- Philippines

- /

- Industrials

- /

- PSE:DMC

DMCI Holdings And 2 More Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are increasingly focused on strategies that offer stability amidst volatility. In this environment, dividend stocks can provide a reliable income stream and potential for capital appreciation, making them an attractive option for those looking to bolster their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.15% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.74% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.48% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

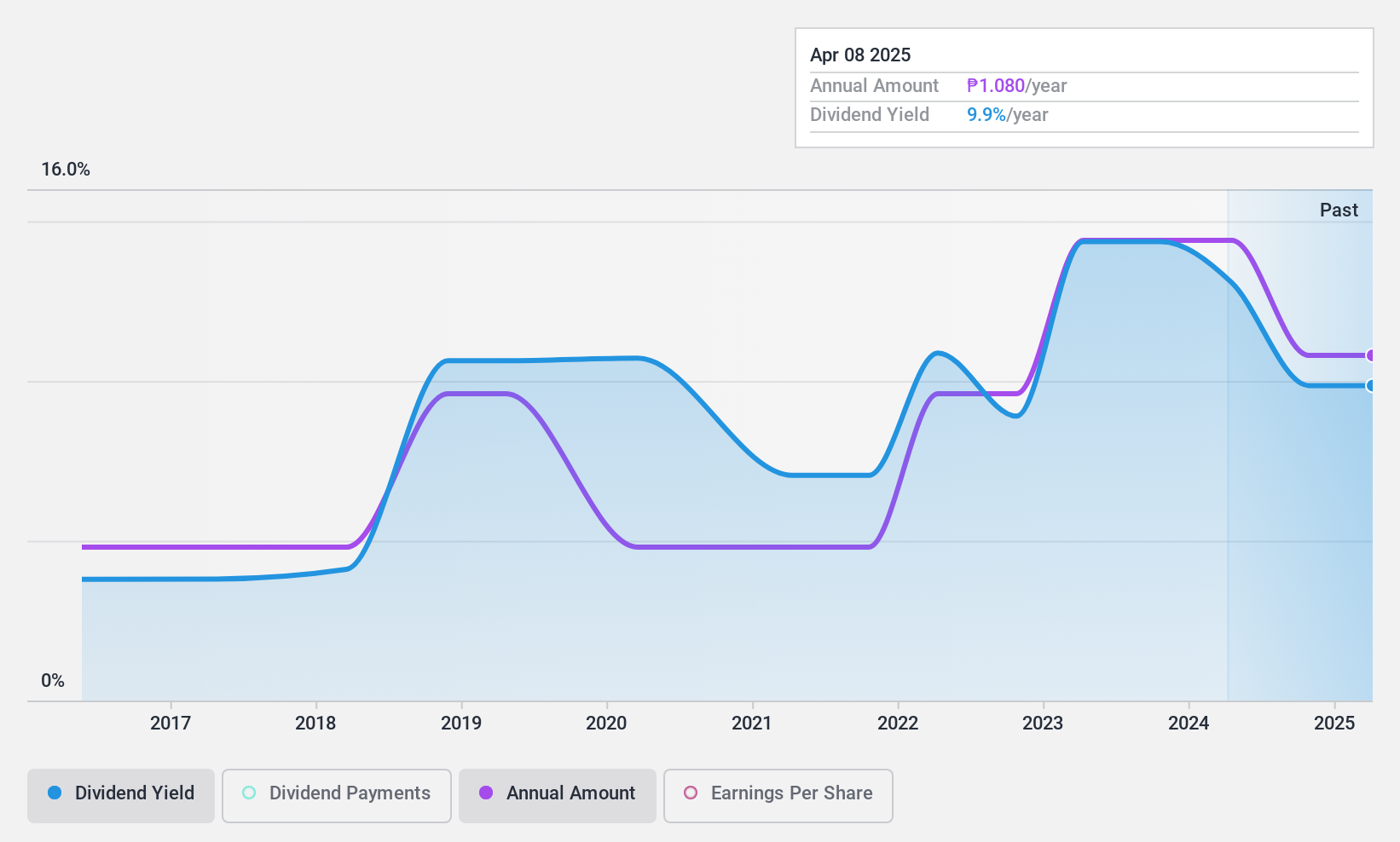

DMCI Holdings (PSE:DMC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DMCI Holdings, Inc. operates in general construction, coal and nickel mining, power generation, real estate development, water concession, and manufacturing both in the Philippines and internationally with a market cap of ₱142.60 billion.

Operations: DMCI Holdings, Inc. generates revenue from its business segments, with DMCI Homes contributing ₱11.55 billion and DMCI Mining adding ₱2.43 billion.

Dividend Yield: 8.8%

DMCI Holdings recently declared a special cash dividend of PHP 0.48 per share, reflecting its commitment to shareholder returns despite a volatile dividend history. The company's dividends are well-covered by earnings and cash flows, with payout ratios at 30.1% and 31.5%, respectively, suggesting sustainability in the near term. However, earnings for Q3 showed a decline in sales compared to the previous year, indicating potential challenges ahead for consistent dividend growth.

- Navigate through the intricacies of DMCI Holdings with our comprehensive dividend report here.

- Our expertly prepared valuation report DMCI Holdings implies its share price may be lower than expected.

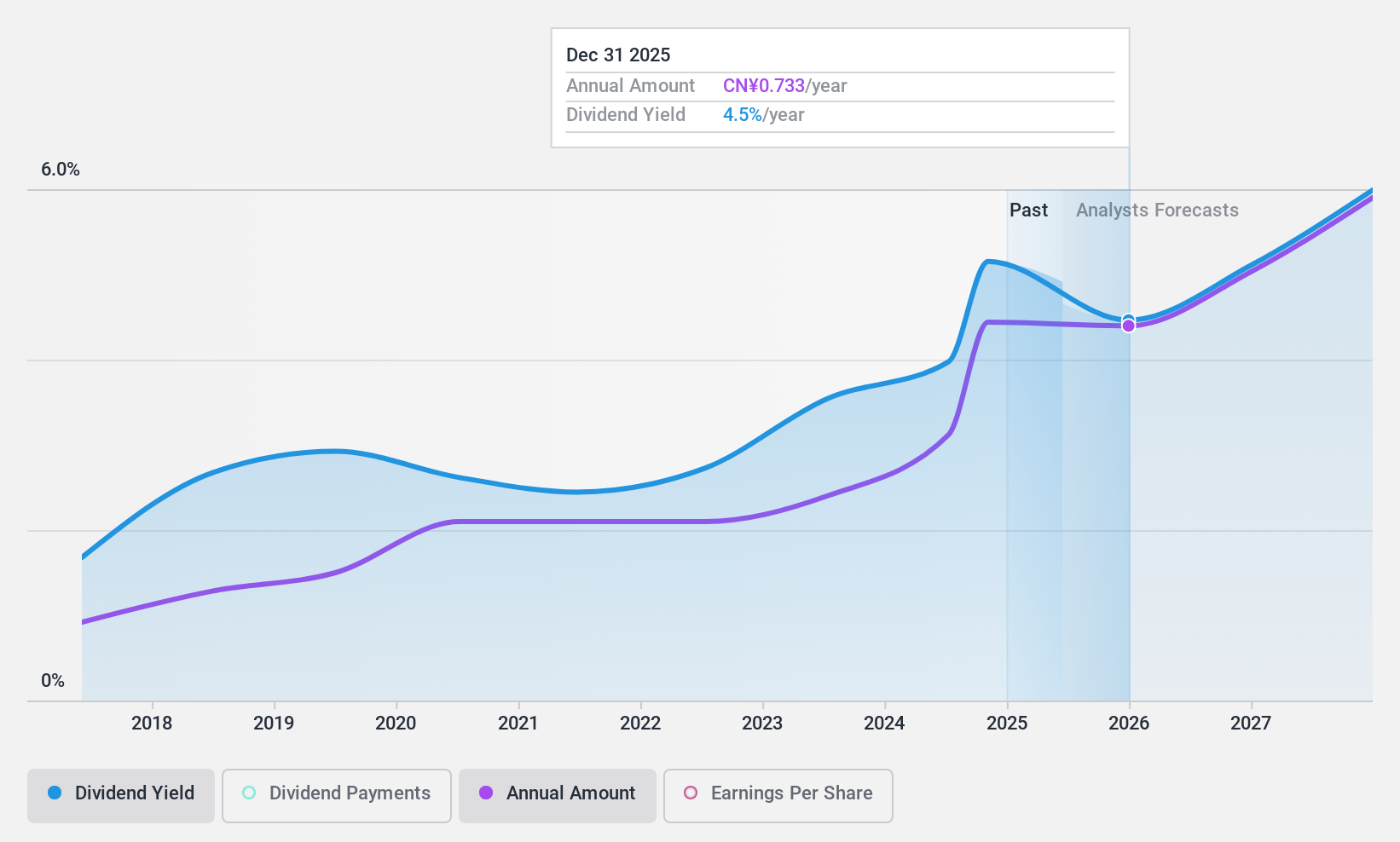

Bank of Hangzhou (SHSE:600926)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Hangzhou Co., Ltd. offers a range of banking products and services to individuals, corporate clients, and small to micro businesses in China, with a market cap of CN¥87.89 billion.

Operations: Bank of Hangzhou Co., Ltd. generates its revenue through a variety of banking products and services tailored for individuals, corporate clients, and small to micro businesses in China.

Dividend Yield: 5.1%

Bank of Hangzhou's dividend yield is among the top 25% in the Chinese market, supported by a low payout ratio of 33.1%, ensuring coverage by earnings. The company has demonstrated reliable and stable dividend payments over its eight-year history, though it lacks a longer track record. Recent inclusion in major indices like the Shanghai Stock Exchange 180 Value Index underscores its growing recognition. Earnings have grown significantly, supporting future dividend sustainability.

- Dive into the specifics of Bank of Hangzhou here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Bank of Hangzhou is trading behind its estimated value.

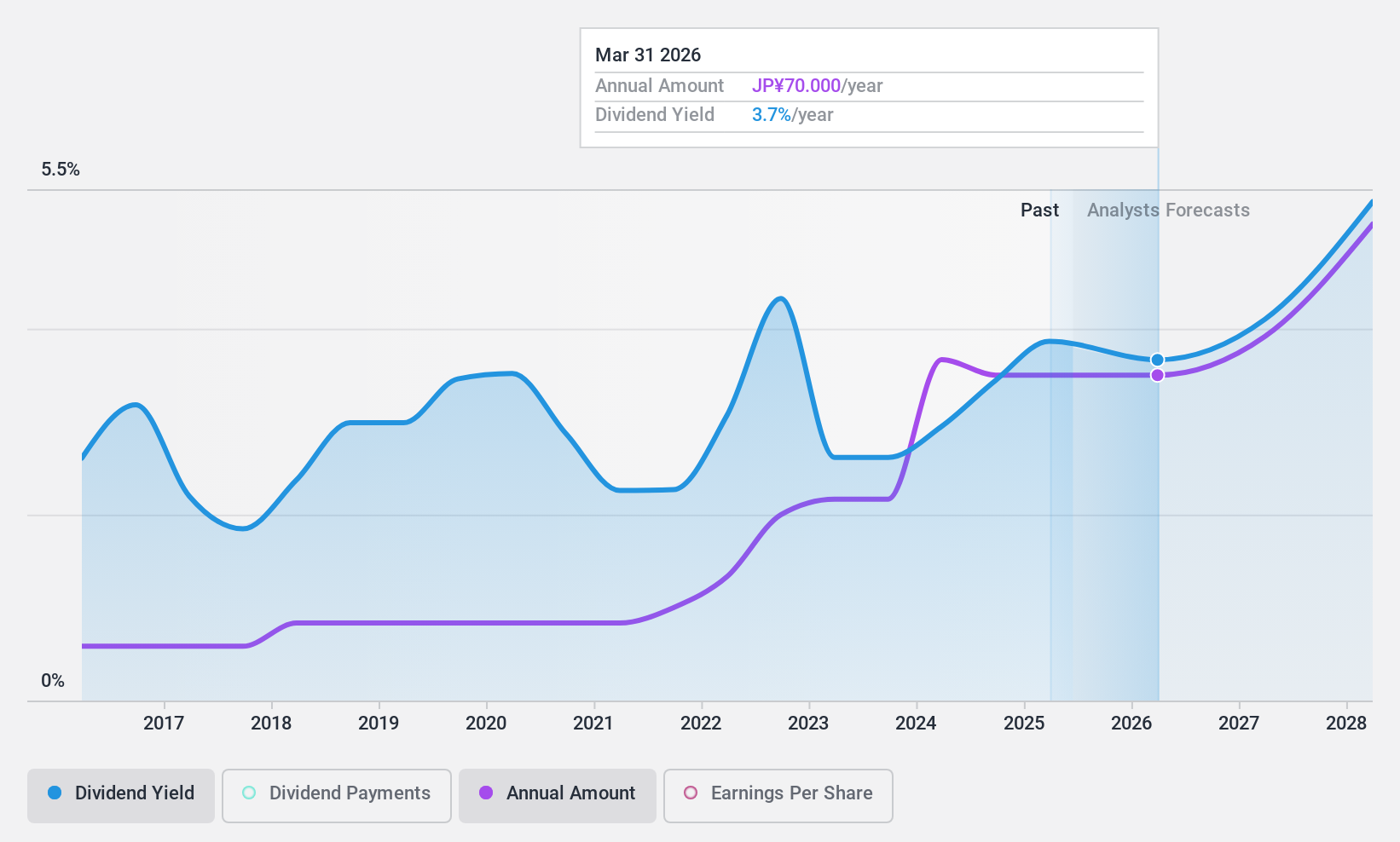

Macnica Holdings (TSE:3132)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Macnica Holdings, Inc. imports, sells, and exports electronic components in Japan with a market cap of ¥315.92 billion.

Operations: Macnica Holdings generates revenue from its Network Business segment, which accounts for ¥139.96 billion, and its Integrated Circuits, Electronic Devices and Other Businesses segment, contributing ¥860.76 billion.

Dividend Yield: 3.9%

Macnica Holdings offers a dividend yield in the top 25% of the Japanese market, with dividends covered by earnings and cash flows. However, its dividend history is unstable and unreliable over the past decade. Recent efforts to enhance shareholder returns include a share buyback program worth ¥3 billion. While dividends have increased recently, ongoing acquisition plans in Asia could impact future payouts as the company navigates industry consolidation pressures and seeks to expand its market presence.

- Click here to discover the nuances of Macnica Holdings with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Macnica Holdings' share price might be too pessimistic.

Turning Ideas Into Actions

- Access the full spectrum of 1937 Top Dividend Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:DMC

DMCI Holdings

Through its subsidiaries, engages in the general construction, coal and nickel mining, power generation, real estate development, water concession, and manufacturing businesses in the Philippines and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives