- Philippines

- /

- Food

- /

- PSE:FB

San Miguel Food and Beverage (PSE:FB): Is the Market Missing an Undervalued Opportunity?

Reviewed by Simply Wall St

Price-to-Earnings of 11.3x: Is it justified?

San Miguel Food and Beverage currently trades at a Price-to-Earnings (P/E) ratio of 11.3x, which is significantly lower compared to both its local and regional industry peers.

The P/E ratio measures how much investors are willing to pay for each peso of earnings, and it is a widely used benchmark for valuing companies in mature, stable sectors such as food and beverage. It provides a quick snapshot of market sentiment and future growth expectations relative to company profits.

For FB, this lower-than-average P/E suggests the market is either underappreciating its growth prospects or maintaining skepticism despite steady performance. Given the company's healthy bottom-line growth and positive industry comparisons, investors may want to take a closer look at whether this valuation gap is a hidden opportunity or a signal of caution.

Result: Fair Value of ₱154.6 (UNDERVALUED)

See our latest analysis for San Miguel Food and Beverage.However, slower net income growth and the stock’s recent lackluster monthly return could limit near-term upside if these trends persist.

Find out about the key risks to this San Miguel Food and Beverage narrative.Another View: What Does the SWS DCF Model Say?

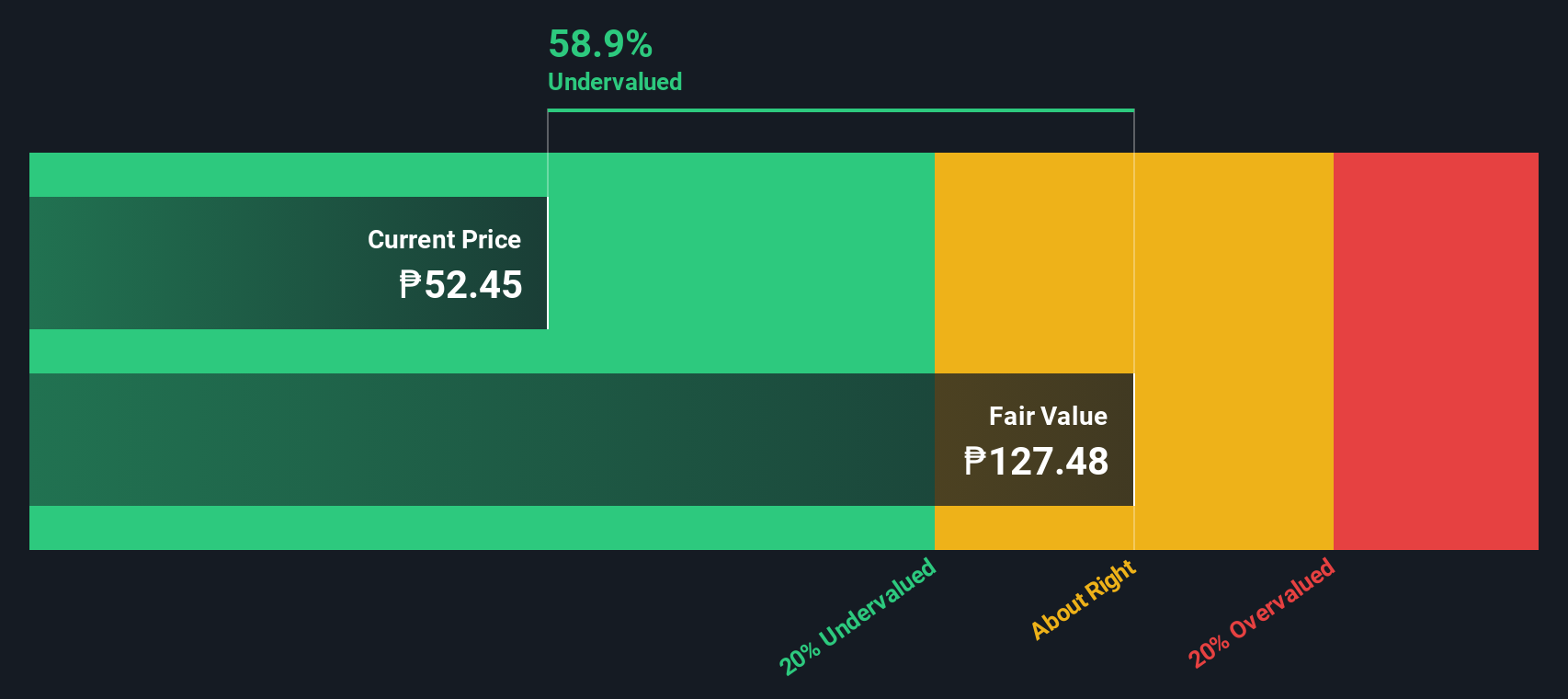

While the company looks undervalued using its earnings multiple compared to the industry, our DCF model also points to an undervalued situation. Both methods align for now. However, could a shift in forecasts change the picture?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own San Miguel Food and Beverage Narrative

If you see things differently or want to dig into the numbers your own way, you can put together your own analysis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding San Miguel Food and Beverage.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Maximize your chances of finding the next big winner by checking out these proven strategies below. Your portfolio will thank you.

- Spot opportunities in undervalued gems by using undervalued stocks based on cash flows to zero in on companies the market may be overlooking.

- Tap into the future of artificial intelligence with AI penny stocks as you look for fast-growing innovators set to transform entire industries.

- Secure reliable cash flow and growth with dividend stocks with yields > 3%, showcasing businesses with attractive yields over 3% and a record of rewarding shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About PSE:FB

San Miguel Food and Beverage

Manufactures and markets processed meat products.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives