- Thailand

- /

- Construction

- /

- SET:TRITN

Green Cross Health Among 3 Penny Stocks Worth Watching

Reviewed by Simply Wall St

Global markets have experienced a turbulent week, with U.S. stocks facing volatility due to AI competition fears and mixed corporate earnings reports, while European indices hit record highs following the ECB's rate cut. Amid these fluctuating conditions, investors often seek opportunities in less conventional areas of the market. Penny stocks, though an older term, continue to hold relevance for those interested in smaller or newer companies that offer potential value and growth. This article will explore three penny stocks that stand out for their financial strength and potential to deliver significant returns over time.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.69 | HK$42.39B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.61B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.89 | £482.95M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £178.85M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.10 | HK$698.27M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| China Lilang (SEHK:1234) | HK$3.92 | HK$4.69B | ★★★★★☆ |

Click here to see the full list of 5,728 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Green Cross Health (NZSE:GXH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Green Cross Health Limited operates in New Zealand, offering healthcare and advice services to communities, with a market cap of NZ$114.88 million.

Operations: The company generates revenue through its Medical Services segment, which contributes NZ$149.29 million, and its Pharmacy Services segment, which accounts for NZ$364.32 million.

Market Cap: NZ$114.88M

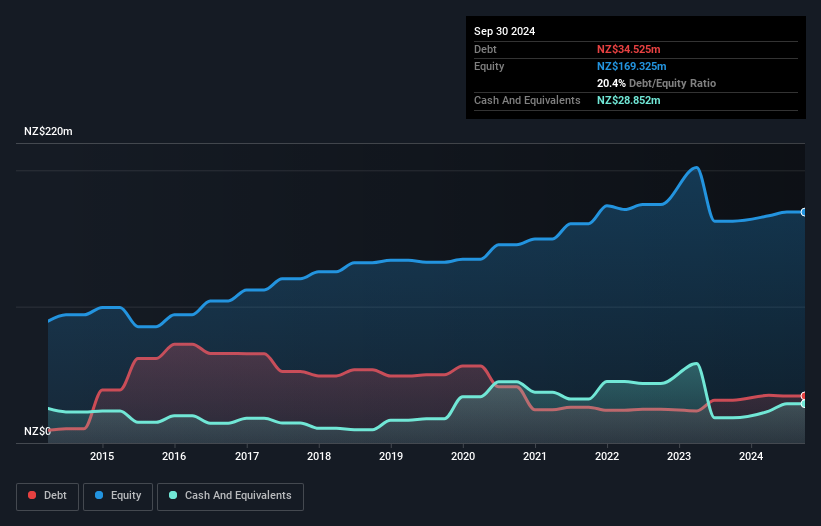

Green Cross Health Limited, with a market cap of NZ$114.88 million, shows mixed results in its financial health and growth prospects. The company reported half-year sales of NZ$259.88 million, reflecting slight growth from the previous year, but earnings have declined by 3.1% annually over five years. While it maintains high-quality earnings and satisfactory debt management with net debt to equity at 3.4%, its short-term assets fall short of covering liabilities, indicating potential liquidity challenges. The board and management are experienced; however, the share price has been volatile recently and dividends remain unstable despite recent payouts.

- Take a closer look at Green Cross Health's potential here in our financial health report.

- Examine Green Cross Health's past performance report to understand how it has performed in prior years.

Build King Holdings (SEHK:240)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Build King Holdings Limited is an investment holding company involved in building construction and civil engineering works in Hong Kong and the People's Republic of China, with a market cap of HK$1.17 billion.

Operations: The company's revenue is primarily derived from construction work, amounting to HK$13.01 billion.

Market Cap: HK$1.17B

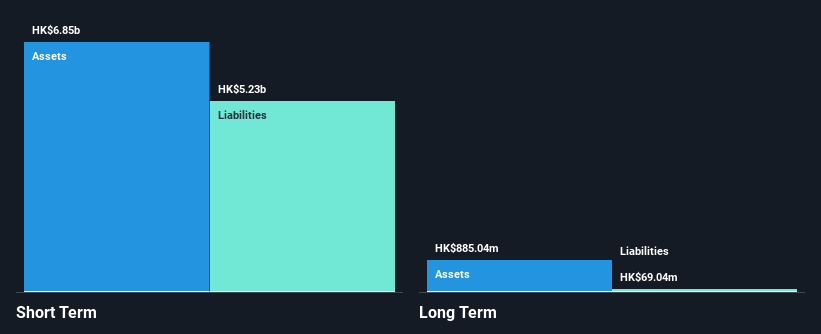

Build King Holdings, with a market cap of HK$1.17 billion, demonstrates financial resilience despite recent challenges. The company generates significant revenue from construction work, totaling HK$13.01 billion. While its net profit margins have decreased over the past year, it trades at a substantial discount to estimated fair value and has not experienced shareholder dilution recently. The company's short-term assets comfortably cover both short-term and long-term liabilities, and it maintains more cash than debt. Despite negative earnings growth last year compared to industry averages, Build King's earnings have grown annually by 6.4% over five years, supported by an experienced management team and board of directors.

- Jump into the full analysis health report here for a deeper understanding of Build King Holdings.

- Explore historical data to track Build King Holdings' performance over time in our past results report.

Triton Holding (SET:TRITN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Triton Holding Public Company Limited is an investment holding company involved in the construction and engineering sector in Thailand, with a market cap of THB1.11 billion.

Operations: The company generates revenue primarily from its Constructions Business, which accounts for THB375.42 million, and its Electricity and Energy Business, contributing THB73.58 million.

Market Cap: THB1.11B

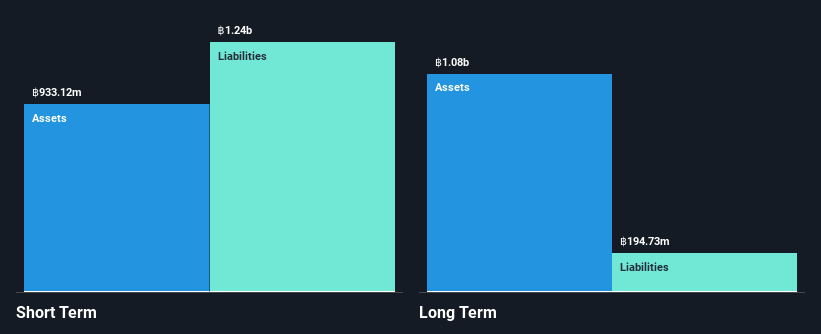

Triton Holding, with a market cap of THB1.11 billion, faces financial challenges as it reports declining revenues and increasing losses. The company's earnings have decreased significantly over the past five years, and its net debt to equity ratio has risen to 23.8%, considered satisfactory but indicative of increased leverage. Although Triton's short-term assets do not cover its short-term liabilities (THB1.3 billion), they exceed long-term liabilities (THB161.9 million). Recent board meetings suggest strategic shifts, including capital increases and potential investments in leisure projects, while maintaining a seasoned management team with an average tenure of 6.1 years.

- Click to explore a detailed breakdown of our findings in Triton Holding's financial health report.

- Review our historical performance report to gain insights into Triton Holding's track record.

Next Steps

- Take a closer look at our Penny Stocks list of 5,728 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Triton Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:TRITN

Triton Holding

An investment holding company, engages in the construction and engineering business in Thailand.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives