- New Zealand

- /

- Healthcare Services

- /

- NZSE:TAH

If EPS Growth Is Important To You, Third Age Health Services (NZSE:TAH) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Third Age Health Services (NZSE:TAH). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Fast Is Third Age Health Services Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that Third Age Health Services has managed to grow EPS by 25% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Third Age Health Services is growing revenues, and EBIT margins improved by 5.3 percentage points to 20%, over the last year. Both of which are great metrics to check off for potential growth.

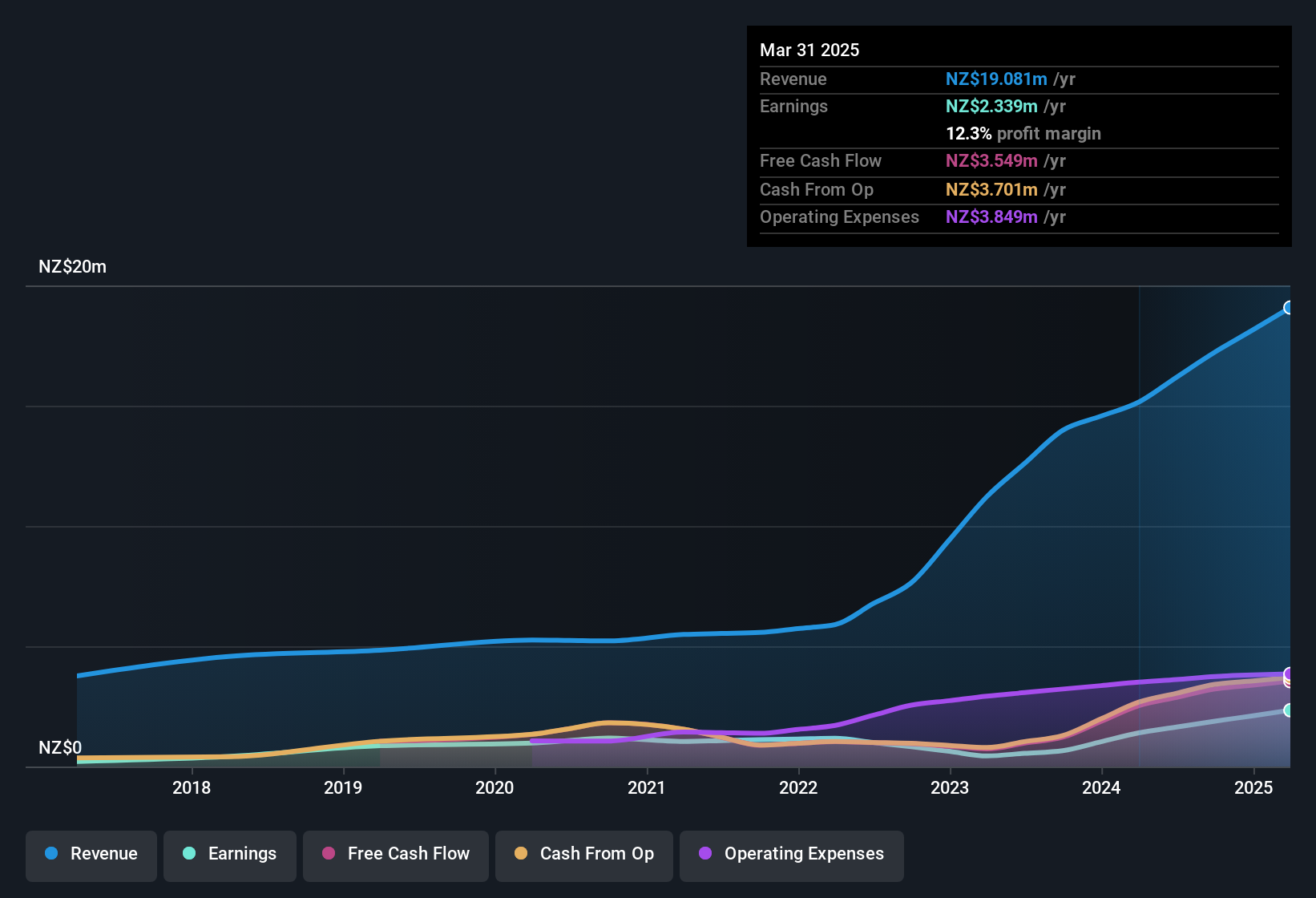

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

View our latest analysis for Third Age Health Services

Third Age Health Services isn't a huge company, given its market capitalisation of NZ$45m. That makes it extra important to check on its balance sheet strength.

Are Third Age Health Services Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Third Age Health Services insiders both bought and sold shares over the last twelve months, but they did end up spending NZ$40k more on stock than they received from selling it. So, on balance, the insider transactions are mildly encouraging. It is also worth noting that it was Independent Director Wayne Williams who made the biggest single purchase, worth NZ$68k, paying NZ$3.40 per share.

On top of the insider buying, we can also see that Third Age Health Services insiders own a large chunk of the company. Indeed, with a collective holding of 69%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. In terms of absolute value, insiders have NZ$31m invested in the business, at the current share price. So there's plenty there to keep them focused!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Tony Wai is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Third Age Health Services with market caps under NZ$343m is about NZ$639k.

Third Age Health Services offered total compensation worth NZ$456k to its CEO in the year to March 2025. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add Third Age Health Services To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Third Age Health Services' strong EPS growth. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say that this stock may well deserve a spot on your watchlist. We don't want to rain on the parade too much, but we did also find 2 warning signs for Third Age Health Services that you need to be mindful of.

Keen growth investors love to see insider activity. Thankfully, Third Age Health Services isn't the only one. You can see a a curated list of New Zealander companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Third Age Health Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:TAH

Third Age Health Services

Provides general practice health care services for older people living in retirement villages, private hospitals, and secure dementia units in New Zealand.

Outstanding track record and fair value.

Market Insights

Community Narratives