- Philippines

- /

- Real Estate

- /

- PSE:HOUSE

Uncovering 3 Undiscovered Gems in Global Markets with Strong Potential

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have shown resilience, with the Russell 2000 Index outperforming larger indices amid expectations of lower interest rates. As investors navigate this "bad news is good news" environment, characterized by shifting economic indicators and central bank policies, identifying undiscovered gems becomes crucial for those seeking growth opportunities. A good stock in today's market often combines strong fundamentals with the ability to adapt to economic shifts and capitalize on sector-specific trends.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Soft-World International | NA | -1.48% | 5.58% | ★★★★★★ |

| Champion Building MaterialsLtd | 29.77% | -2.25% | 8.58% | ★★★★★★ |

| Sinotherapeutics | NA | 29.32% | -5.40% | ★★★★★★ |

| HG Metal Manufacturing | 3.75% | 8.47% | 6.94% | ★★★★★★ |

| Shenzhen Zhongheng Huafa | NA | 2.16% | 35.13% | ★★★★★★ |

| CHTC Helon | 2.04% | 7.49% | 11.24% | ★★★★★★ |

| Te Chang Construction | 15.29% | 14.72% | 17.71% | ★★★★★☆ |

| Kinpo Electronics | 106.22% | 5.77% | 45.80% | ★★★★★☆ |

| AblePrint Technology | 7.90% | 35.99% | 14.47% | ★★★★★☆ |

| DINE. de | 78.90% | 35.52% | -13.75% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

8990 Holdings (PSE:HOUSE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: 8990 Holdings, Inc. is a Philippine company focused on developing housing projects, with a market capitalization of ₱52.60 billion.

Operations: 8990 Holdings generates revenue primarily from three segments: low-cost mass housing, medium-rise condominiums, and high-rise condominium units, with the latter contributing ₱9.99 billion. The company focuses on providing affordable housing solutions in the Philippines.

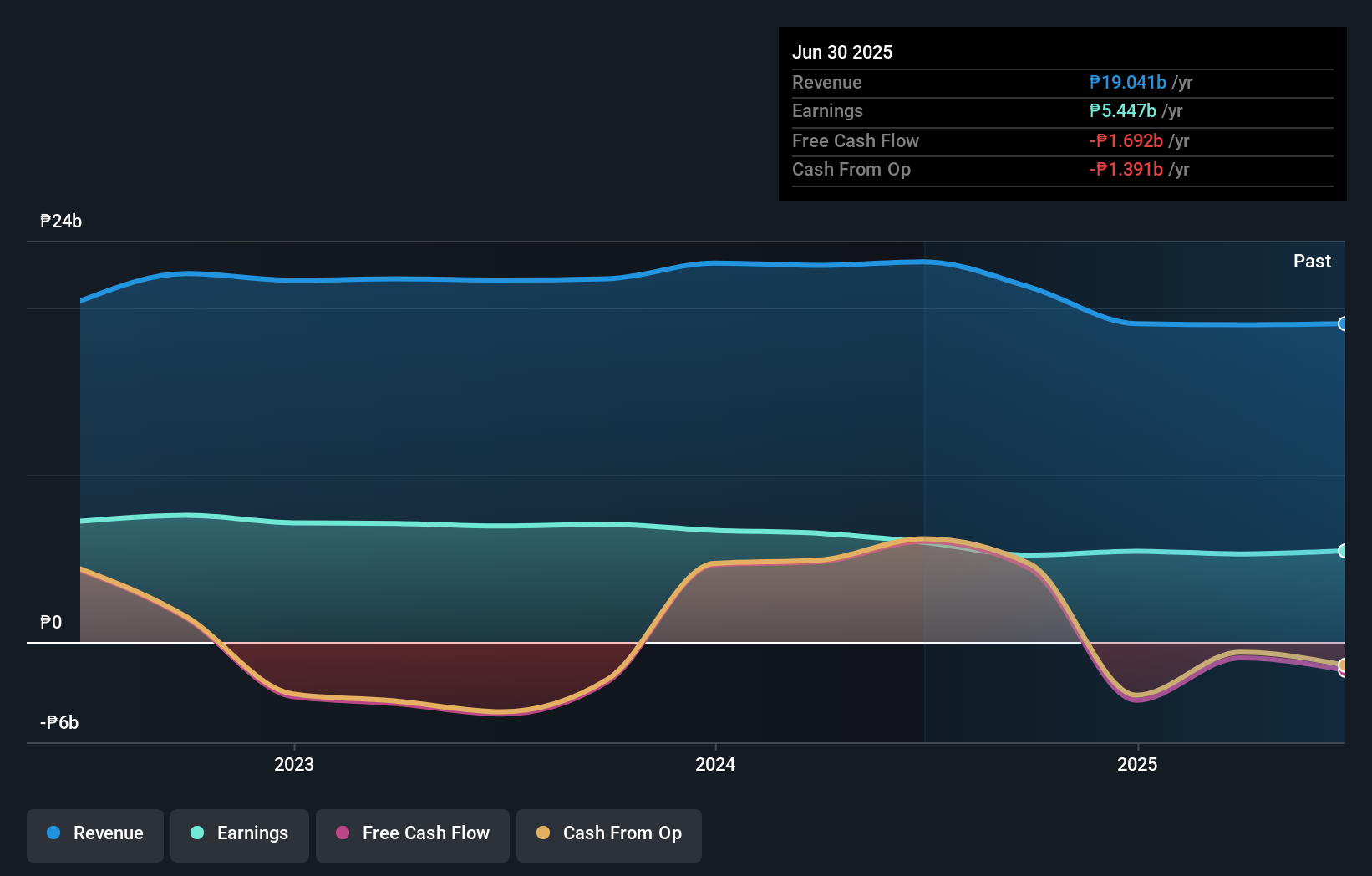

8990 Holdings, a notable player in the real estate sector, reported half-year sales of PHP 174.37 million, up from PHP 134.69 million last year. Its revenue remained steady at PHP 10.14 billion compared to the previous year's PHP 10.14 billion, while net income saw a slight increase to PHP 3.08 billion from PHP 3.06 billion. The company faces challenges with high net debt to equity ratio at 79% but has reduced it from over five years ago when it was at nearly 91%. Recently, significant corporate changes include Gwen Lourdes Lim's appointment as chairperson of the Audit and Risk Management Committee and plans for voluntary delisting approved by shareholders representing a substantial majority of common shares.

- Take a closer look at 8990 Holdings' potential here in our health report.

Explore historical data to track 8990 Holdings' performance over time in our Past section.

Sumitomo DensetsuLtd (TSE:1949)

Simply Wall St Value Rating: ★★★★★★

Overview: Sumitomo Densetsu Co., Ltd., along with its subsidiaries, functions as a construction company across several Asian countries including Japan, Indonesia, Thailand, Cambodia, Myanmar, the Philippines, China, and Malaysia with a market capitalization of ¥233.67 billion.

Operations: Sumitomo Densetsu generates revenue primarily from its Utilities Engineering Service segment, which accounts for ¥199.01 billion. The company's market capitalization stands at ¥233.67 billion.

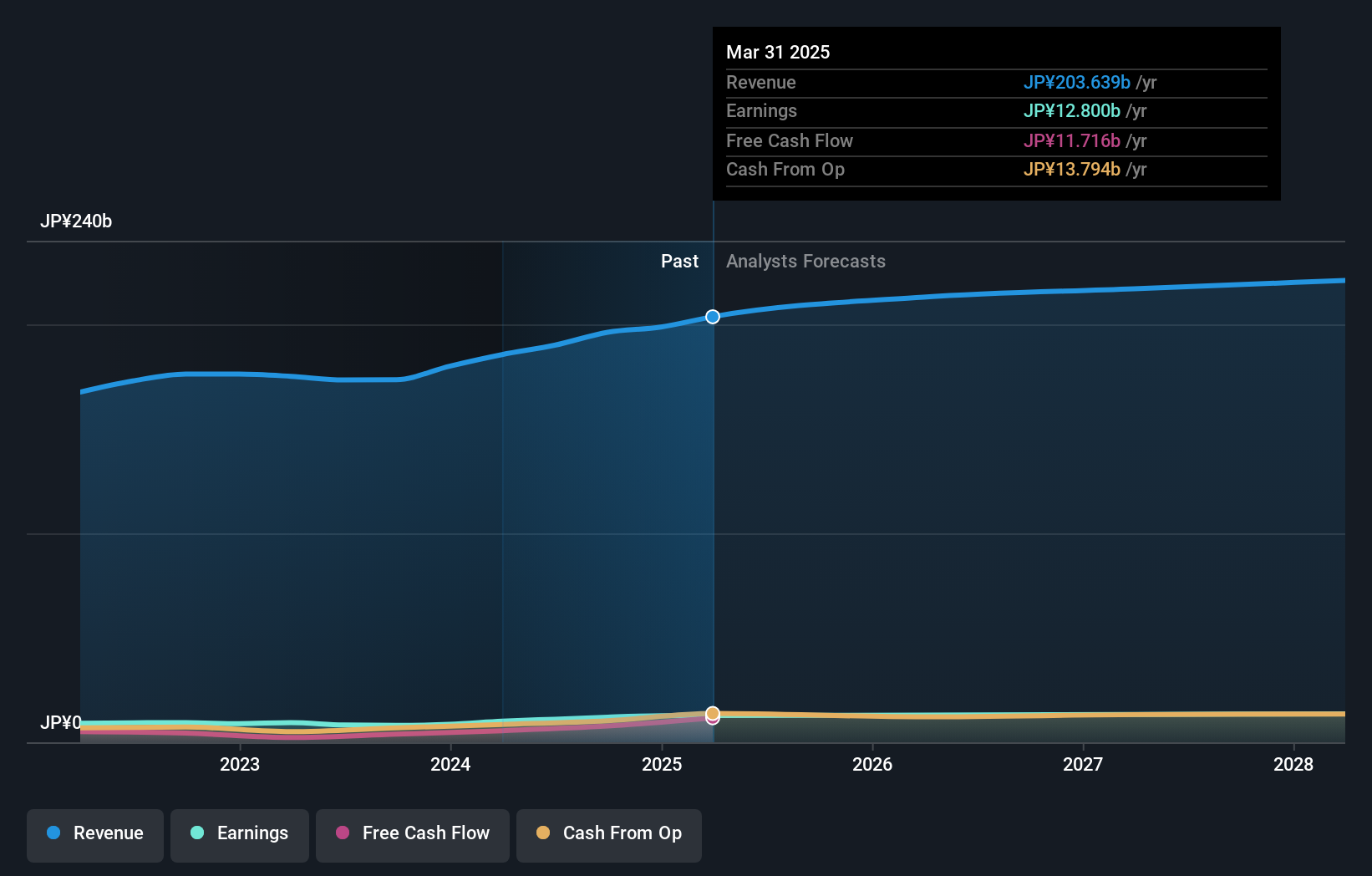

Sumitomo Densetsu, a smaller player in the construction industry, has seen its earnings grow at an annual rate of 8.6% over the past five years, reflecting robust performance. The company’s debt to equity ratio has improved significantly from 3.3 to 1.7 during this period, indicating better financial health. It remains free cash flow positive and holds more cash than total debt, which is reassuring for stakeholders concerned about liquidity risks. Recent guidance suggests net sales of ¥210 billion and operating profit of ¥18 billion for the fiscal year ending March 2026, highlighting steady growth potential despite not outpacing industry peers last year.

- Get an in-depth perspective on Sumitomo DensetsuLtd's performance by reading our health report here.

Techno Ryowa (TSE:1965)

Simply Wall St Value Rating: ★★★★★★

Overview: Techno Ryowa Ltd. specializes in the design, construction, and maintenance of environmental control systems primarily in Japan, with a market cap of ¥105.97 billion.

Operations: Techno Ryowa Ltd. generates significant revenue from its Air Conditioning Hygiene Equipment Construction Business, contributing ¥59.70 billion, followed by the General Building Equipment Work segment at ¥25.04 billion. The Electrical Equipment Construction Business and Cooling and Heating Equipment Sales Segment add ¥2.45 billion and ¥1.21 billion, respectively, to the company's revenue streams.

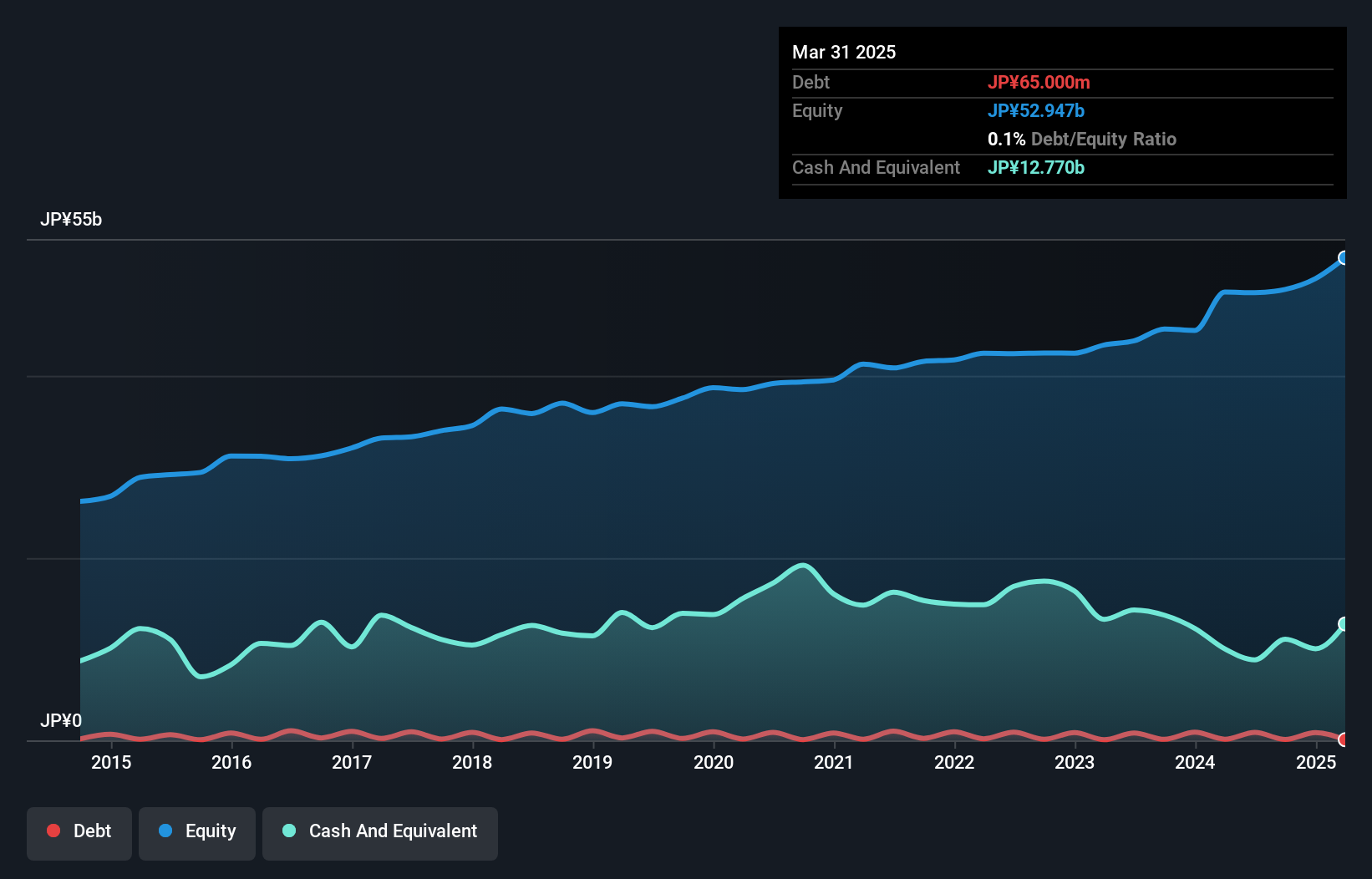

Techno Ryowa, a nimble player in its sector, has shown impressive earnings growth of 81.7% over the past year, outpacing the broader construction industry’s 19.6%. The company's price-to-earnings ratio stands at 13.5x, which is attractive compared to the JP market average of 14.5x. Over five years, Techno Ryowa has successfully reduced its debt-to-equity ratio from 2.2% to 1.5%, reflecting prudent financial management and a strong balance sheet position with more cash than total debt. Recently, it completed share repurchases totaling ¥2,199 million for about 2.57% of outstanding shares by August end this year.

- Click to explore a detailed breakdown of our findings in Techno Ryowa's health report.

Review our historical performance report to gain insights into Techno Ryowa's's past performance.

Next Steps

- Investigate our full lineup of 2927 Global Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:HOUSE

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives