- Philippines

- /

- REITS

- /

- PSE:VREIT

Top Asian Dividend Stocks For November 2025

Reviewed by Simply Wall St

As Asian markets navigate a complex landscape marked by China's economic slowdown and Japan's cautious fiscal policies, investors are increasingly focusing on stable income sources amid global uncertainties. In this context, dividend stocks in Asia offer a compelling opportunity for those seeking consistent returns, as they can provide a buffer against market volatility and serve as a reliable income stream.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.27% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.80% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.93% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 4.37% | ★★★★★★ |

| NCD (TSE:4783) | 4.58% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.07% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.66% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.84% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.38% | ★★★★★★ |

Click here to see the full list of 1057 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

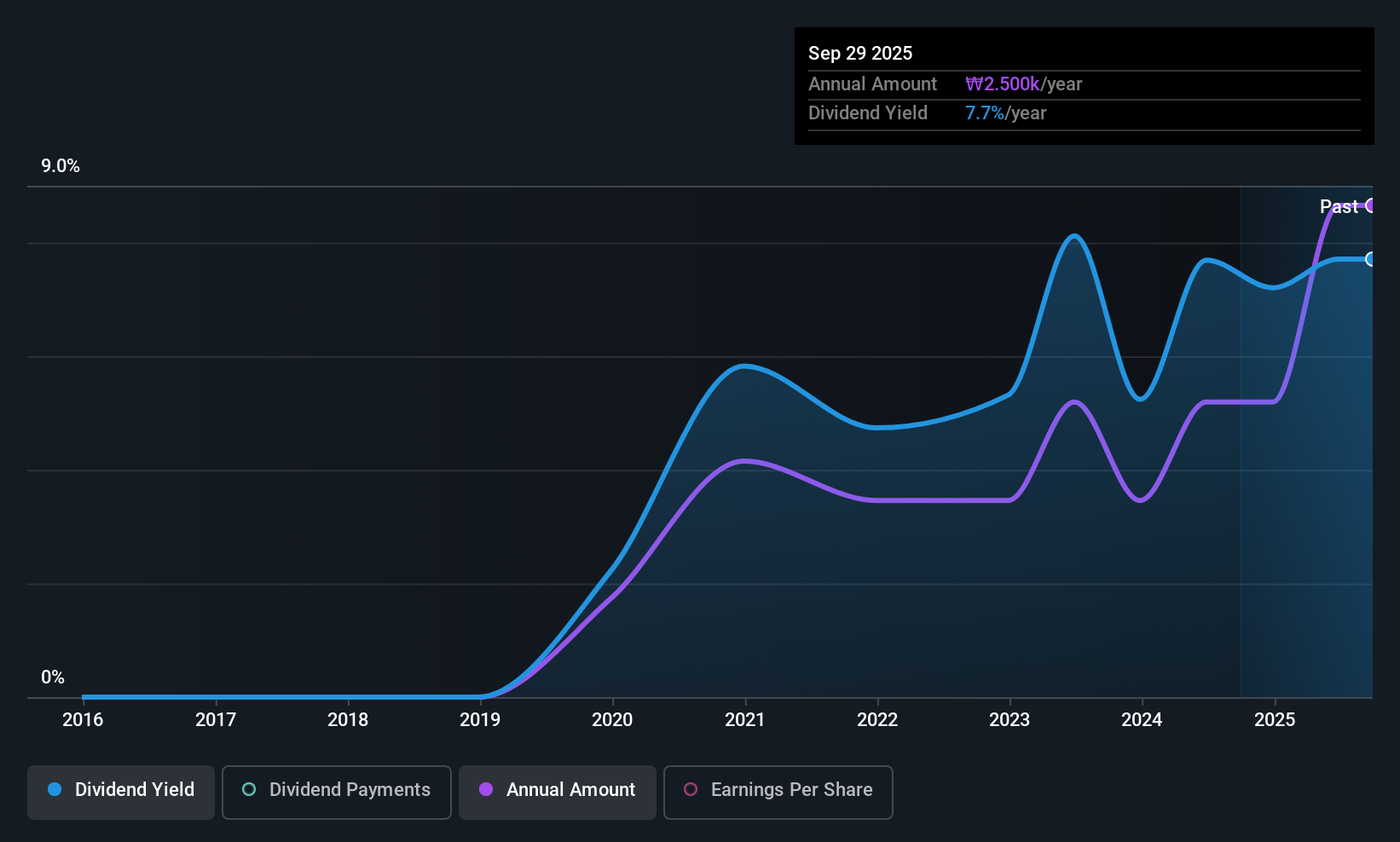

Seoho ElectricLtd (KOSDAQ:A065710)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Seoho Electric Co., Ltd specializes in designing and manufacturing electric variable speed drive control devices across several countries, with a market cap of ₩198.84 billion.

Operations: Seoho Electric Co., Ltd generates its revenue through the design and manufacture of electric variable speed drive control devices, serving markets in South Korea, China, Singapore, Oman, Mexico, Australia, and other international locations.

Dividend Yield: 5.7%

Seoho Electric Ltd. demonstrates solid dividend coverage with a payout ratio of 57.5% and a cash payout ratio of 45.9%, indicating dividends are well-supported by earnings and cash flows. Despite recent robust earnings growth, the company's dividend history is less stable, with volatility over its six-year payment period. The stock trades at a significant discount to estimated fair value, offering an attractive yield in the top 25% of the Korean market despite its inconsistent track record.

- Navigate through the intricacies of Seoho ElectricLtd with our comprehensive dividend report here.

- Our valuation report unveils the possibility Seoho ElectricLtd's shares may be trading at a discount.

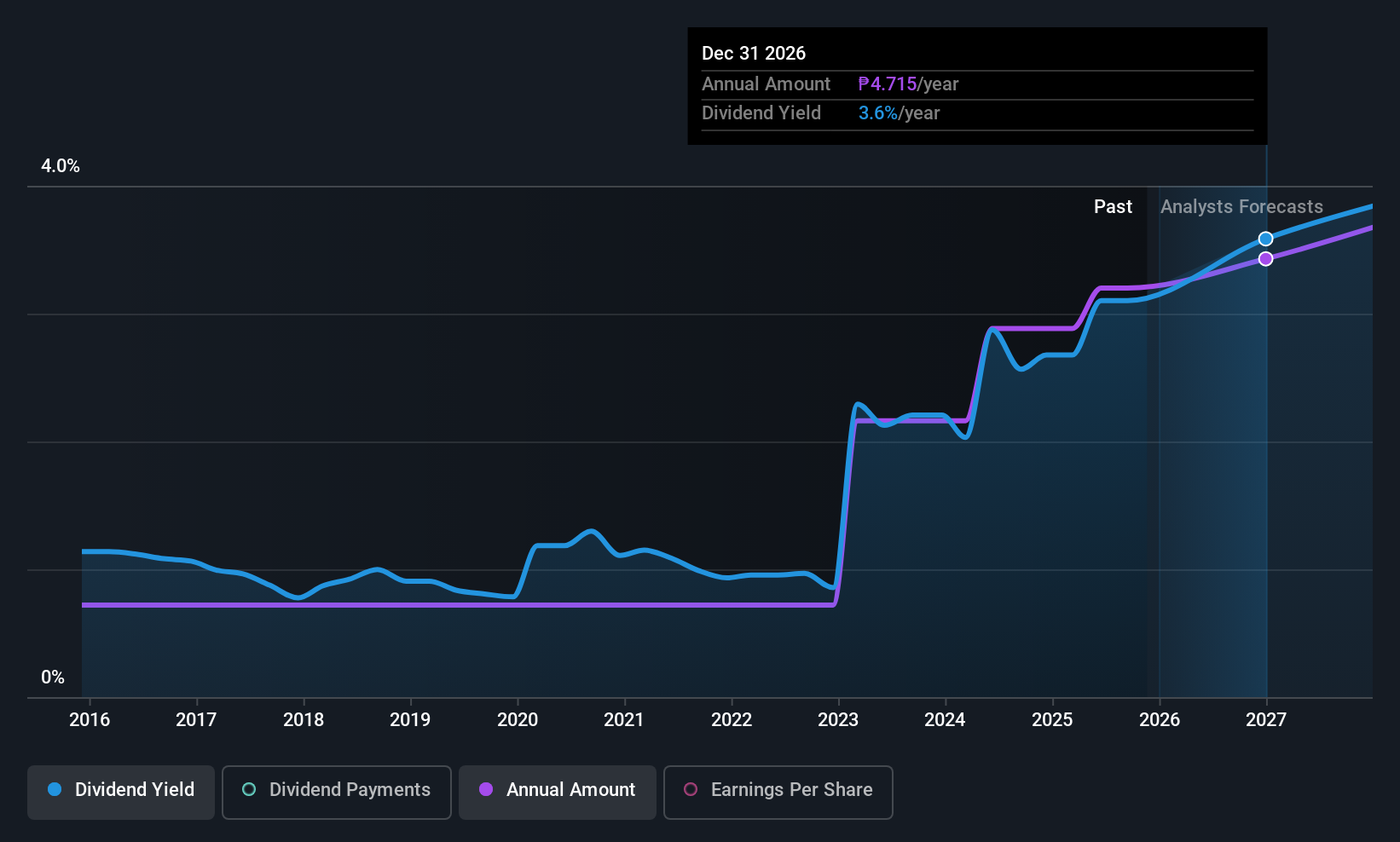

BDO Unibank (PSE:BDO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BDO Unibank, Inc., along with its subsidiaries, offers a wide range of banking products and services to both individuals and corporations in the Philippines and abroad, with a market cap of ₱706.74 billion.

Operations: BDO Unibank's revenue segments include Commercial Banking at ₱262.41 billion, Insurance at ₱29.28 billion, Private Banking at ₱3.06 billion, Investment Banking at ₱2.37 billion, and Leasing and Finance at ₱1.33 billion.

Dividend Yield: 3.3%

BDO Unibank offers a stable dividend history with consistent growth over the past decade, supported by a low payout ratio of 6.3%, ensuring dividends are well-covered by earnings. Trading below estimated fair value, it presents potential for capital appreciation. However, its dividend yield of 3.32% is lower than the top quartile in the Philippine market and is accompanied by a high level of bad loans at 2.6%. Recent earnings reports show steady growth in net income and interest income, reinforcing its financial stability amidst executive changes focused on IT leadership enhancements.

- Dive into the specifics of BDO Unibank here with our thorough dividend report.

- Our valuation report here indicates BDO Unibank may be undervalued.

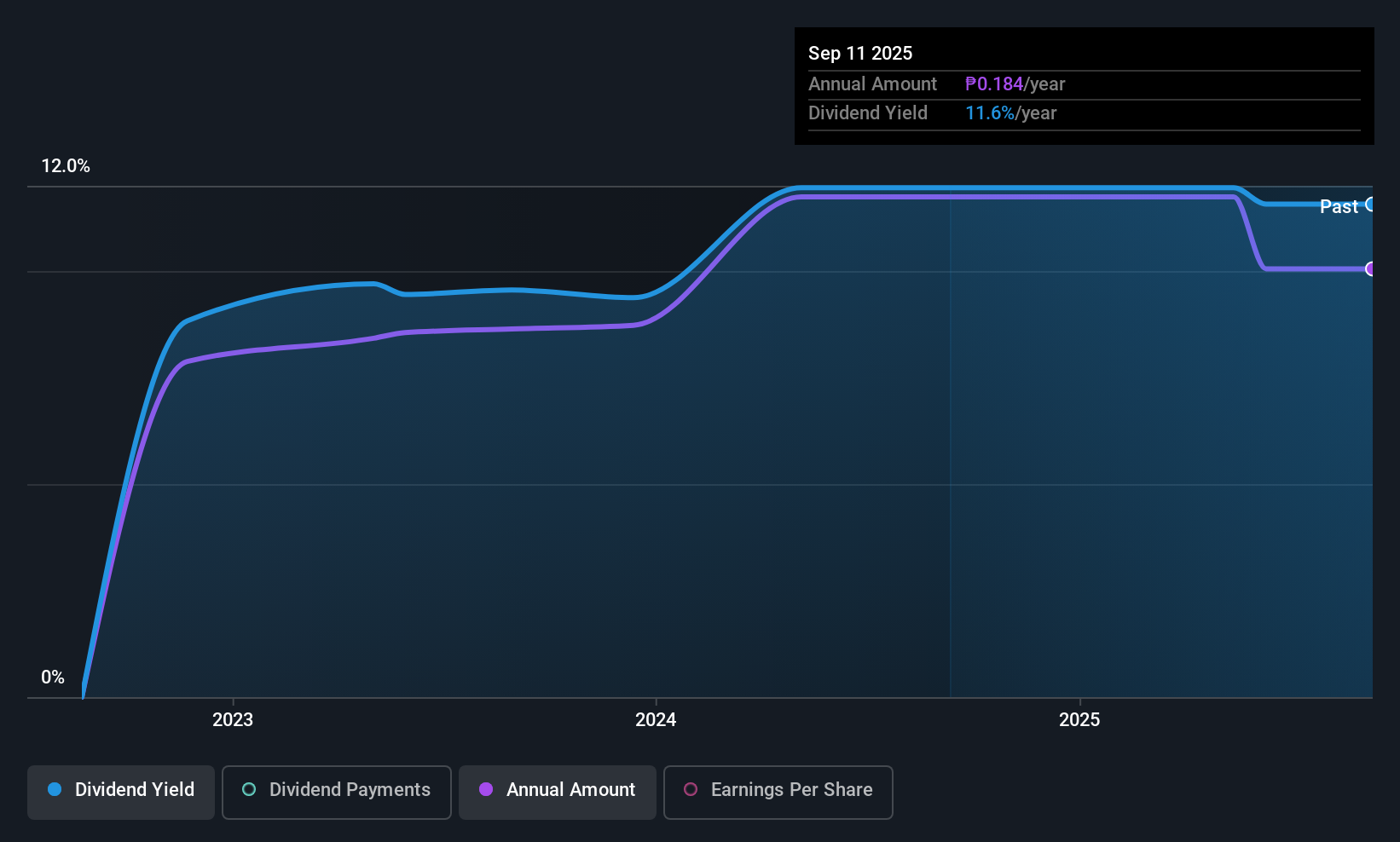

VistaREIT (PSE:VREIT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: VistaREIT Inc is a real estate investment trust with a market capitalization of ₱9.90 billion, focusing on property investments and management.

Operations: VistaREIT Inc generates revenue from its real estate investment activities, focusing on property investments and management.

Dividend Yield: 14.0%

VistaREIT's dividend payments are stable and well-covered by earnings and cash flows, with a low payout ratio of 16.4% and a cash payout ratio of 41.4%. Despite only three years of dividend history, its yield is among the top 25% in the Philippine market. Recent earnings show slight revenue decline but improved net income, indicating financial resilience. Trading significantly below fair value suggests potential for capital appreciation despite recent large one-off items impacting results.

- Get an in-depth perspective on VistaREIT's performance by reading our dividend report here.

- The valuation report we've compiled suggests that VistaREIT's current price could be quite moderate.

Key Takeaways

- Get an in-depth perspective on all 1057 Top Asian Dividend Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:VREIT

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives