Stock Analysis

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Fisher & Paykel Healthcare Corporation Limited (NZSE:FPH) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Fisher & Paykel Healthcare

How Much Debt Does Fisher & Paykel Healthcare Carry?

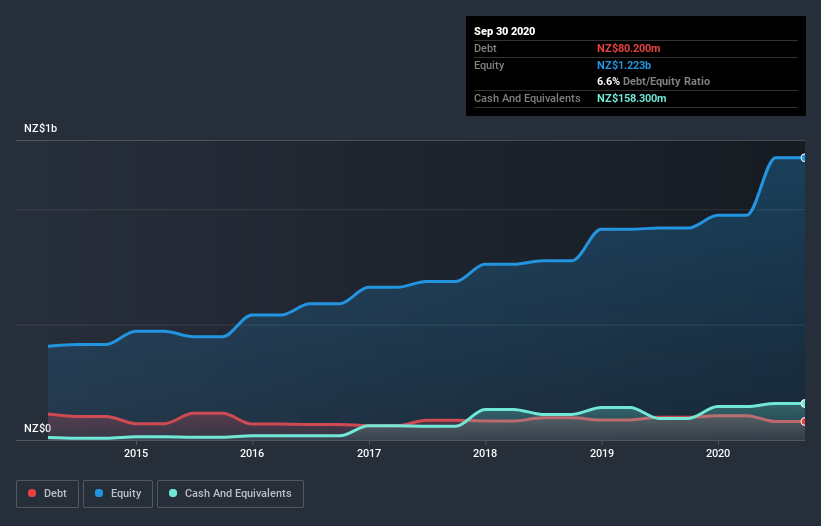

You can click the graphic below for the historical numbers, but it shows that Fisher & Paykel Healthcare had NZ$80.2m of debt in September 2020, down from NZ$98.8m, one year before. However, it does have NZ$158.3m in cash offsetting this, leading to net cash of NZ$78.1m.

How Healthy Is Fisher & Paykel Healthcare's Balance Sheet?

According to the last reported balance sheet, Fisher & Paykel Healthcare had liabilities of NZ$336.1m due within 12 months, and liabilities of NZ$72.5m due beyond 12 months. Offsetting this, it had NZ$158.3m in cash and NZ$239.7m in receivables that were due within 12 months. So its liabilities total NZ$10.6m more than the combination of its cash and short-term receivables.

This state of affairs indicates that Fisher & Paykel Healthcare's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the NZ$17.5b company is short on cash, but still worth keeping an eye on the balance sheet. While it does have liabilities worth noting, Fisher & Paykel Healthcare also has more cash than debt, so we're pretty confident it can manage its debt safely.

In addition to that, we're happy to report that Fisher & Paykel Healthcare has boosted its EBIT by 56%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Fisher & Paykel Healthcare's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Fisher & Paykel Healthcare may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Looking at the most recent three years, Fisher & Paykel Healthcare recorded free cash flow of 44% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Fisher & Paykel Healthcare has NZ$78.1m in net cash. And we liked the look of last year's 56% year-on-year EBIT growth. So is Fisher & Paykel Healthcare's debt a risk? It doesn't seem so to us. We'd be very excited to see if Fisher & Paykel Healthcare insiders have been snapping up shares. If you are too, then click on this link right now to take a (free) peek at our list of reported insider transactions.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Fisher & Paykel Healthcare or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Fisher & Paykel Healthcare is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NZSE:FPH

Fisher & Paykel Healthcare

Designs, manufactures, markets, and sells medical device products and systems in North America, Europe, the Asia Pacific, and internationally.

Flawless balance sheet with high growth potential.