A Look at Norwegian (OB:NAS) Valuation Following Share Buy-Back Programme Announcement

Reviewed by Simply Wall St

Norwegian Air Shuttle (OB:NAS) is launching a share buy-back programme, engaging DNB Carnegie to repurchase up to 3,000,000 shares as part of ongoing employee and executive incentive schemes. The move is authorized by the company’s AGM and complies with EU regulations.

See our latest analysis for Norwegian Air Shuttle.

Norwegian Air Shuttle’s latest buy-back program comes during a year when the stock’s share price has climbed 35.8% year-to-date. However, recent weeks have been more turbulent, with the past month’s share price return down 7.8%. Still, its one-year total shareholder return stands at an impressive 51%, showing resilience and renewed investor confidence over the longer term.

If you’re intrigued by recovery stories and want to spot more companies with momentum, now’s a great time to discover See the full list for free.

Yet with shares still trading at a discount to analyst targets, the key question is whether Norwegian Air Shuttle is undervalued or if the market has already baked in expectations for further growth. Could this be a real buying opportunity?

Most Popular Narrative: 14.8% Undervalued

With the narrative’s fair value estimate at NOK 18.17 per share compared to Norwegian Air Shuttle’s last close of NOK 15.47, the narrative suggests further upside potential. This valuation leans on expectations around demand and margin improvements, and it sets the stage for an in-depth, forward-looking analysis.

The growth in passenger numbers and market share in Norway, along with increasing corporate travel agreements, indicates a robust demand for Norwegian Air Shuttle's services. This suggests potential revenue growth in the future. The acquisition of Wideroe and the resulting operational synergies, as well as the launch of a new distribution platform, are expected to streamline operations and enhance efficiency, which could improve net margins.

Curious about what’s driving the optimism behind this valuation? The narrative rests on bold growth plays in key markets and a margin story that stands apart from most rivals. What are the data-backed targets and unspoken assumptions propelling this narrative’s fair value? Dive in to uncover which financial levers are forecast to transform Norwegian’s bottom line and what risks they are betting will not appear.

Result: Fair Value of NOK 18.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, operational setbacks such as punctuality challenges or unresolved legal disputes could disrupt Norwegian Air Shuttle’s positive outlook and slow its momentum.

Find out about the key risks to this Norwegian Air Shuttle narrative.

Another View: Gauging Value by Earnings Ratio

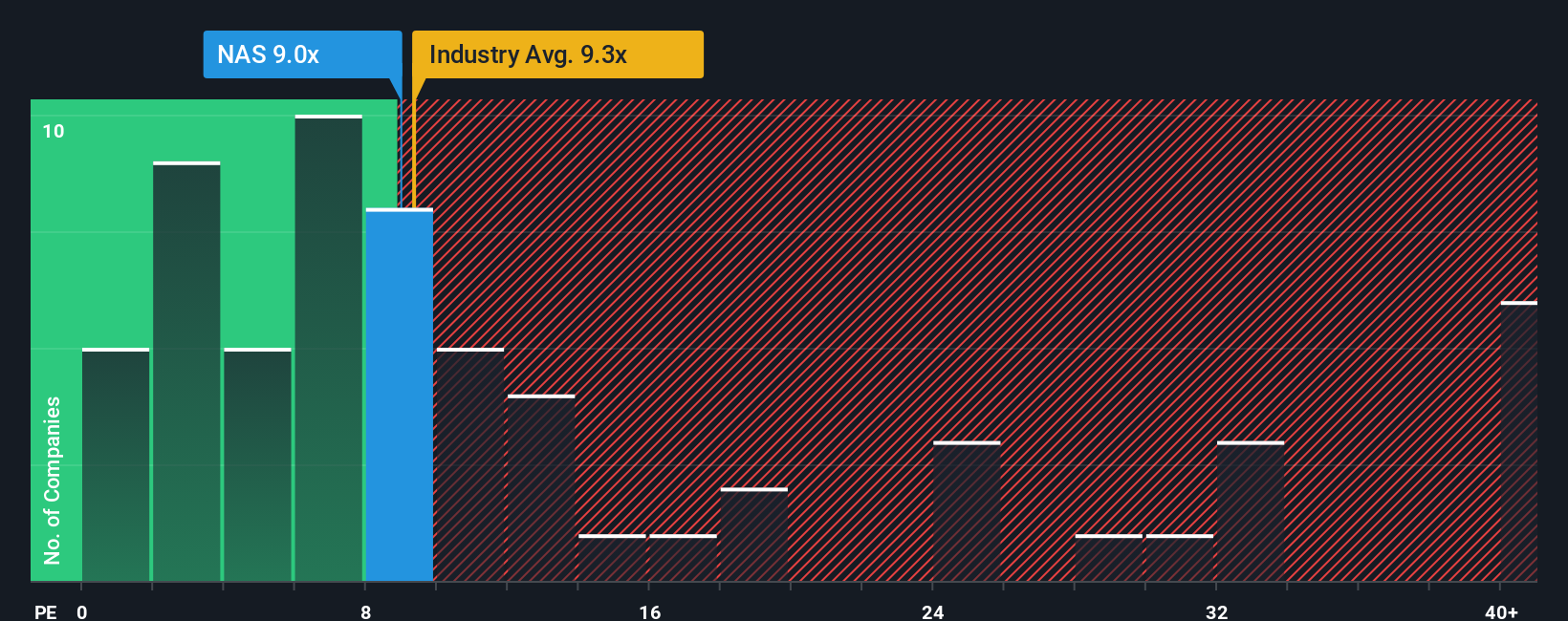

Stepping away from analyst price targets, the company’s price-to-earnings ratio tells a different story. Norwegian Air Shuttle trades at 6.8 times earnings, which is higher than the peer average of 4.3 but below the global industry average of 8.9. The fair ratio sits just under current levels at 6.7. This suggests shares could be on the pricier side compared to similar companies. Does this premium signal true strength, or does it increase valuation risk if momentum slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Norwegian Air Shuttle Narrative

If you see the story differently, or want to shape your own perspective based on the latest data, you can build a fresh narrative for Norwegian Air Shuttle yourself in just a few minutes. Do it your way

A great starting point for your Norwegian Air Shuttle research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't limit your opportunities to just one company. Stay ahead of the crowd by finding stocks with strong growth or hidden value, and keep your portfolio competitive.

- Strengthen your income strategy as you target stable returns by checking out these 15 dividend stocks with yields > 3% with attractive yields and financial resilience.

- Capitalize on AI innovation with these 27 AI penny stocks powering breakthroughs in automation and machine learning.

- Ride the wave of digital finance by identifying companies at the forefront when you sort through these 81 cryptocurrency and blockchain stocks driving growth in cryptocurrency and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norwegian Air Shuttle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NAS

Norwegian Air Shuttle

Provides air travel services in Norway and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives