- Thailand

- /

- Construction

- /

- SET:PSG

3 Asian Penny Stocks With Market Caps Under US$500M

Reviewed by Simply Wall St

As global markets navigate a mix of economic signals, the Asian market has been particularly influenced by developments in U.S.-China trade relations and domestic policy shifts. For investors interested in smaller or emerging companies, penny stocks—despite their somewhat dated name—remain a relevant area for potential growth. By focusing on those with robust financial health, these stocks can offer unexpected value and stability amidst broader market fluctuations.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.96 | HK$2.41B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.50 | HK$927.78M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.49 | HK$2.07B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.07 | SGD433.66M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.72 | THB2.83B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.101 | SGD52.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.43 | SGD13.5B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.05 | HK$2.82B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.07 | NZ$152.31M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.38 | THB8.85B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 959 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

NZME (NZSE:NZM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NZME Limited, with a market cap of NZ$221.72 million, operates in New Zealand's integrated media and entertainment sector through its subsidiaries.

Operations: NZME generates its revenue from several key segments, including Publishing at NZ$194.19 million, Audio at NZ$117.12 million, and Oneroof at NZ$27.51 million.

Market Cap: NZ$221.72M

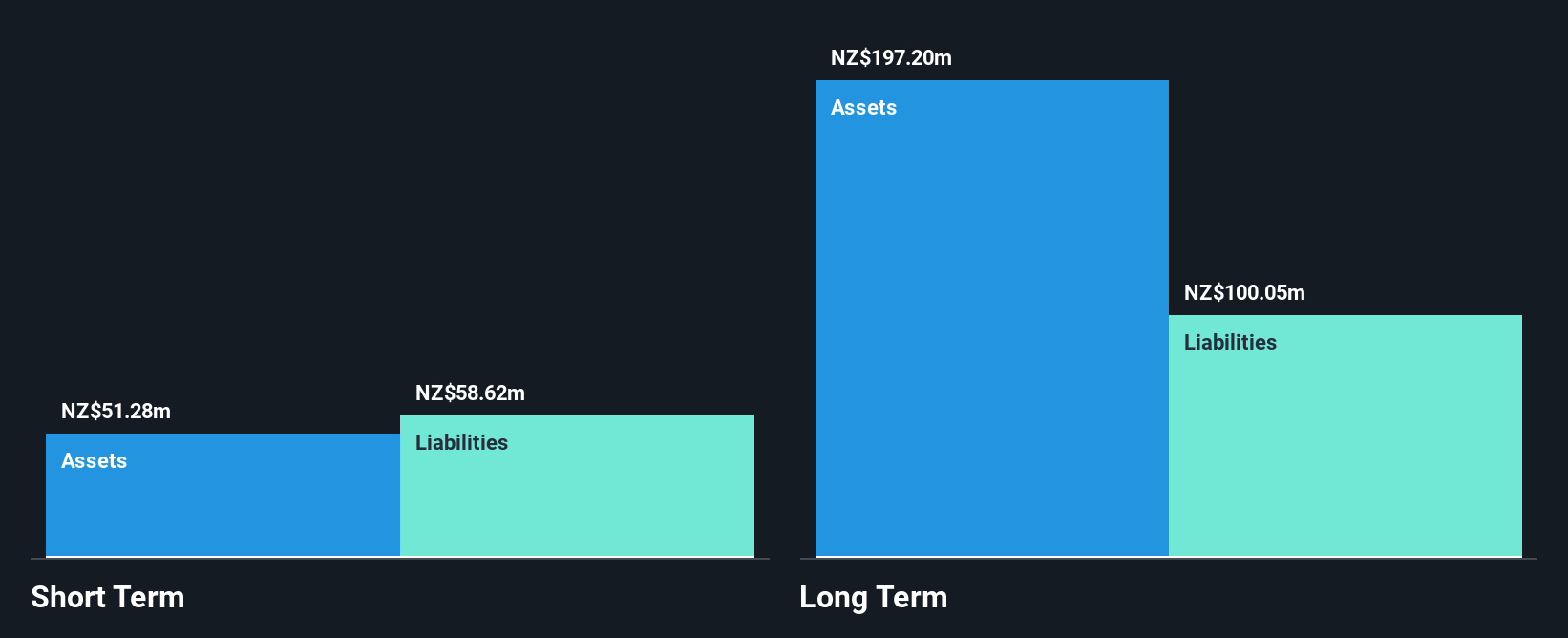

NZME Limited, with a market cap of NZ$221.72 million, operates in New Zealand's media sector and has shown resilience despite recent challenges. The company reported a net loss for the half-year ending June 2025, reflecting ongoing profitability issues. However, it maintains a satisfactory net debt to equity ratio of 37.1% and has reduced its debt from 67.4% over five years, indicating improved financial management. While dividends are not well-covered by earnings due to unprofitability, NZME offers a dividend yield of 7.26%. The appointment of Jo Hempstead as CFO could bolster strategic financial planning efforts moving forward.

- Click to explore a detailed breakdown of our findings in NZME's financial health report.

- Examine NZME's earnings growth report to understand how analysts expect it to perform.

PSG Corporation (SET:PSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PSG Corporation Public Company Limited, with a market cap of THB15.40 billion, operates in Thailand and the Lao People's Democratic Republic, focusing on turnkey engineering, procurement, and construction (EPC) as well as large-scale construction projects.

Operations: The company generates revenue from its Plant and Building Construction segment, amounting to THB2.63 billion.

Market Cap: THB15.4B

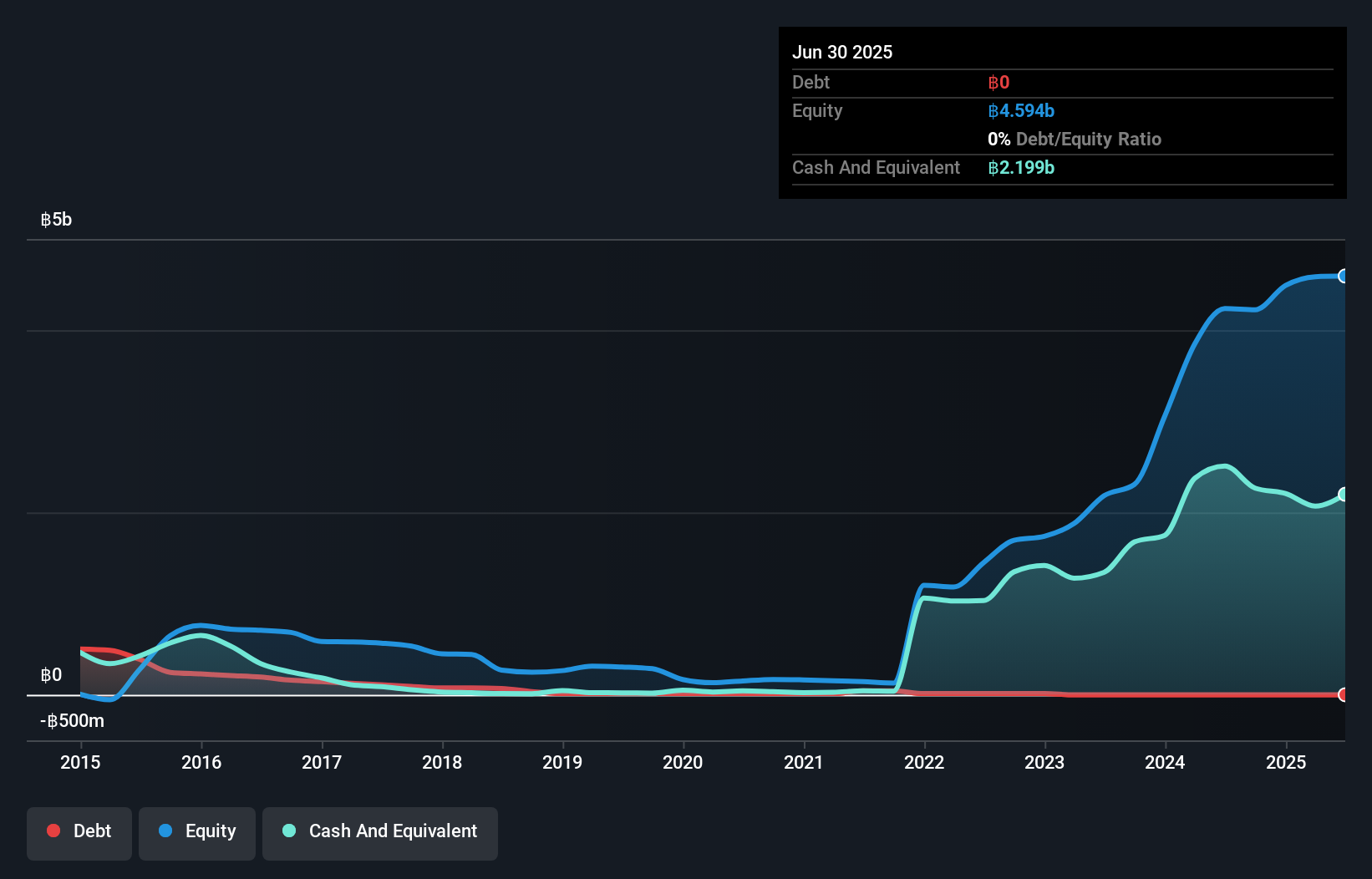

PSG Corporation faces challenges with declining earnings and revenue, reporting a net income of THB 19.03 million for Q2 2025, significantly lower than the previous year. The company has undertaken a reverse stock split and capital reduction to address financial deficits, indicating strategic restructuring efforts. Despite its volatility and low return on equity of 8.4%, PSG remains debt-free with strong short-term asset coverage over liabilities. However, profit margins have decreased from last year’s high levels, reflecting ongoing operational hurdles in its core construction business across Thailand and Laos amidst an unstable market environment for penny stocks.

- Click here to discover the nuances of PSG Corporation with our detailed analytical financial health report.

- Assess PSG Corporation's previous results with our detailed historical performance reports.

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: UOB-Kay Hian Holdings Limited is an investment holding company offering services such as stockbroking, futures broking, structured lending, investment trading, margin financing, and research services with a market cap of SGD2.42 billion.

Operations: The company generates SGD654.91 million in revenue from its securities and futures broking and related services segment.

Market Cap: SGD2.42B

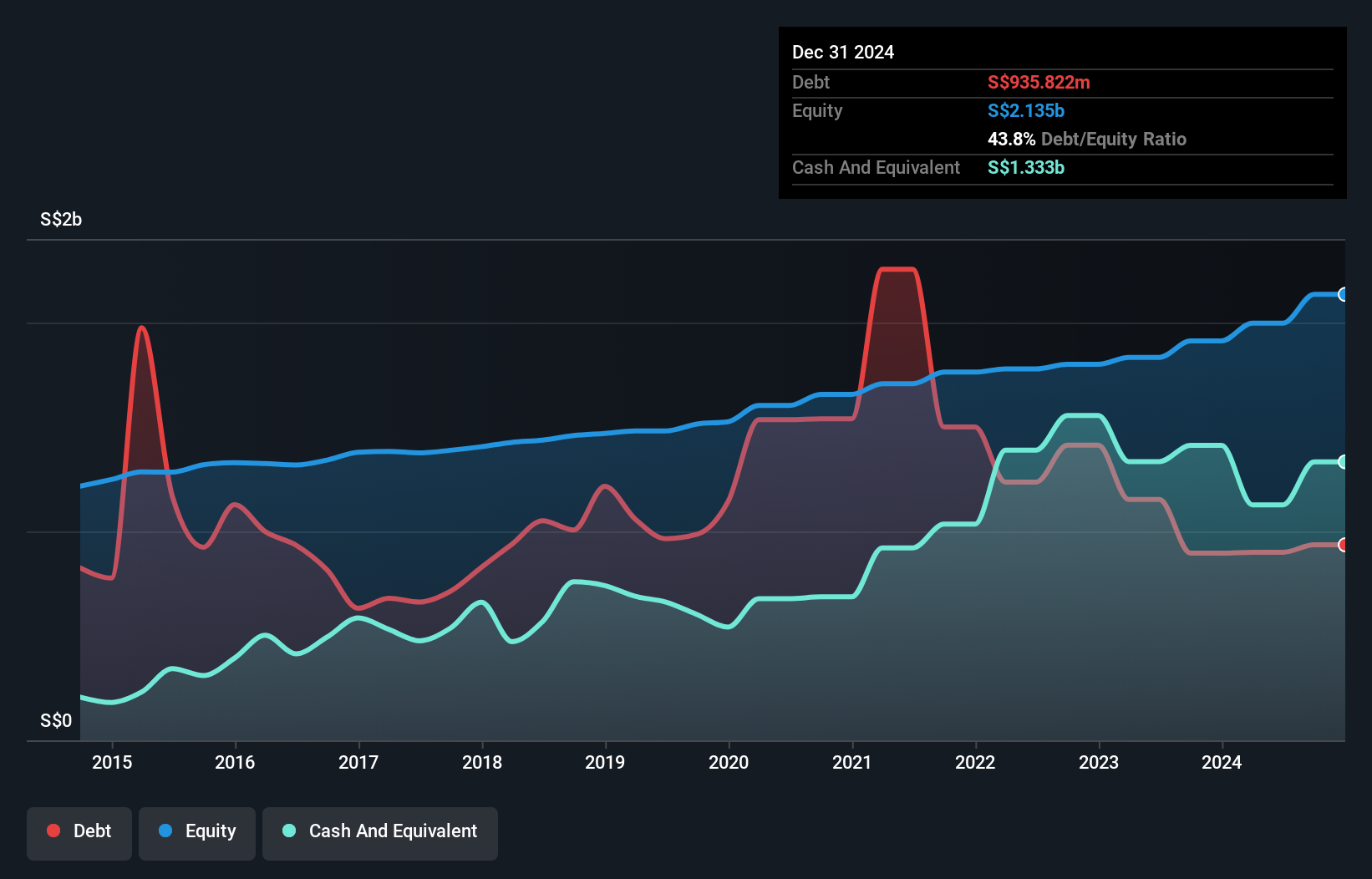

UOB-Kay Hian Holdings, with a market cap of SGD2.42 billion, operates in the investment sector offering services like stockbroking and margin financing. Despite its stable weekly volatility, the company faces challenges with declining net profit margins and negative earnings growth over the past year. However, it maintains high-quality earnings and reduced its debt-to-equity ratio from 95.8% to 74.2% over five years. Recent board changes align with corporate governance practices amid a strategic renewal process. UOB-Kay Hian was recently added to the S&P Global BMI Index, reflecting its significance in global markets despite insider selling concerns.

- Navigate through the intricacies of UOB-Kay Hian Holdings with our comprehensive balance sheet health report here.

- Explore historical data to track UOB-Kay Hian Holdings' performance over time in our past results report.

Make It Happen

- Jump into our full catalog of 959 Asian Penny Stocks here.

- Contemplating Other Strategies? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:PSG

PSG Corporation

Together with its subsidiary, engages in turnkey engineering, procurement, and construction (EPC), and large-scale construction projects in Thailand and the Lao People’s Democratic Republic.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives