- New Zealand

- /

- Electric Utilities

- /

- NZSE:GNE

Is Genesis Energy’s 271MWp Solar Farm Acquisition Transforming the Investment Case for NZSE:GNE?

Reviewed by Sasha Jovanovic

- Genesis Energy recently acquired the conditional rights to develop a 271MWp solar farm in Rangiriri, Waikato, near Auckland and key grid infrastructure, with an estimated project cost of $487 million and a planned annual generation of 437 GWh.

- This move expands Genesis's advanced-stage solar pipeline to around 700MWp and is central to its Gen35 plan of boosting renewable generation, supporting hydro assets, and reducing reliance on gas during peak summer demand.

- We'll explore how Genesis Energy's commitment to large-scale solar development may reshape its investment outlook amid a broad transition to renewables.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Genesis Energy Investment Narrative Recap

To be a Genesis Energy shareholder today, you need conviction in the company's long-term renewable shift and its ability to manage both the financial and operational risks inherent in transforming an established energy mix. The recently announced Rangiriri solar acquisition could add momentum to Genesis's renewable build-out, but is not expected to materially affect the most important near-term catalyst: Genesis’s ability to efficiently execute on projects and deliver forecast margin benefits from their renewables and digital investments. The largest ongoing risk, continued exposure to volatile gas markets and reliance on thermal generation, remains, as this solar project will not significantly reduce that exposure in the short term.

Among recent announcements, the August earnings release stands out, with Genesis reporting both rising revenue and net income for the full year. This is especially relevant as it demonstrates solid operational performance even while the company pursues new capital-intensive projects; it also signals that the foundation for absorbing new solar investments without immediate earnings dilution may already be in place. However, whether these gains can persist as capital spending ramps up and renewables replace gas in the generation mix will depend on execution quality, future fuel costs, and project delivery timelines.

But investors should not overlook the fact that, unlike revenue gains, exposure to gas price volatility and supply risks may grow more pressing once...

Read the full narrative on Genesis Energy (it's free!)

Genesis Energy's outlook projects NZ$3.4 billion in revenue and NZ$147.9 million in earnings by 2028. This assumes a 2.0% annual decline in revenue and an earnings decrease of NZ$21.2 million from the current NZ$169.1 million.

Uncover how Genesis Energy's forecasts yield a NZ$2.56 fair value, in line with its current price.

Exploring Other Perspectives

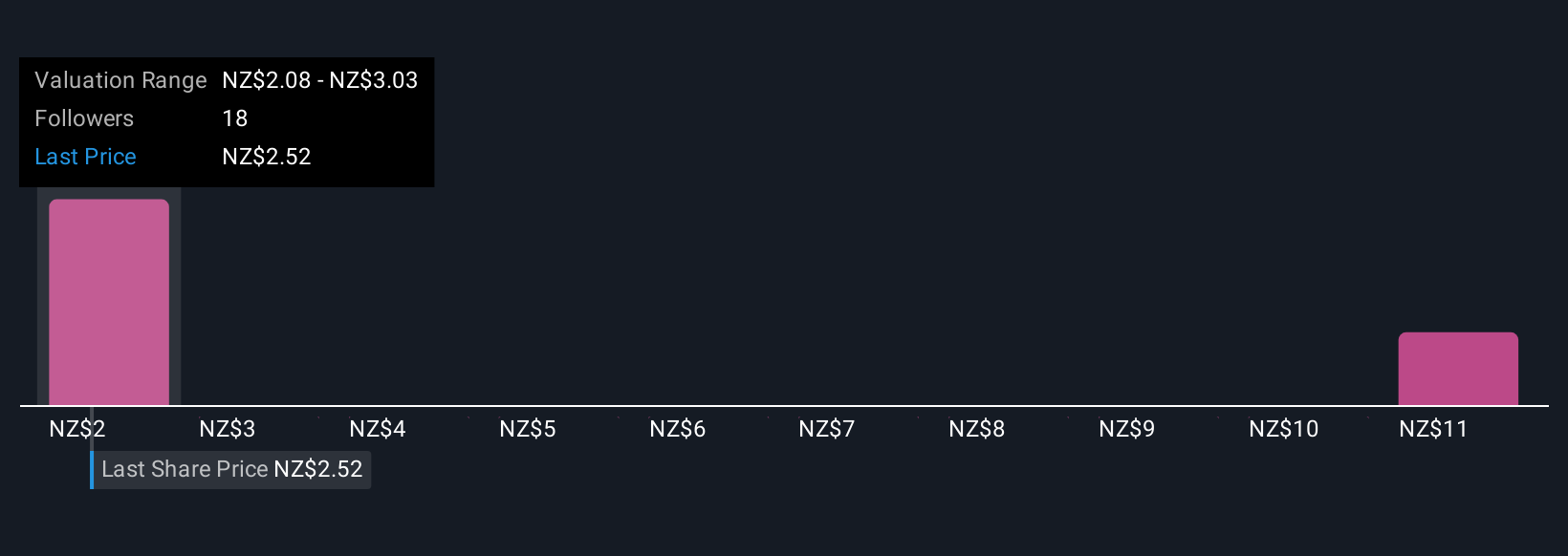

Private investor fair value estimates for Genesis Energy span from NZ$2.08 to NZ$11.65, drawn from five distinct analyses in the Simply Wall St Community. While the company expands its solar pipeline, remember ongoing thermal reliance exposes earnings to fuel cost fluctuations and execution risk, see what your peers think about what lies ahead.

Explore 5 other fair value estimates on Genesis Energy - why the stock might be worth 17% less than the current price!

Build Your Own Genesis Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genesis Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Genesis Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genesis Energy's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:GNE

Genesis Energy

Generates, trades in, and sells electricity to residential and business customers in New Zealand.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives