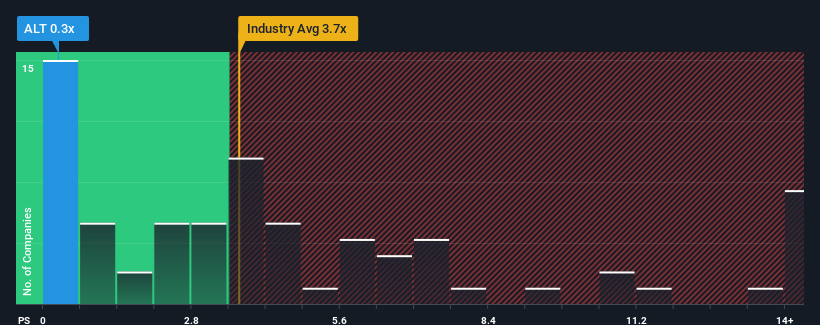

With a price-to-sales (or "P/S") ratio of 0.3x Alternus Energy Group plc (OB:ALT) may be sending very bullish signals at the moment, given that almost half of all the Renewable Energy companies in Norway have P/S ratios greater than 3.9x and even P/S higher than 11x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Alternus Energy Group

What Does Alternus Energy Group's Recent Performance Look Like?

Recent times have been quite advantageous for Alternus Energy Group as its revenue has been rising very briskly. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Alternus Energy Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Alternus Energy Group's Revenue Growth Trending?

In order to justify its P/S ratio, Alternus Energy Group would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 220%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to decline by 3.8% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this information, we find it very odd that Alternus Energy Group is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Upon analysing the past data, we see it is unexpected that Alternus Energy Group is currently trading at a lower P/S than the rest of the industry given that its revenue growth in the past three-year years is exceeding expectations in a challenging industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this positive performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

Having said that, be aware Alternus Energy Group is showing 3 warning signs in our investment analysis, and 2 of those don't sit too well with us.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ALT

Alternus Energy Group

Operates as an international vertically integrated independent power producer.

Medium-low and fair value.

Market Insights

Community Narratives