- New Zealand

- /

- Industrial REITs

- /

- NZSE:GMT

The Bull Case For Goodman Property Trust (NZSE:GMT) Could Change Following Strong H1 Earnings and Guidance Reaffirmation

Reviewed by Sasha Jovanovic

- Goodman Property Trust has reported its half-year earnings for the period ended September 30, 2025, with sales increasing to NZ$144.5 million and net income rising to NZ$61.8 million compared to the previous year.

- The trust highlighted strong growth in earnings per unit and maintained its full-year cash earnings guidance, emphasizing resilience despite economic challenges.

- We’ll explore how Goodman’s reaffirmation of cash earnings guidance may influence the company’s investment narrative moving forward.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Goodman Property Trust's Investment Narrative?

Investors eyeing Goodman Property Trust are often drawn to its reputation for stability in tough economic conditions, and the recent earnings result gives some weight to that narrative. With sales and net income rising significantly in the first half of fiscal 2026 and management reaffirming full-year cash earnings guidance, Goodman appears to be delivering on its promised resilience. That said, this latest update could soften, but not necessarily transform, the debate around short term risks and catalysts. While the confirmed cash distribution and improved profitability may ease worries about cash flow and support the share price in the near term, some persistent questions remain, especially around the premium price-to-earnings ratio and forecasts for revenue declines. For now, the latest results help reinforce the bullish case, but don’t fully resolve structural concerns over valuations, cash flow coverage for debt, or dividend sustainability. In contrast, operating cash flow coverage for debt remains a key risk investors should keep front of mind.

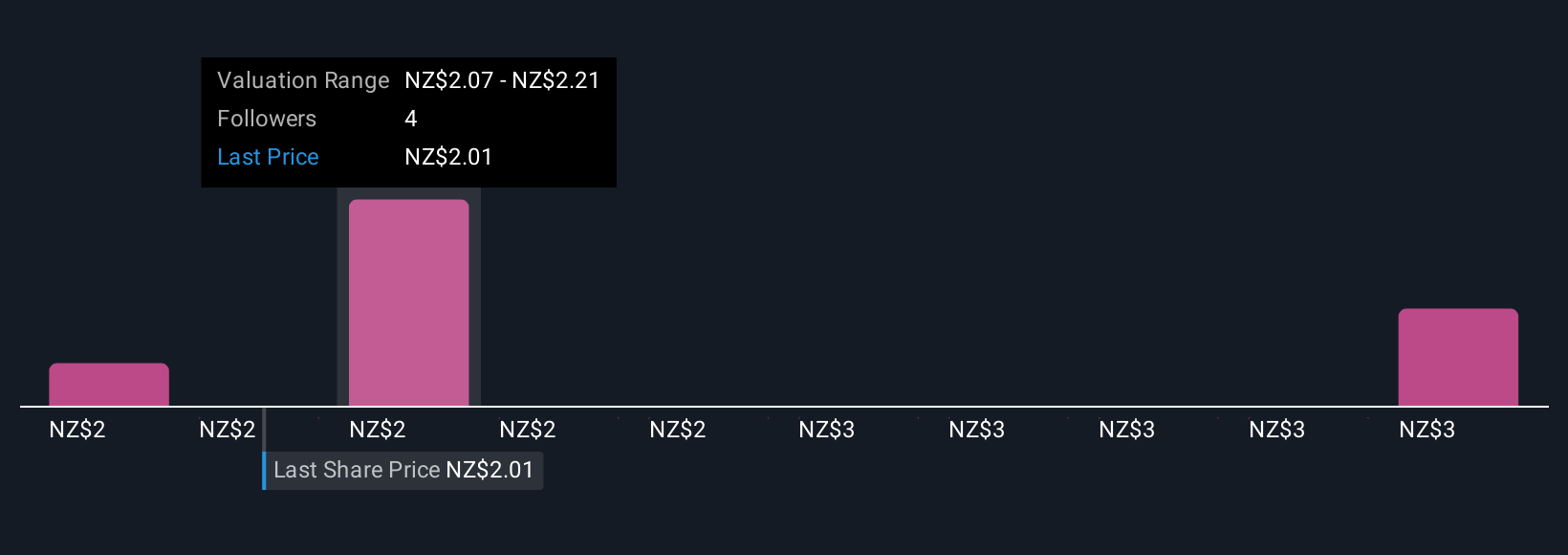

Despite retreating, Goodman Property Trust's shares might still be trading 37% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on Goodman Property Trust - why the stock might be worth 12% less than the current price!

Build Your Own Goodman Property Trust Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Goodman Property Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Goodman Property Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Goodman Property Trust's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:GMT

Goodman Property Trust

GMT is a managed investment scheme, listed on the NZX.

Average dividend payer and slightly overvalued.

Market Insights

Community Narratives