- Philippines

- /

- Wireless Telecom

- /

- PSE:TEL

PLDT (PSE:TEL) Declares Dividends Amid Q2 Revenue and Net Income Increase

Reviewed by Simply Wall St

PLDT (PSE:TEL) recently announced second-quarter results showing an increase in revenue and net income, as well as declared regular and preferred cash dividends. Despite these positive financial results, the company's share price saw a 10% decline over the last quarter. This downturn can be contextualized by broader market trends, as major indices including the S&P 500 and Dow Jones also experienced retreats from record highs, particularly impacting tech stocks. Concurrently, PLDT is managing capital expenditures and planning infrastructure expansions, which may weigh on short-term investor sentiment but position the company for future growth.

Be aware that PLDT is showing 2 weaknesses in our investment analysis.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

The recent results from PLDT, showing increased revenue and net income, seem to highlight the company's ongoing efforts to bolster its position through infrastructure expansion and new digital offerings. Despite these positive outcomes, the share price experienced a decline, which is mirrored by broader market downturns, affecting especially tech stocks, due to current market conditions. This scenario is further complicated by the company's high capital expenditure plans that might influence short-term sentiment among investors, yet could support future growth if digital expansion successfully boosts revenues, particularly in fiber broadband and 5G adoption.

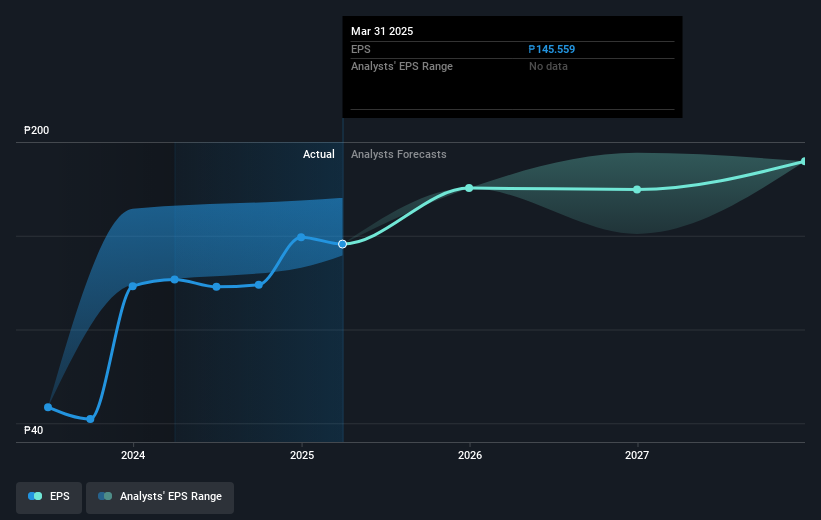

For a longer-term perspective, PLDT's total shareholder return, including share price and dividends, has been 10.71% over a five-year period, indicating modest performance. Over the past year, the stock underperformed compared to the Philippine Wireless Telecom industry, which showed considerable gains of 22.2%. Analysts forecast slower revenue growth at 3% annually compared to the overall Philippine market's 7.3%, signaling potential challenges in reaching projected targets. The current share price of ₱1123.00 is significantly below the analyst price target of ₱1663.75, suggesting a substantial upside if the company's earnings can meet expectations, including profit margins forecast to rise to 17.1% over the next few years.

Examine PLDT's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:TEL

PLDT

Provides telecommunications and digital services in the Philippines.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives