- New Zealand

- /

- Electric Utilities

- /

- NZSE:GNE

Does Genesis Energy's Edgecumbe Solar Farm Investment Signal Renewed Momentum for Its Renewable Strategy (NZSE:GNE)?

Reviewed by Sasha Jovanovic

- Genesis Energy announced it has reached a Final Investment Decision for the construction of the 136 MWp Edgecumbe Solar Farm in the Bay of Plenty, with first generation targeted for the second half of FY27 and contracts secured with Horizon Networks and METLEN for delivery.

- This marks a significant step in advancing Genesis’s Gen35 renewable strategy and highlights the company’s flexibility in capital management, as the project will initially be funded on balance sheet with future capital recycling options considered to maximize shareholder value.

- We'll explore how the Edgecumbe Solar Farm’s funding and renewable focus could influence Genesis Energy’s long-term growth outlook and investment narrative.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Genesis Energy Investment Narrative Recap

To be a Genesis Energy shareholder, you need to believe that the company’s transition toward renewables and its disciplined capital management can offset persistent headwinds from carbon-intensive operations. The announcement of the Edgecumbe Solar Farm is a meaningful marker for its Gen35 renewable strategy but does not materially shift the focus from Genesis’s most immediate catalyst, the steady ramp-up in renewables, and its key short-term risk, continued exposure to gas and coal volatility and policy changes.

The Rangiriri Solar Farm announcement in October is directly relevant here, underlining Genesis’s intent to grow solar generation capacity while using flexible, balance-sheet funding. Both Edgecumbe and Rangiriri reinforce the central narrative: renewable investments are ramping up, but the near-term growth driver remains how agilely Genesis can manage thermal generation risks as decarbonization accelerates and the regulatory environment evolves.

Yet, even as new solar projects signal progress, investors should be aware that execution risks around major capital projects and exposure to fuel cost swings remain top of mind...

Read the full narrative on Genesis Energy (it's free!)

Genesis Energy's outlook sees revenue falling to NZ$3.4 billion and earnings dropping to NZ$147.9 million by 2028. This scenario is based on an expected annual revenue decline of 2.0% and a decrease in earnings of NZ$21.2 million from the current NZ$169.1 million.

Uncover how Genesis Energy's forecasts yield a NZ$2.56 fair value, a 4% upside to its current price.

Exploring Other Perspectives

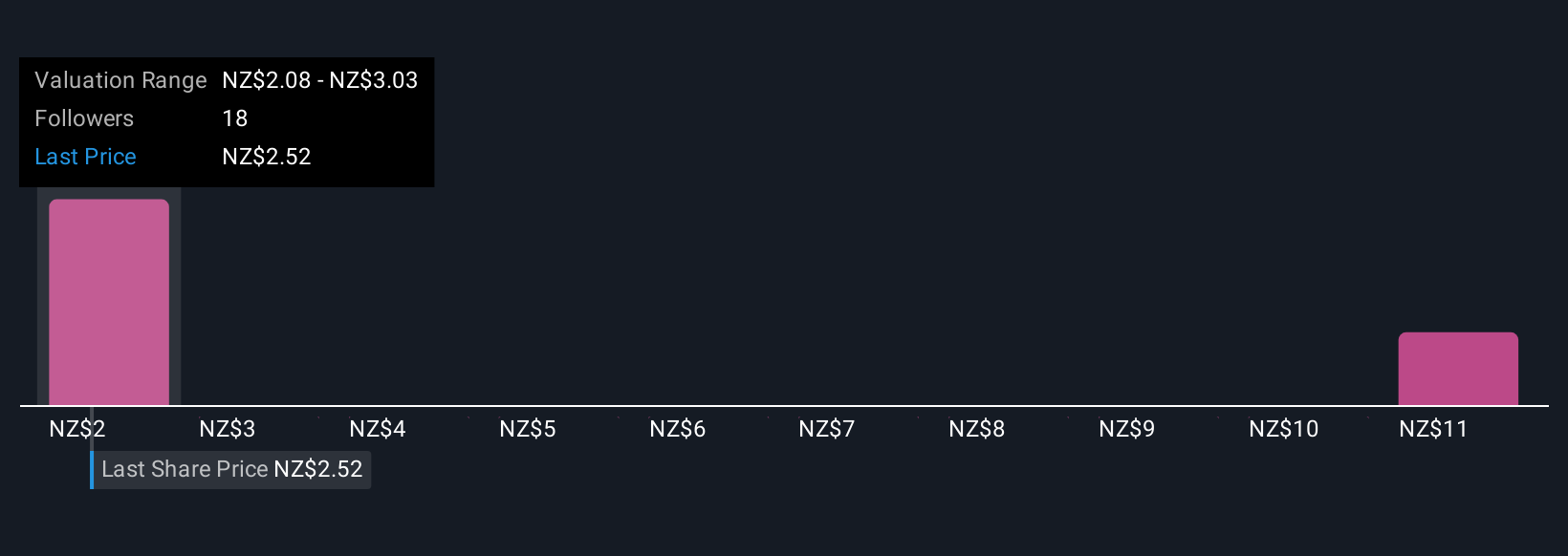

Fair value estimates from five Simply Wall St Community members range widely, from NZ$2.08 to NZ$11.56 per share. With these diverging opinions in mind, remember Genesis’s progress in renewables sits alongside ongoing reliance on thermal generation, affecting both future earnings and risk exposure.

Explore 5 other fair value estimates on Genesis Energy - why the stock might be worth 15% less than the current price!

Build Your Own Genesis Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genesis Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Genesis Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genesis Energy's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:GNE

Genesis Energy

Generates, trades in, and sells electricity to residential and business customers in New Zealand.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success