changes, including the election of Mr. Menardo G. Jimenez, Jr. as a director and appointing Fr. Roberto C. Yap, S.J. as an independent advisor, coinciding with the company declaring a PHP 2,437,500 cash dividend on Voting Preferred Stock. Despite these announcements, PLDT's share price experienced a 1% decline last week. This movement contrasts with the broader market, which showed an increase, suggesting that internal changes and dividend declarations at PLDT perhaps had a stabilizing or neutral impact against the prevailing upward market trend.

Be aware that PLDT is showing 2 warning signs in our investment analysis.

The executive and board changes at PLDT, coinciding with dividend announcements, appear to have a stabilizing impact, as seen with the recent 1% decline in share price despite a broader market increase. Over the longer term, PLDT's total shareholder return was 41.50% over five years, suggesting a solid performance when factoring in dividends, though the company underperformed compared to the Philippines Wireless Telecom industry, which saw a 12.3% increase in the last year.

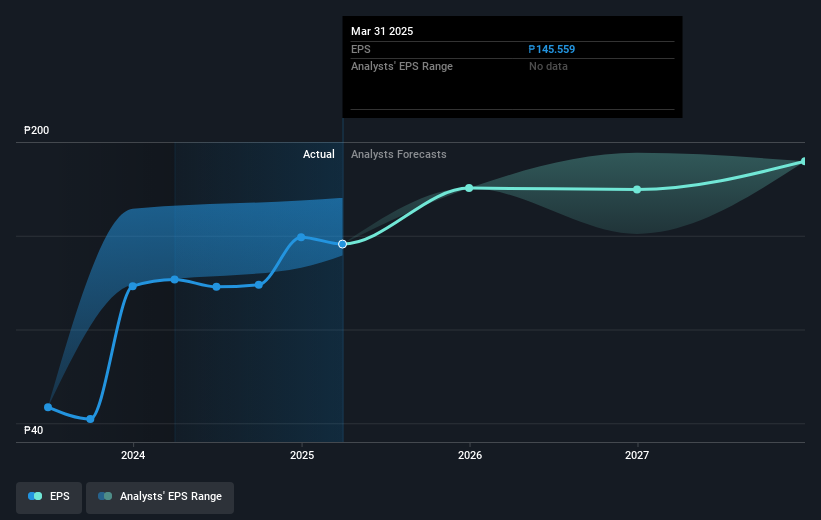

These internal shifts, while not immediately boosting share prices, could lay groundwork for future growth in areas like digital finance and fiber connectivity. Revenue and earnings are forecasted to grow, with income projected to rise to ₱39.9 billion by 2028. However, elevated costs and heavy debt may constrain earnings potential. Current analyst consensus reflects a 28.7% upside opportunity based on a price target of ₱1743.75, indicating potential confidence in PLDT's strategic direction against the current share price of ₱1246. Moreover, these catalysts may eventually be reflected in the company's earnings and revenues as they capitalize on digital service expansions.

Our expertly prepared valuation report PLDT implies its share price may be lower than expected.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:TEL

PLDT

Provides telecommunications and digital services in the Philippines.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives