As global markets grapple with AI-related concerns and fluctuating economic data, investors are increasingly seeking stability amidst the volatility. In such an environment, dividend stocks can offer a reliable income stream, making them an attractive option for those looking to balance risk with steady returns.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.35% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.72% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.93% | ★★★★★★ |

| NCD (TSE:4783) | 4.51% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.20% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.58% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.64% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.82% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.82% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.46% | ★★★★★★ |

Click here to see the full list of 1355 stocks from our Top Global Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Centro Escolar University (PSE:CEU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Centro Escolar University operates educational institutions in the Philippines and has a market cap of ₱6.70 billion.

Operations: Centro Escolar University generates revenue from its educational institutions with contributions of ₱1.63 billion from Mendiola, ₱284.75 million from Malolos, ₱176.41 million from Makati-Legaspi, ₱238.54 million from Makati-Gil Puyat, and ₱82.30 million from Las Piñas College, as well as ₱133.30 million from Malolos Integrated School and a pre-operating amount of ₱4.92 million for Makati-Legaspi Hospital.

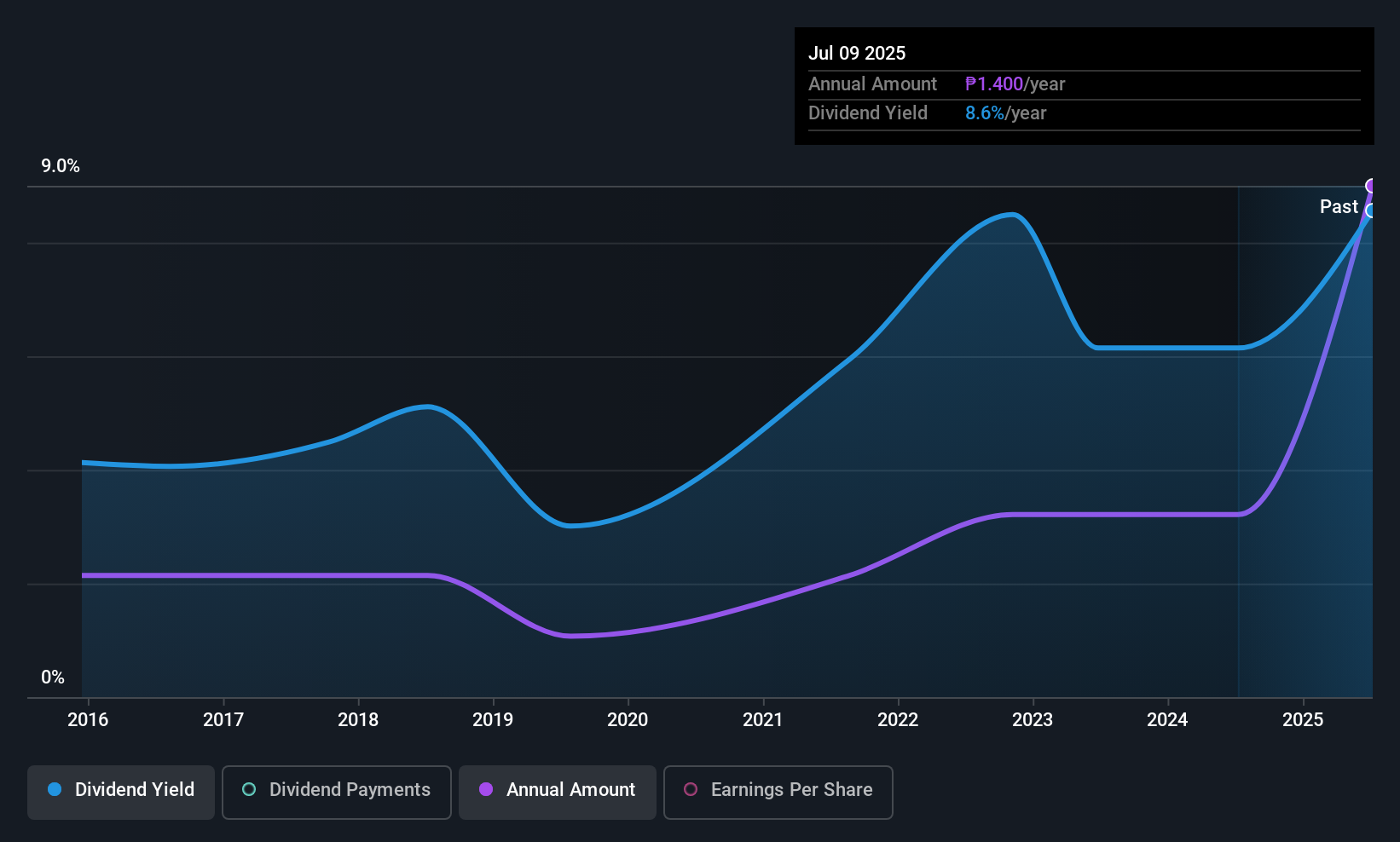

Dividend Yield: 8.9%

Centro Escolar University's dividend yield of 8.93% ranks it among the top 25% in the PH market, but sustainability concerns arise due to a high cash payout ratio of 94.7%, indicating dividends are not well covered by free cash flows. Despite earnings growth and increased dividends over the past decade, payouts have been unreliable and volatile. Recent financials show improved net income, yet board changes suggest ongoing strategic adjustments may impact future dividend stability.

- Click here to discover the nuances of Centro Escolar University with our detailed analytical dividend report.

- According our valuation report, there's an indication that Centro Escolar University's share price might be on the expensive side.

Robinsons Land (PSE:RLC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Robinsons Land Corporation, along with its subsidiaries, is engaged in the acquisition, development, operation, leasing, disposal, and sale of real estate properties in the Philippines and has a market capitalization of approximately ₱74.96 billion.

Operations: Robinsons Land Corporation generates revenue primarily from its Robinsons Malls segment at ₱19.63 billion, followed by the Residential Division at ₱11.08 billion, Robinsons Offices at ₱8.88 billion, Robinsons Hotels and Resorts at ₱6.42 billion, and Robinsons Destination Estates at ₱1.07 billion, with additional contributions from Chengdu Xin Yao and Robinsons Logistics and Industrial Facilities segments.

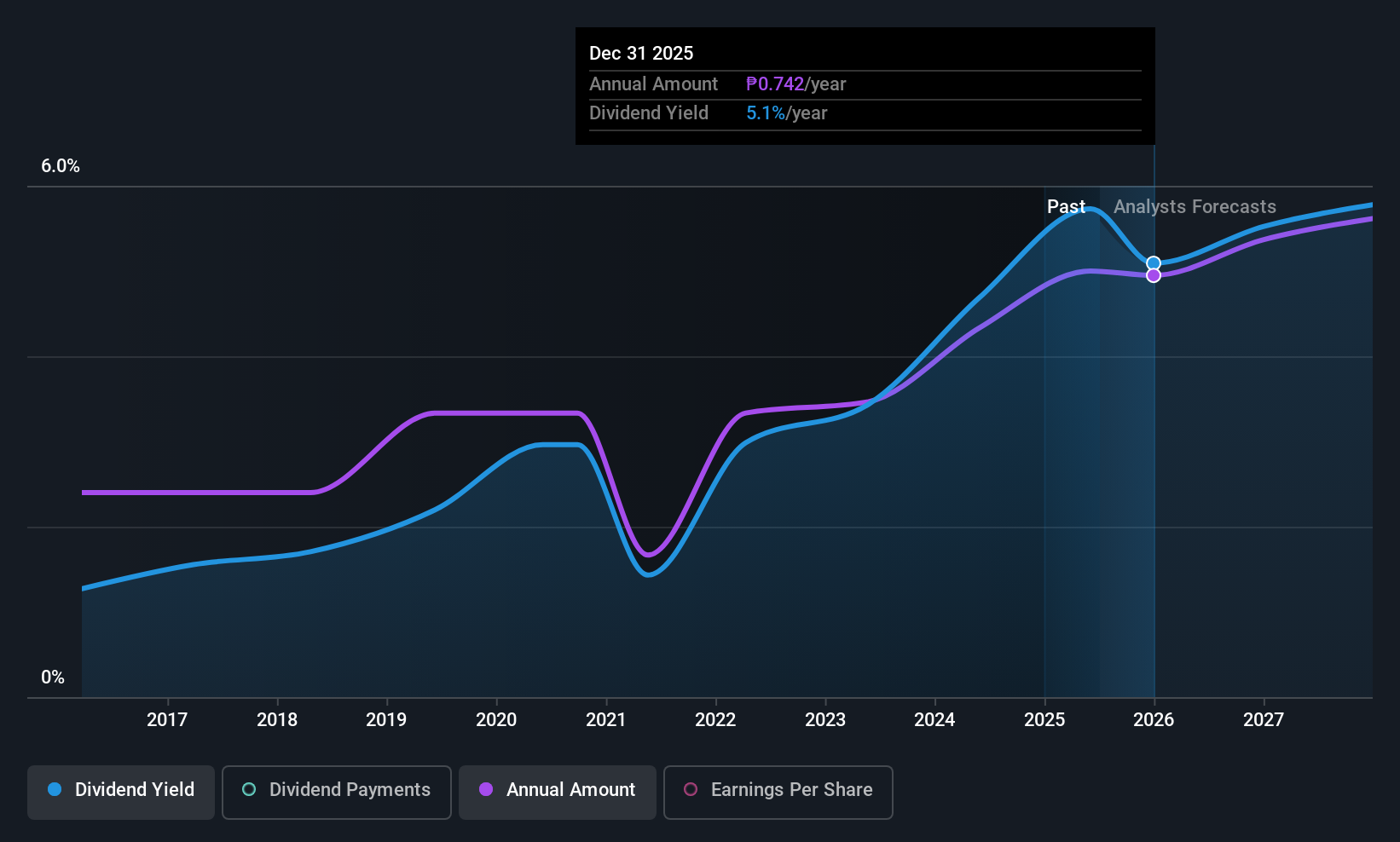

Dividend Yield: 4.7%

Robinsons Land's dividend yield of 4.81% is below the top tier in the PH market, but its low cash payout ratio of 16.4% suggests dividends are well covered by cash flows. Despite a volatile dividend history over the past decade, recent earnings growth and increased payouts reflect potential for stability. The company's Q3 2025 results showed revenue growth to PHP 12.58 billion and net income improvement to PHP 3.30 billion, supporting its earnings coverage for dividends at a payout ratio of 27%.

- Dive into the specifics of Robinsons Land here with our thorough dividend report.

- Our expertly prepared valuation report Robinsons Land implies its share price may be too high.

KYORIN Pharmaceutical (TSE:4569)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KYORIN Pharmaceutical Co., Ltd. researches, develops, manufactures, and sells ethical and generic drugs both in Japan and internationally, with a market cap of ¥85.08 billion.

Operations: KYORIN Pharmaceutical Co., Ltd. generates revenue primarily through the research, development, manufacturing, and sales of ethical and generic drugs in both domestic and international markets.

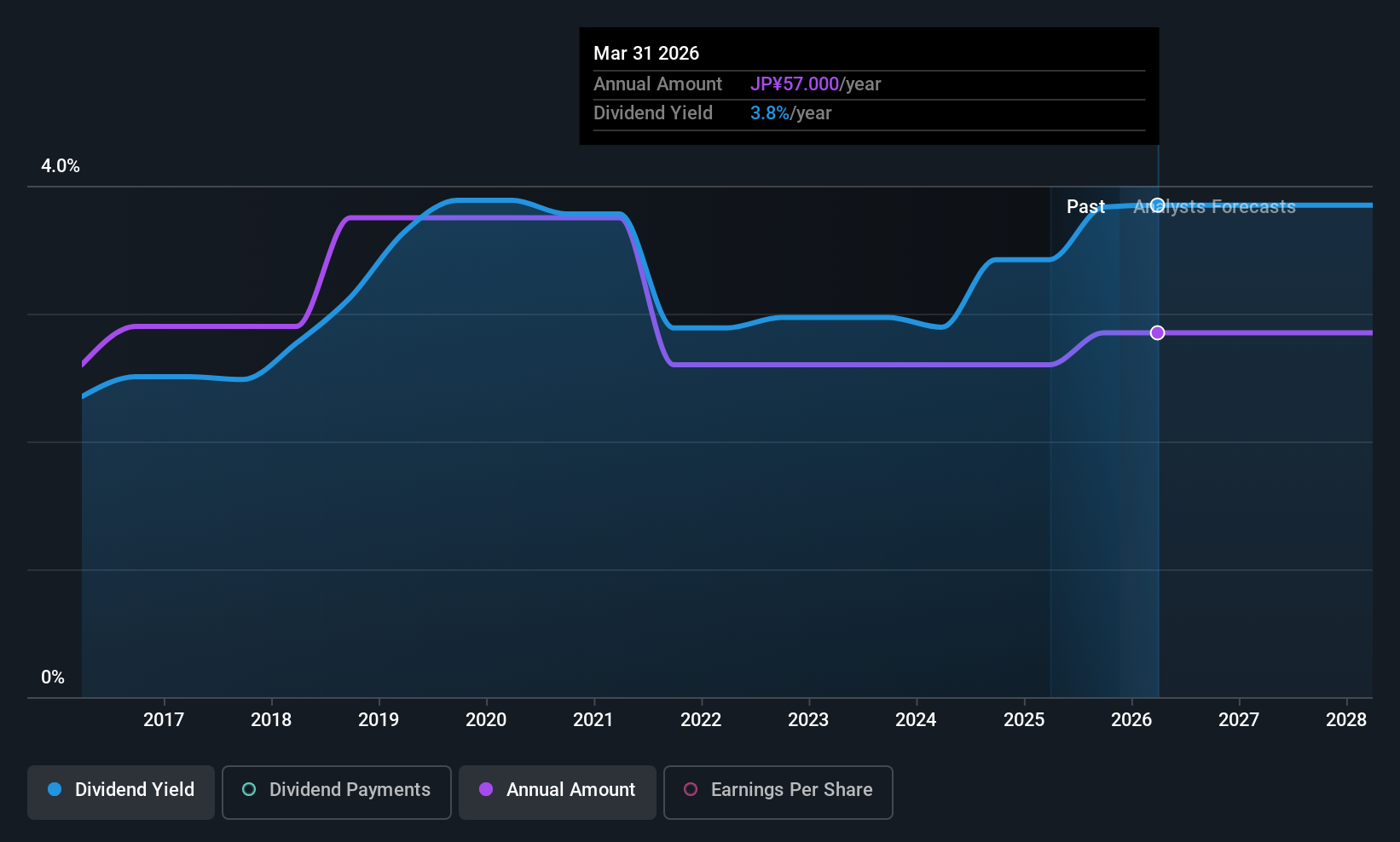

Dividend Yield: 3.8%

KYORIN Pharmaceutical's dividend yield of 3.85% is among the top in Japan, yet its high cash payout ratio of 103.2% indicates dividends aren't well covered by free cash flow. Despite a low earnings payout ratio of 19.7%, past dividend volatility and unreliable payments raise concerns about sustainability. Recent earnings growth doesn't offset forecasts for declining profits, and the stock trades at a discount to estimated fair value, suggesting mixed prospects for dividend stability.

- Unlock comprehensive insights into our analysis of KYORIN Pharmaceutical stock in this dividend report.

- Our expertly prepared valuation report KYORIN Pharmaceutical implies its share price may be lower than expected.

Where To Now?

- Get an in-depth perspective on all 1355 Top Global Dividend Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KYORIN Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4569

KYORIN Pharmaceutical

Through its subsidiaries, researches and develops, manufactures, and sells ethical and generic drugs in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives