- Japan

- /

- Healthcare Services

- /

- NSE:7488

Top Asian Dividend Stocks In November 2025

Reviewed by Simply Wall St

As global markets grapple with concerns over AI valuations and economic uncertainties, Asian markets have also felt the impact, with notable declines in key indices such as Japan's Nikkei 225 and China's CSI 300. In this environment of heightened volatility, dividend stocks can offer a measure of stability and income potential, making them an attractive option for investors seeking to navigate these turbulent times.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.35% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.72% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.93% | ★★★★★★ |

| NCD (TSE:4783) | 4.51% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.13% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.20% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.58% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.64% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.82% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.82% | ★★★★★★ |

Click here to see the full list of 1055 stocks from our Top Asian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

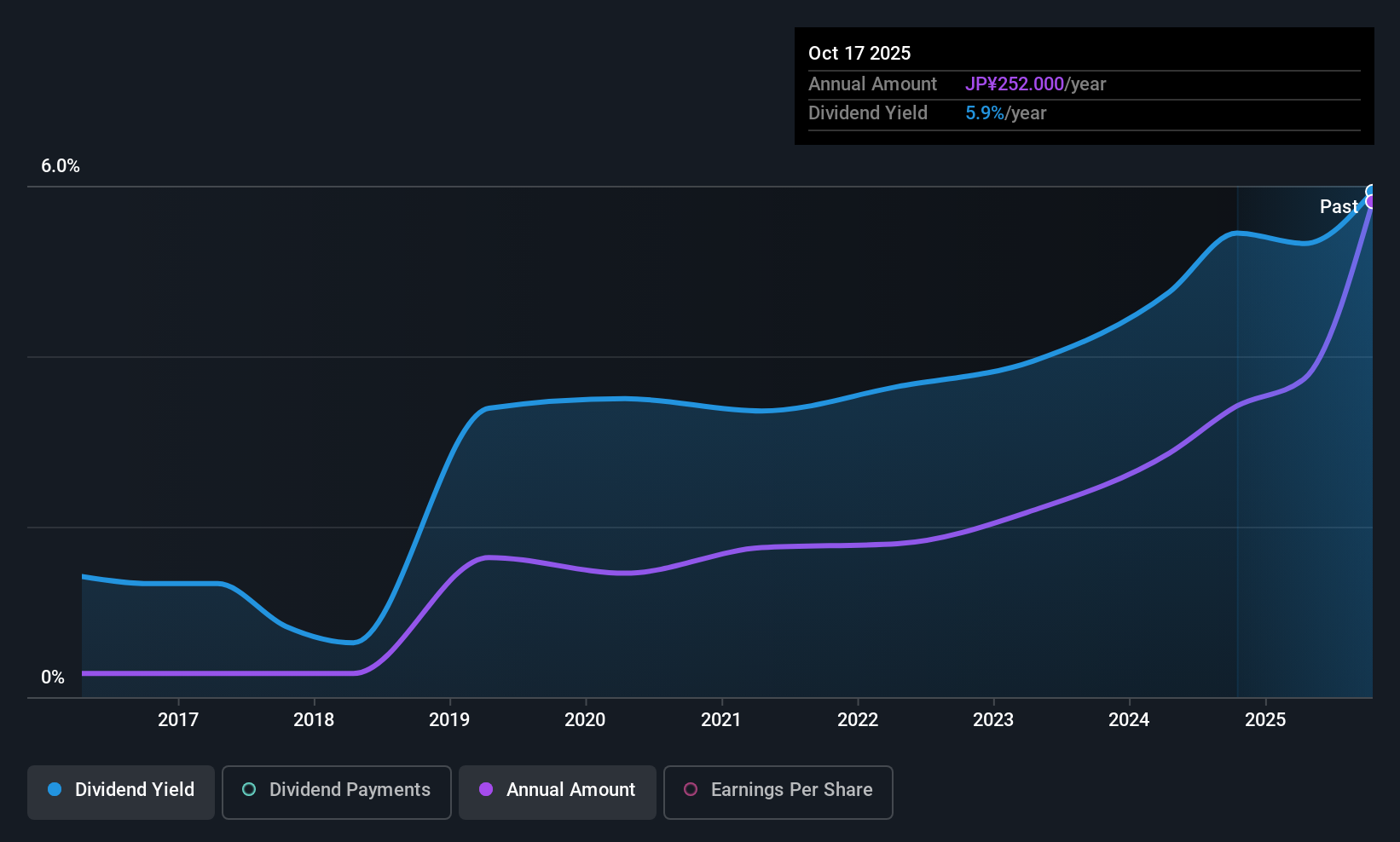

Yagami (NSE:7488)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yagami Inc. is a specialized trading company focused on the educational market in Japan, with a market cap of ¥23.63 billion.

Operations: Yagami Inc.'s revenue is primarily derived from its segments in Scientific Equipment at ¥5.59 billion, Industrial Equipment at ¥2.71 billion, and Health and Medical Equipment at ¥2.71 billion.

Dividend Yield: 5.6%

Yagami's dividends have been stable and reliable over the past decade, with payments consistently increasing. However, despite a reasonable payout ratio of 65.4%, the high cash payout ratio of 109.1% indicates that dividends are not well covered by free cash flows, raising sustainability concerns. Trading at 17% below its estimated fair value, Yagami offers a dividend yield of 5.59%, placing it in the top tier among Japanese market payers but necessitating cautious consideration regarding long-term viability.

- Delve into the full analysis dividend report here for a deeper understanding of Yagami.

- Insights from our recent valuation report point to the potential overvaluation of Yagami shares in the market.

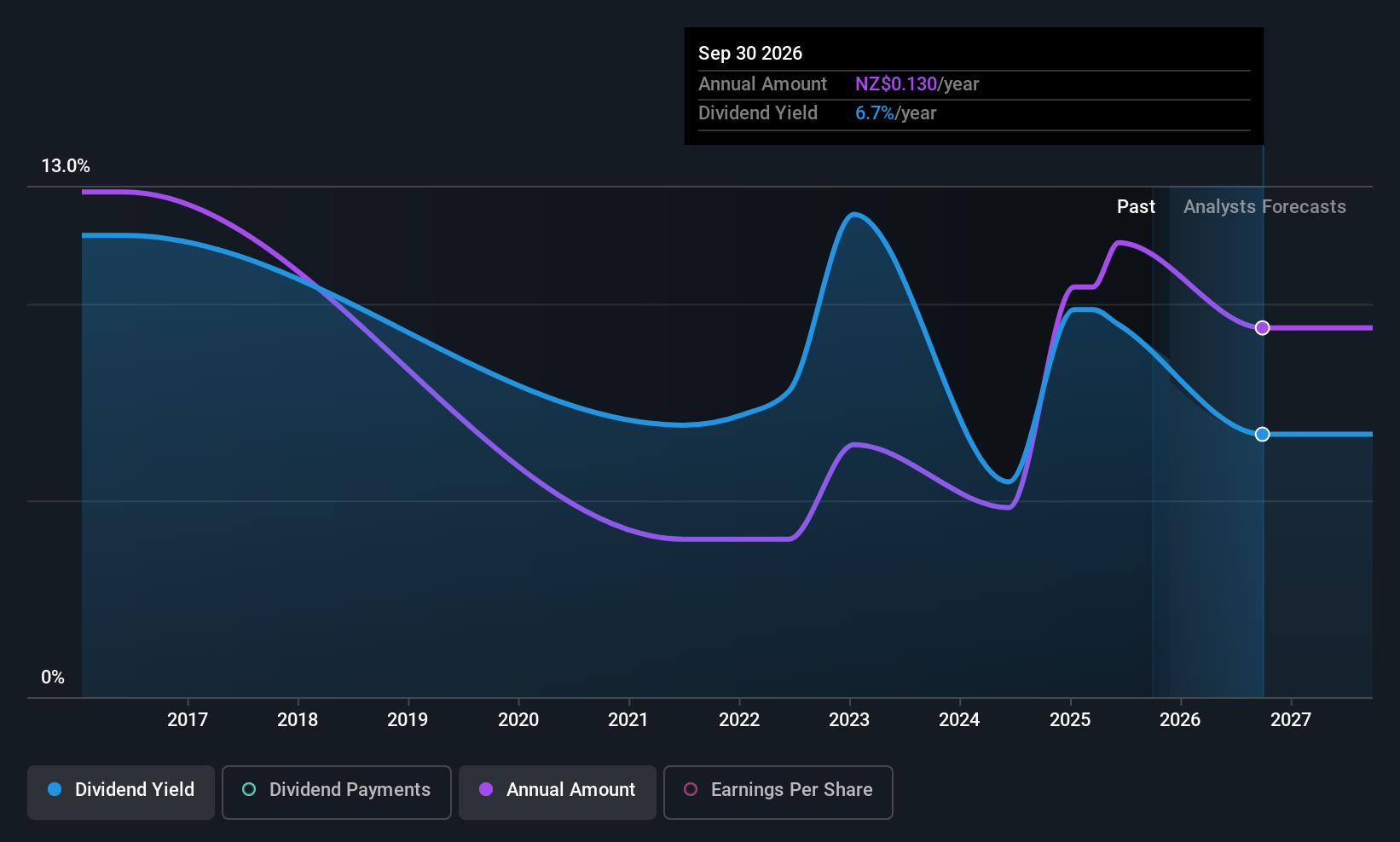

Tower (NZSE:TWR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tower Limited offers general insurance products in New Zealand and the Pacific Islands, with a market capitalization of NZ$664.55 million.

Operations: Tower Limited's revenue is primarily derived from its operations in New Zealand, contributing NZ$563.61 million, and the Pacific Islands, adding NZ$43.67 million.

Dividend Yield: 8.2%

Tower's dividend yield of 8.25% ranks it among the top payers in New Zealand, supported by a payout ratio of 59% and cash payout ratio of 37.1%, indicating strong coverage by earnings and cash flows. However, its dividends have been volatile over the past decade, raising concerns about reliability. Recent developments include a partnership with Westpac NZ for insurance products starting July 2026 and an upward revision in earnings guidance to between $100 million to $110 million for FY2025.

- Take a closer look at Tower's potential here in our dividend report.

- Our valuation report unveils the possibility Tower's shares may be trading at a premium.

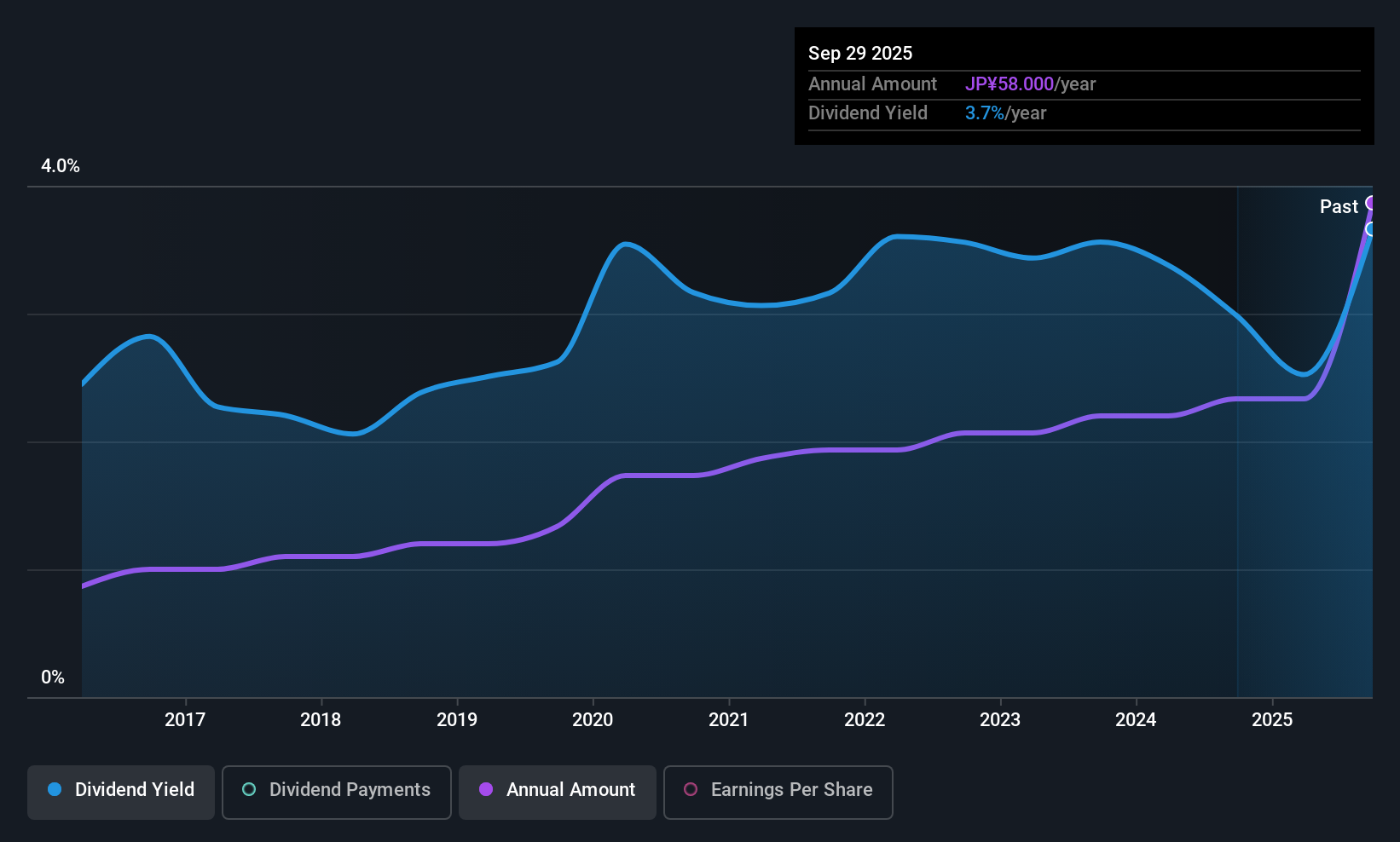

Yellow Hat (TSE:9882)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yellow Hat Ltd. operates in the retail sector, focusing on car and motorcycle accessories, with a market cap of ¥142.87 billion.

Operations: Yellow Hat Ltd.'s revenue segments include the retail of car and motorcycle accessories.

Dividend Yield: 3.5%

Yellow Hat's dividend yield of 3.51% is slightly below the top tier in Japan, with a low payout ratio of 24.8%, suggesting coverage by earnings but not by free cash flows, as the company lacks them. Although dividends have been stable and reliable over the past decade, recent news indicates a reduction from JPY 35 to JPY 29 per share for Q2 2025, reflecting potential sustainability issues despite recent earnings growth.

- Click here to discover the nuances of Yellow Hat with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Yellow Hat is priced higher than what may be justified by its financials.

Seize The Opportunity

- Access the full spectrum of 1055 Top Asian Dividend Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSE:7488

Yagami

Operates as a specialized trading company in the educational market Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success