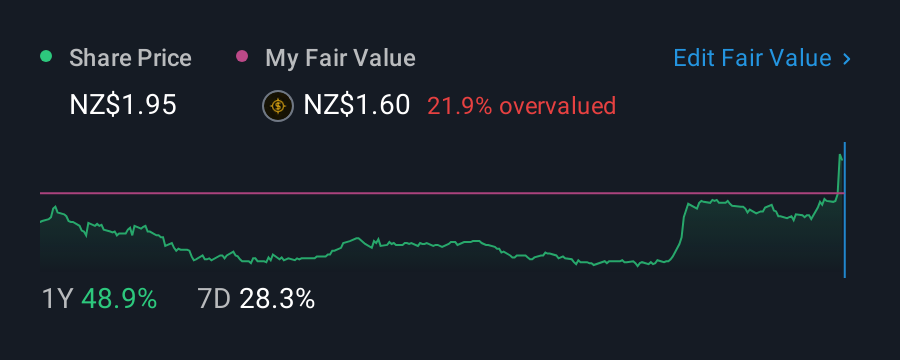

EROAD Limited's (NZSE:ERD) 42% Share Price Surge Not Quite Adding Up

EROAD Limited (NZSE:ERD) shares have continued their recent momentum with a 42% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 55% in the last year.

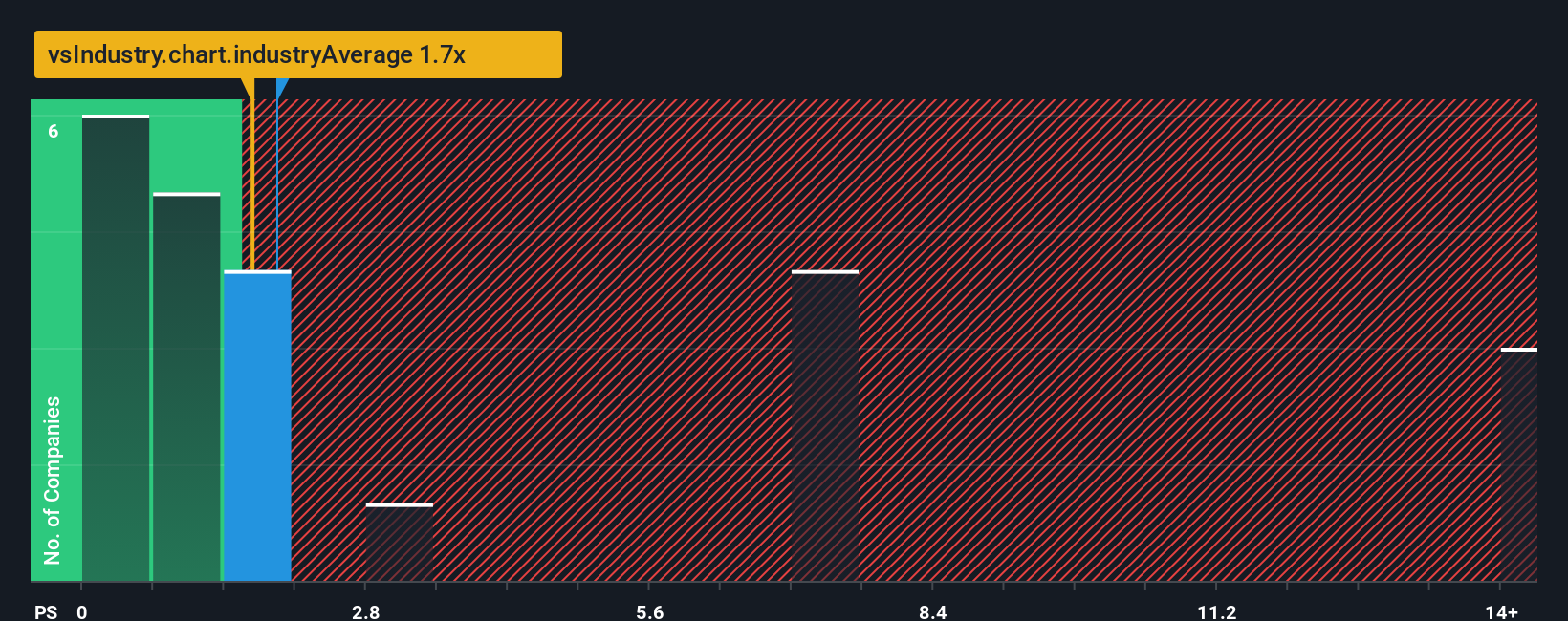

In spite of the firm bounce in price, it's still not a stretch to say that EROAD's price-to-sales (or "P/S") ratio of 1.9x right now seems quite "middle-of-the-road" compared to the Electronic industry in New Zealand, where the median P/S ratio is around 1.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for EROAD

How Has EROAD Performed Recently?

There hasn't been much to differentiate EROAD's and the industry's revenue growth lately. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Keen to find out how analysts think EROAD's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, EROAD would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 6.8% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 69% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 6.9% per annum as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 49% per year growth forecast for the broader industry.

In light of this, it's curious that EROAD's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does EROAD's P/S Mean For Investors?

EROAD appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at the analysts forecasts of EROAD's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Plus, you should also learn about these 2 warning signs we've spotted with EROAD (including 1 which is potentially serious).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if EROAD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:ERD

EROAD

Provides electronic on-board units and software as a service to the transport industry in New Zealand, the United States, and Australia.

Excellent balance sheet and good value.

Market Insights

Community Narratives