- New Zealand

- /

- Retail REITs

- /

- NZSE:KPG

Kiwi Property Group (NZSE:KPG): Evaluating Valuation After Recent Share Gains and Development Progress

Reviewed by Kshitija Bhandaru

See our latest analysis for Kiwi Property Group.

Momentum appears to be building for Kiwi Property Group, with a solid year-to-date share price return of nearly 19% and a robust one-year total shareholder return topping 23%. Recent price strength suggests investors are growing more optimistic about the company's outlook while also weighing shifting risks and market conditions.

If you’re looking to spot more market movers beyond real estate, now is a smart moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

But after such a strong run over the past year, investors may be wondering whether Kiwi Property Group is still undervalued or if its recent gains already reflect all its growth prospects. Is there a genuine buying opportunity here, or has the market already priced in what lies ahead?

Most Popular Narrative: 7.7% Overvalued

Despite the recent price surge, the most-widely followed narrative sees Kiwi Property Group’s estimated fair value trailing its last close. The market’s optimism faces a reality check from future projections that frame current pricing in a new light.

The completion of Stage 1 earthworks at Drury and the designation as a listed project under Fast-Track Legislation highlight development progress, which could significantly impact future revenue growth as infrastructure improves. The resilience in leasing spreads and asset valuation increases, driven by strong lease renewal activity and market demand for quality mixed-use developments, indicates potential future revenue and earnings growth.

Want to know which bold financial projections are driving this call? The narrative hinges on major shifts in profit margins and a future profit multiple that challenges market norms. What is behind such a confident target? Dive in to see what the consensus believes will shape Kiwi Property Group’s next five years.

Result: Fair Value of $1.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, declining retail spending in New Zealand and recent cuts in occupancy rates could present challenges to the bullish case for Kiwi Property Group's earnings growth.

Find out about the key risks to this Kiwi Property Group narrative.

Another View: Discounted Cash Flow Offers a Different Take

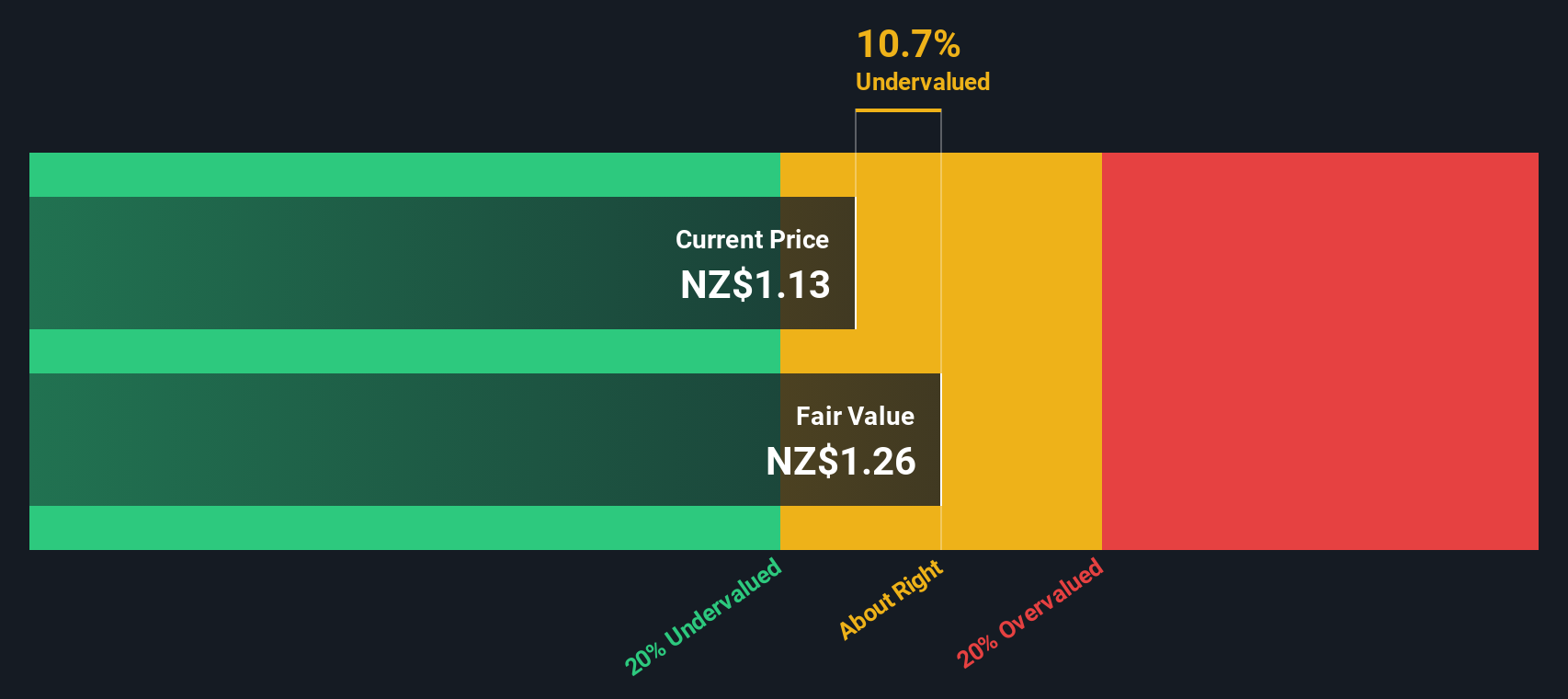

While analysts see Kiwi Property Group as slightly overvalued based on earnings potential, our SWS DCF model suggests a more optimistic outlook. According to this cash flow approach, the company actually trades about 13% below its fair value. So which method paints a truer picture of value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kiwi Property Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kiwi Property Group Narrative

If you have a different perspective or like to dig into the numbers yourself, it's easy to shape your own view in just a few clicks with Do it your way.

A great starting point for your Kiwi Property Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take your portfolio to the next level by tapping into new opportunities you might not have considered. These categories are moving fast, so don't let them pass you by:

- Tap into emerging fields by checking out these 24 AI penny stocks to see which companies are pioneering artificial intelligence advancements.

- Unlock consistent income streams by reviewing these 19 dividend stocks with yields > 3%, which offers yields above 3% for income-focused investors.

- Supercharge your search for value in today's market with these 900 undervalued stocks based on cash flows, based on strong cash flows and sound fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kiwi Property Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:KPG

Kiwi Property Group

Kiwi Property (NZX: KPG) is one of the largest listed property companies on the New Zealand Stock Exchange and is a member of the S&P/NZX 20 Index.

Acceptable track record with limited growth.

Similar Companies

Market Insights

Community Narratives