- Sweden

- /

- Healthcare Services

- /

- OM:AMBEA

Undervalued Small Caps With Insider Activity To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and mixed economic data, small-cap stocks have faced their share of volatility, with indices like the S&P 600 reflecting broader market sentiment. Despite these challenges, certain small-cap companies may present opportunities for investors by demonstrating resilience through insider activity and strategic positioning. In such an environment, identifying stocks that show potential for growth while maintaining strong fundamentals can be crucial for those considering investments in this segment.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Maharashtra Seamless | 10.5x | 1.6x | 47.48% | ★★★★★☆ |

| Gamma Communications | 23.5x | 2.4x | 31.77% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 13.3x | 2.2x | 32.36% | ★★★★☆☆ |

| Logistri Fastighets | 12.6x | 8.9x | 36.38% | ★★★★☆☆ |

| Optima Health | NA | 1.5x | 47.73% | ★★★★☆☆ |

| Mark Dynamics Indonesia | 12.7x | 4.1x | 3.13% | ★★★☆☆☆ |

| Industri Jamu dan Farmasi Sido Muncul | 15.2x | 4.5x | -4.59% | ★★★☆☆☆ |

| Fourlis Holdings | 8.3x | 0.4x | -192.57% | ★★★☆☆☆ |

| Avia Avian | 13.8x | 3.2x | 19.75% | ★★★☆☆☆ |

| Mukand | 16.0x | 0.3x | 2.07% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

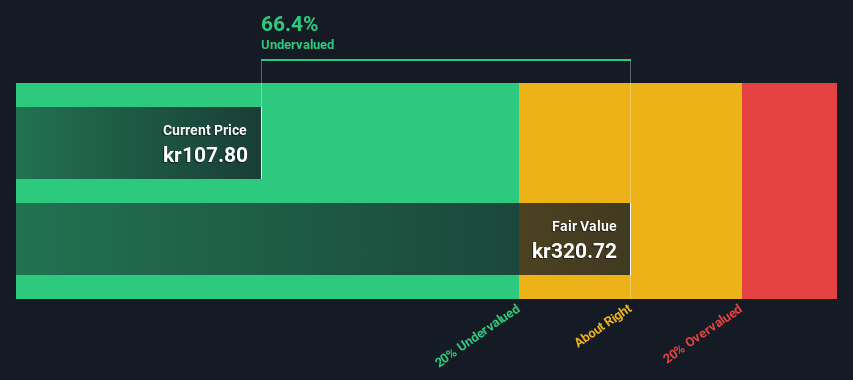

Bang & Olufsen (CPSE:BO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bang & Olufsen is a Danish company known for designing and manufacturing high-end audio products, televisions, and telephones, with a market capitalization of approximately DKK 1.77 billion.

Operations: The company's revenue streams are primarily derived from the EMEA region, followed by APAC, Americas, and Brand Partnering activities. Over recent periods, the gross profit margin has shown an upward trend, reaching 54.20% as of February 2025. Operating expenses are significant, with sales and marketing being a major component alongside research and development costs.

PE: -31.9x

Bang & Olufsen, a smaller company in the market, recently reported a net loss of DKK 13 million for Q2 2025, contrasting with last year's net income. Despite this setback, insider confidence is evident as an executive increased their shareholding by over 31% in recent months with a transaction valued at approximately DKK 2.68 million. The company’s revenue guidance remains stable for fiscal year 2025 despite challenging sales figures and reliance on external borrowing without customer deposits.

- Take a closer look at Bang & Olufsen's potential here in our valuation report.

Explore historical data to track Bang & Olufsen's performance over time in our Past section.

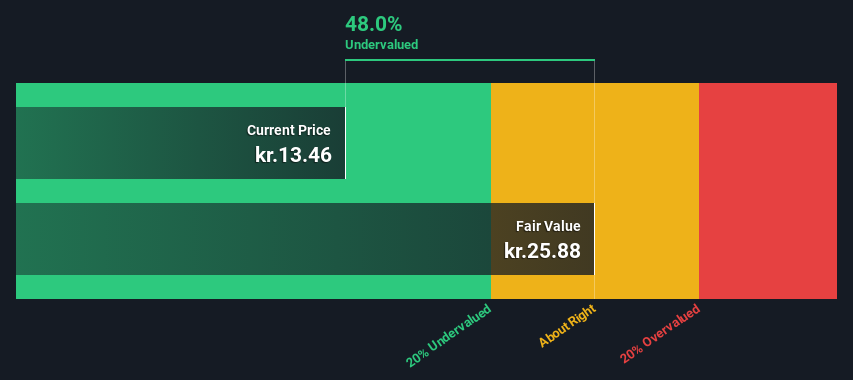

Ambea (OM:AMBEA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ambea is a leading provider of care services in the Nordic region, with operations across segments such as Klara, Nytida, Stendi, Altiden, and Vardaga; it has a market capitalization of approximately SEK 3.86 billion.

Operations: The company generates revenue primarily from segments such as Vardaga (SEK 4.98 billion), Nytida (SEK 4.16 billion), and Stendi (SEK 3.33 billion). Over recent periods, its gross profit margin has shown an upward trend, reaching 26.74% by September 2024. Operating expenses have been a significant part of the cost structure, with general and administrative expenses consistently contributing to these costs.

PE: 14.8x

Ambea, a company in the healthcare sector, recently reported an increase in net income to SEK 620 million for the full year ending December 31, 2024. Earnings per share rose to SEK 7.21 from SEK 5.07. Despite relying on higher-risk external borrowing for funding, insider confidence is evident with Daniel Björklund acquiring 16,650 shares valued at approximately SEK 999,000 between January and February this year. This suggests potential growth as earnings are forecasted to grow annually by about 8.66%.

- Unlock comprehensive insights into our analysis of Ambea stock in this valuation report.

Examine Ambea's past performance report to understand how it has performed in the past.

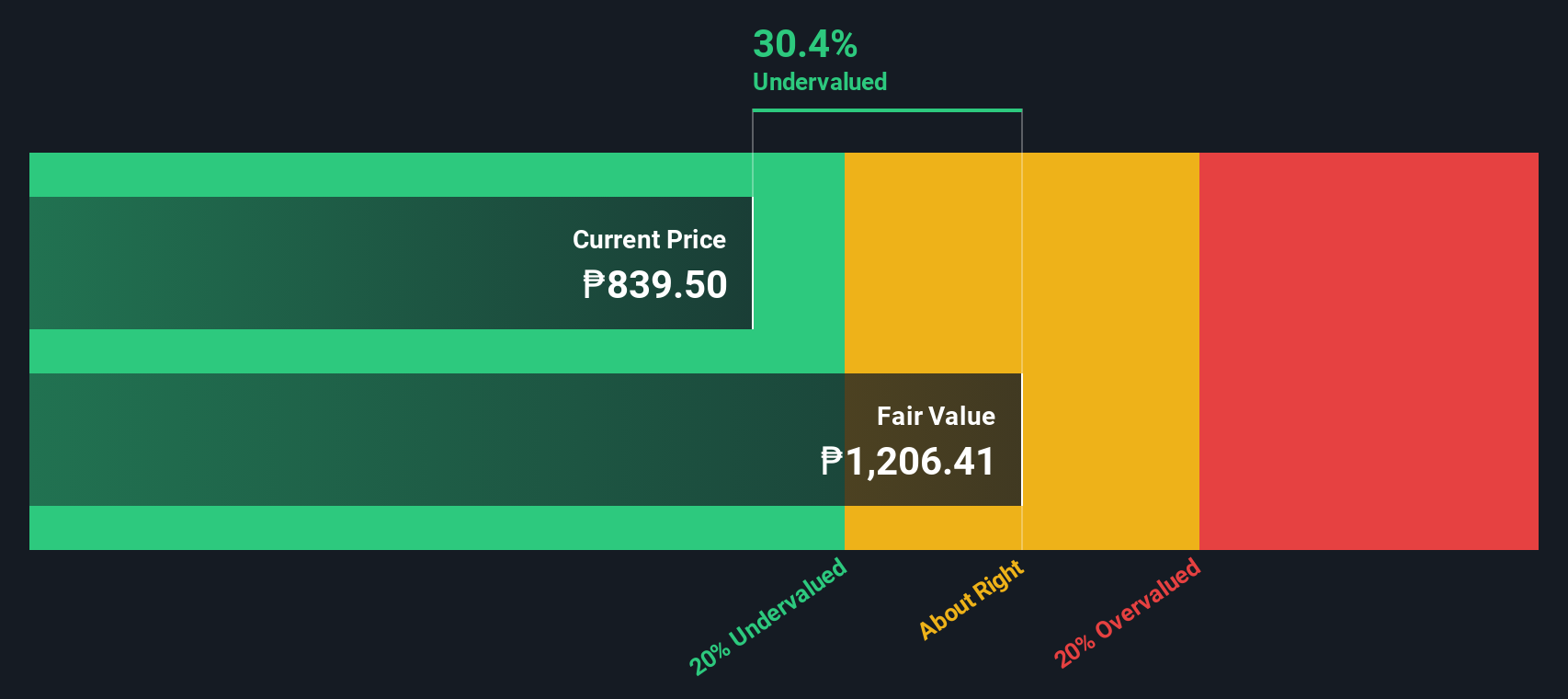

Far Eastern University (PSE:FEU)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Far Eastern University operates as an educational institution in the Philippines, managing multiple schools with a focus on various academic programs and has a market capitalization of ₱9.45 billion.

Operations: The company's revenue primarily comes from FEU Main, Trimestral Schools, and Other Schools. The gross profit margin has shown fluctuations, reaching 61.37% in August 2023 and then slightly decreasing to 58.09% by February 2025. Operating expenses include significant allocations for general and administrative costs, with depreciation and amortization also being notable components.

PE: 9.4x

Far Eastern University, a smaller company in the education sector, recently reported strong financial performance for the second quarter and six months ending November 30, 2024. Sales grew to PHP 24.8 million from PHP 14.81 million year-on-year, while net income increased to PHP 729.58 million from PHP 664.71 million. The company's earnings per share also improved, indicating operational efficiency despite relying on external borrowing for funding—considered riskier than customer deposits. Insider confidence is evident with Anthony Raymond Goquingco purchasing shares worth approximately PHP 236K in January, reflecting potential optimism about future prospects despite recent share price volatility over the past three months.

- Navigate through the intricacies of Far Eastern University with our comprehensive valuation report here.

Evaluate Far Eastern University's historical performance by accessing our past performance report.

Summing It All Up

- Embark on your investment journey to our 191 Undervalued Small Caps With Insider Buying selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:AMBEA

Ambea

Provides elderly care, disability care, and psychosocial support for the elderly and people with disabilities in Sweden, Norway, and Denmark.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives