- New Zealand

- /

- Hospitality

- /

- NZSE:SKC

Undervalued Asian Small Caps With Insider Action To Watch In October 2025

Reviewed by Simply Wall St

In recent weeks, Asian markets have shown resilience despite global economic uncertainties, with China's stock indices posting gains amid strong domestic liquidity and Japan's equities rising on tempered expectations of interest rate hikes. As investors navigate these dynamic conditions, identifying small-cap stocks with potential insider activity can offer unique opportunities for those looking to capitalize on undervalued assets in the region.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Domino's Pizza Enterprises | NA | 0.5x | 39.56% | ★★★★★☆ |

| Aurelia Metals | 8.7x | 1.2x | 36.94% | ★★★★★☆ |

| Growthpoint Properties Australia | NA | 6.0x | 28.20% | ★★★★★☆ |

| East West Banking | 3.2x | 0.8x | 16.00% | ★★★★☆☆ |

| Eureka Group Holdings | 11.0x | 4.8x | 26.29% | ★★★★☆☆ |

| Nickel Asia | 20.5x | 2.1x | 47.06% | ★★★★☆☆ |

| Cettire | NA | 0.3x | 25.69% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 45.05% | ★★★★☆☆ |

| BWP Trust | 10.0x | 13.1x | 13.10% | ★★★★☆☆ |

| Southern Cross Electrical Engineering | 17.8x | 0.7x | 27.39% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

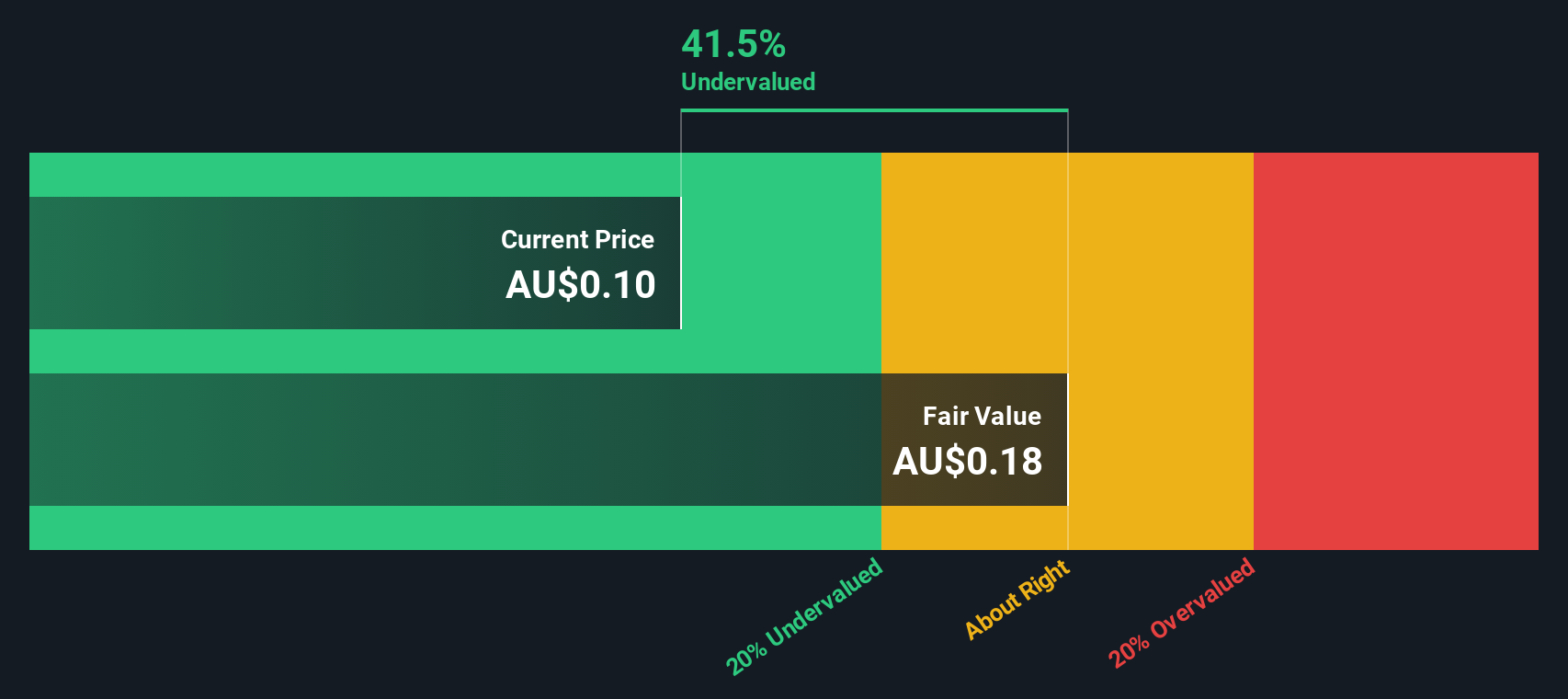

AMA Group (ASX:AMA)

Simply Wall St Value Rating: ★★★★★★

Overview: AMA Group operates in the automotive aftercare and accessories sector, focusing on collision repair services and parts supply, with a market capitalization of A$1.01 billion.

Operations: Capital Smart and Ama Collision are the primary revenue drivers, contributing significantly to the total revenue of A$1.01 billion. The company's gross profit margin has shown an upward trend, reaching 56.98% as of June 2025. Operating expenses have consistently been a major cost component, with general and administrative expenses being particularly notable.

PE: -58.9x

AMA Group, a company with a focus on external borrowing for funding, reported A$1.01 billion in sales for the year ending June 2025, up from A$933 million previously. Despite a net loss of A$7.47 million, insider confidence is evident as an individual acquired over 5 million shares valued at approximately A$499K. This suggests potential optimism about future growth prospects, with earnings expected to increase significantly by 68.78% annually according to forecasts.

- Unlock comprehensive insights into our analysis of AMA Group stock in this valuation report.

Evaluate AMA Group's historical performance by accessing our past performance report.

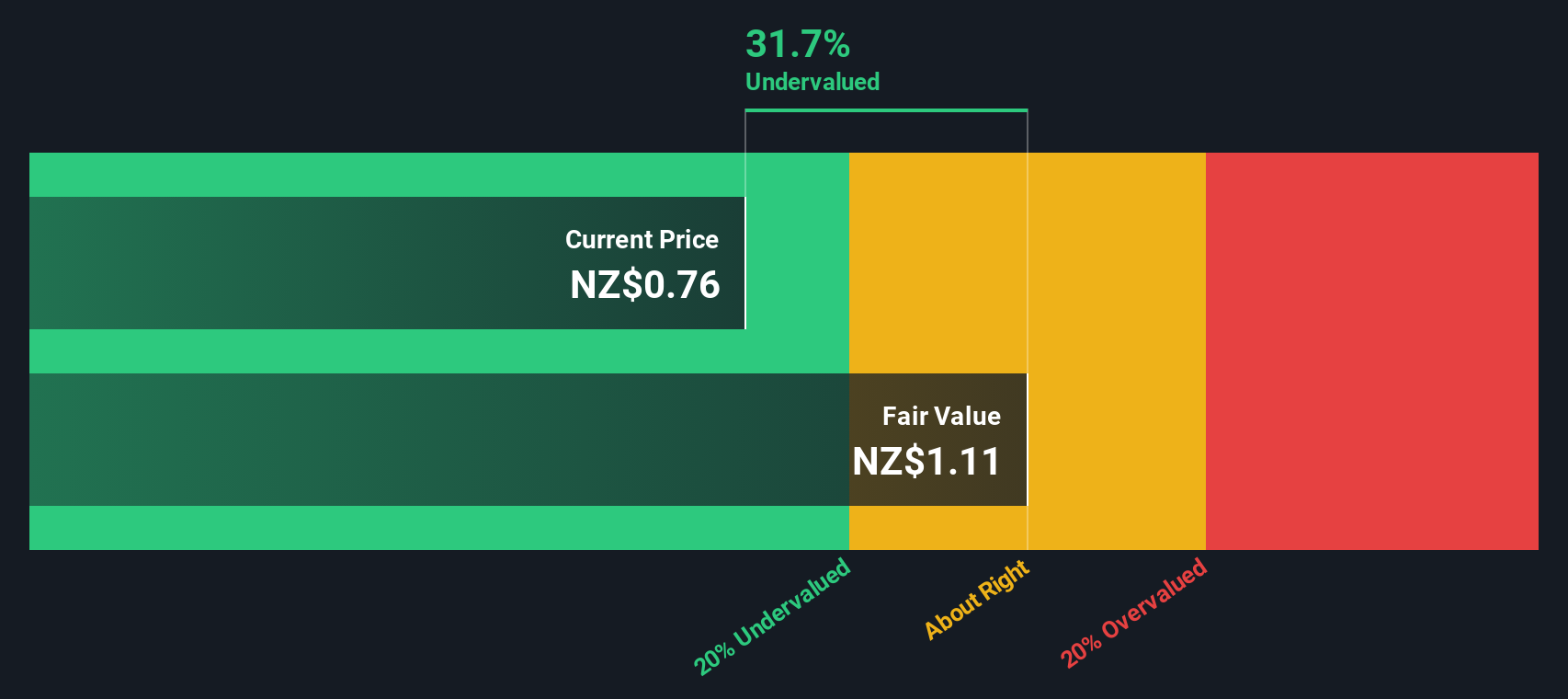

SkyCity Entertainment Group (NZSE:SKC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: SkyCity Entertainment Group is a prominent entertainment and gaming company operating casinos, hotels, and restaurants primarily in New Zealand and Australia, with a market cap of approximately NZ$2.61 billion.

Operations: SkyCity Entertainment Group's revenue is primarily derived from its Auckland and Adelaide operations, with Auckland contributing the largest share. The company has experienced fluctuations in its net income margin, which reached a high of 51.95% in December 2019 before turning negative in recent periods, such as -18.91% in December 2024. Operating expenses and non-operating expenses have been significant factors impacting profitability, with notable increases observed over time.

PE: 24.9x

SkyCity Entertainment Group, a smaller player in Asia's market, is navigating financial challenges with strategic asset sales and equity offerings. Recently, they raised NZ$240 million through share issuance to strengthen their balance sheet. Despite being dropped from major indices in September 2025, insider confidence remains evident as Jason Walbridge acquired 200,000 shares for approximately NZ$140K. The company aims to divest Auckland assets worth over NZ$250 million to reduce debt while anticipating earnings growth of nearly 36% annually.

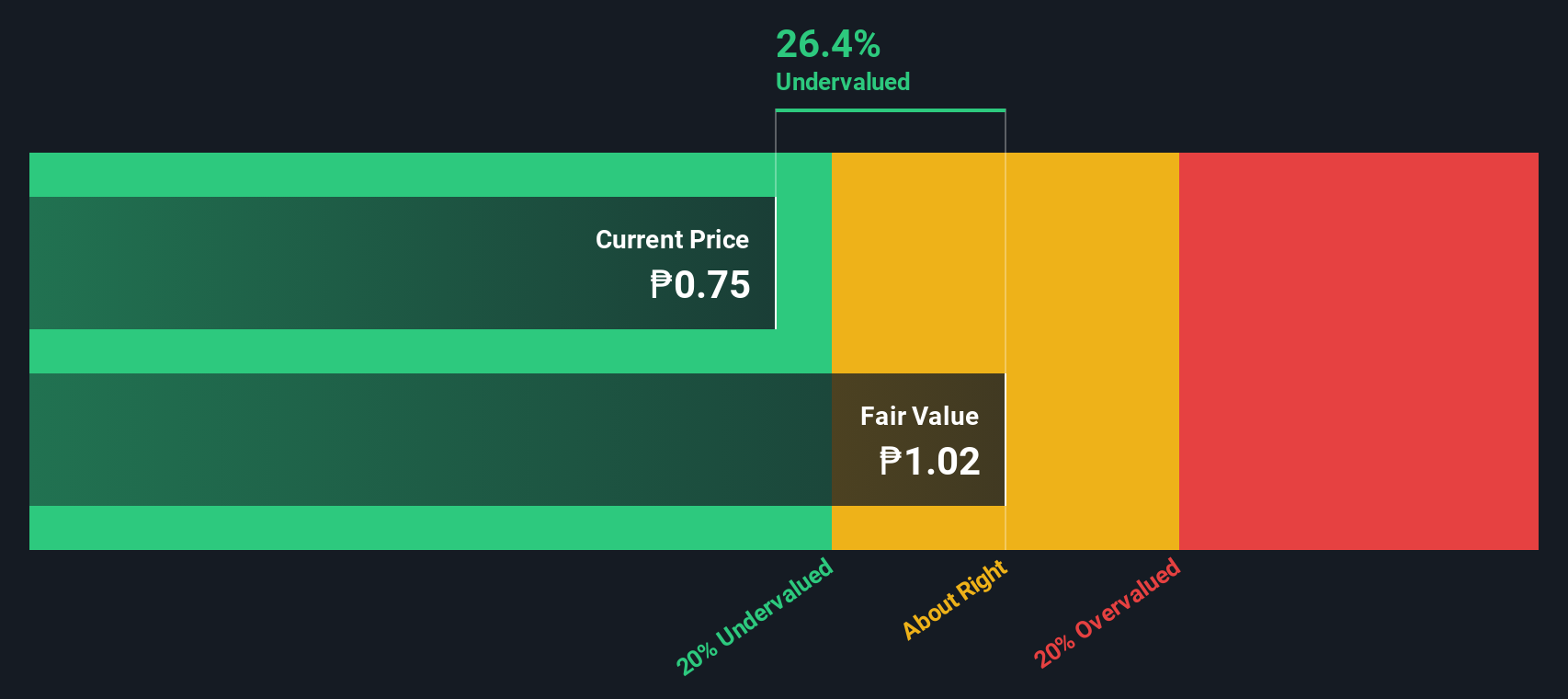

Filinvest Land (PSE:FLI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Filinvest Land is a real estate company engaged in leasing and real estate operations, with a market capitalization of approximately ₱21.76 billion.

Operations: The company's primary revenue streams are derived from leasing and real estate operations, with the latter contributing significantly more. In recent periods, the gross profit margin has shown an upward trend, reaching 53.27% by March 2025. Operating expenses have consistently included significant components such as general and administrative expenses and sales & marketing costs.

PE: 4.4x

Filinvest Land, a smaller company in the Asian market, shows potential for value with recent insider confidence. Between July and August 2025, insiders increased their share purchases, indicating belief in the company's prospects. Despite facing challenges with earnings not fully covering interest payments due to reliance on external borrowing, Filinvest's revenue grew slightly to PHP 6.17 billion in Q2 2025 from PHP 6.09 billion a year prior. Leadership changes include Ana Venus A. Mejia's appointment as COO, suggesting strategic shifts aimed at future growth.

- Click here and access our complete valuation analysis report to understand the dynamics of Filinvest Land.

Gain insights into Filinvest Land's past trends and performance with our Past report.

Make It Happen

- Unlock our comprehensive list of 42 Undervalued Asian Small Caps With Insider Buying by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:SKC

SkyCity Entertainment Group

Operates in the gaming, entertainment, hotel, convention, hospitality, and tourism sectors in New Zealand and Australia.

Fair value with moderate growth potential.

Market Insights

Community Narratives