- New Zealand

- /

- Airlines

- /

- NZSE:AIR

Did New Queenstown-Brisbane Route and Loyalty Revamp Just Shift Air New Zealand's (NZSE:AIR) Investment Narrative?

Reviewed by Sasha Jovanovic

- Air New Zealand recently announced the launch of a new seasonal non-stop route between Queenstown and Brisbane, set to begin in June 2026 and operate three times a week using Airbus A320neo aircraft.

- This expansion, combined with a significant revamp of the airline's loyalty program, introducing the exclusive Koru Black tier, highlights a focus on enhancing customer experience and international connectivity.

- We'll examine how the Queenstown-Brisbane route launch and loyalty program upgrade influence Air New Zealand's investment narrative and future prospects.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Air New Zealand Investment Narrative Recap

To own Air New Zealand shares, investors must believe in the airline’s ability to expand its network, manage cost pressures, and execute on growth strategies, despite headwinds. The recent cabin crew strike vote comes at a time when rising costs and industrial relations have become the biggest near-term risk, potentially outweighing new route excitement as a short-term catalyst. In the immediate term, fears of operational disruption linked to labor unrest look more critical than news of future route launches.

The announcement of the $100 million share buy-back stands out in this context. While designed to optimize capital structure, the timing has drawn union criticism during wage negotiations, sharpening focus on cost management and the airline’s balancing act between workforce relations and shareholder returns.

By contrast, developing industrial risk is something investors should watch closely, as prolonged disruption could...

Read the full narrative on Air New Zealand (it's free!)

Air New Zealand's outlook forecasts NZ$7.8 billion in revenue and NZ$239.0 million in earnings by 2028. This assumes a 4.7% annual revenue growth rate and an increase in earnings of NZ$113.0 million from the current level of NZ$126.0 million.

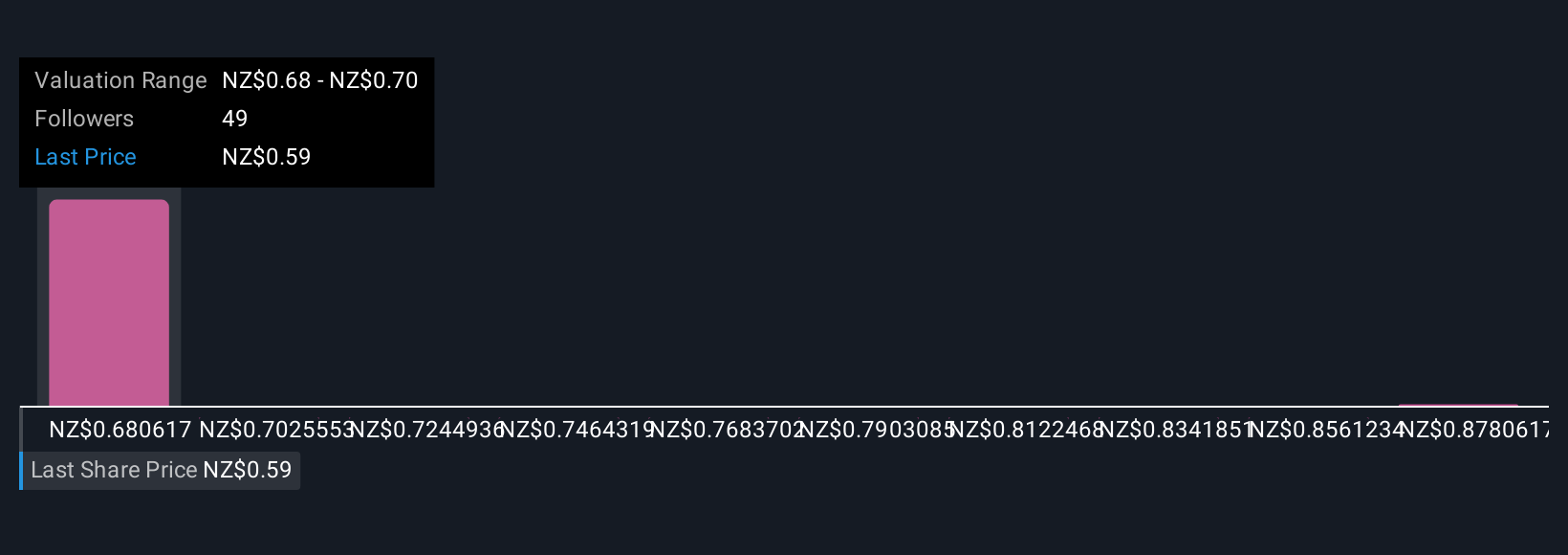

Uncover how Air New Zealand's forecasts yield a NZ$0.656 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided four fair value estimates for Air New Zealand, ranging from NZ$0.656 to NZ$0.90 per share. While these views vary, looming cost inflation and labor tensions could shape sentiment and future valuations, review multiple perspectives to inform your outlook.

Explore 4 other fair value estimates on Air New Zealand - why the stock might be worth as much as 45% more than the current price!

Build Your Own Air New Zealand Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air New Zealand research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Air New Zealand research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air New Zealand's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:AIR

Air New Zealand

Provides air passenger and cargo transportation on scheduled airlines services in New Zealand, Australia, the Pacific Islands, Asia, the United Kingdom, Europe, and the Americas.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives