- Sweden

- /

- Consumer Durables

- /

- OM:BESQAB

Top European Growth Companies With Strong Insider Ownership November 2025

Reviewed by Simply Wall St

As European markets face renewed concerns over inflated AI stock valuations and receding expectations for U.S. interest rate cuts, investors are increasingly focused on identifying resilient growth opportunities. In this environment, companies with strong insider ownership often stand out as they may indicate confidence from those who know the business best, aligning management interests with shareholders and potentially providing stability during volatile times.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 109.1% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.5% |

| CD Projekt (WSE:CDR) | 29.7% | 50.7% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Let's explore several standout options from the results in the screener.

Himalaya Shipping (OB:HSHP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Himalaya Shipping Ltd. offers dry bulk shipping services globally and has a market capitalization of NOK3.96 billion.

Operations: The company's revenue is primarily derived from its transportation and shipping segment, totaling $119.38 million.

Insider Ownership: 30.5%

Earnings Growth Forecast: 79.4% p.a.

Himalaya Shipping, with substantial insider ownership, presents a mixed growth outlook. Despite recent dividend decreases to US$0.07 per share and declining profit margins from 21.9% to 4.4%, the company is trading significantly below fair value estimates and forecasts indicate strong earnings growth of 79.41% annually over the next three years, outpacing the Norwegian market's expected growth of 16.1%. Revenue is also projected to grow at a faster rate than the market average.

- Unlock comprehensive insights into our analysis of Himalaya Shipping stock in this growth report.

- The valuation report we've compiled suggests that Himalaya Shipping's current price could be inflated.

Besqab (OM:BESQAB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Besqab (OM:BESQAB) focuses on the green field development of residential buildings and converting commercial real estate into residential premises, with a market cap of SEK2.63 billion.

Operations: The company's revenue segments include Project Development, generating SEK2.60 billion, and Investment Properties, contributing SEK28.20 million.

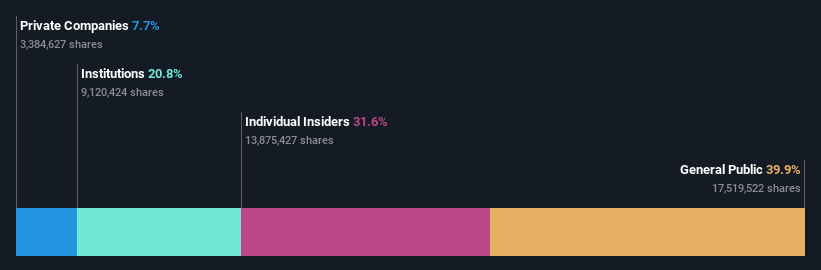

Insider Ownership: 17.5%

Earnings Growth Forecast: 80.7% p.a.

Besqab, with high insider ownership, is positioned for significant growth despite recent financial setbacks. The company reported a net loss of SEK 13.9 million in Q3 2025 but is trading well below its estimated fair value and forecasts suggest an annual revenue growth of 38.2%, surpassing the Swedish market average. Recent strategic acquisitions in Stockholm aim to bolster long-term growth, while management changes focus on sustainability and digitalization to enhance operational efficiency.

- Click here and access our complete growth analysis report to understand the dynamics of Besqab.

- Our expertly prepared valuation report Besqab implies its share price may be too high.

Zalando (XTRA:ZAL)

Simply Wall St Growth Rating: ★★★★☆☆

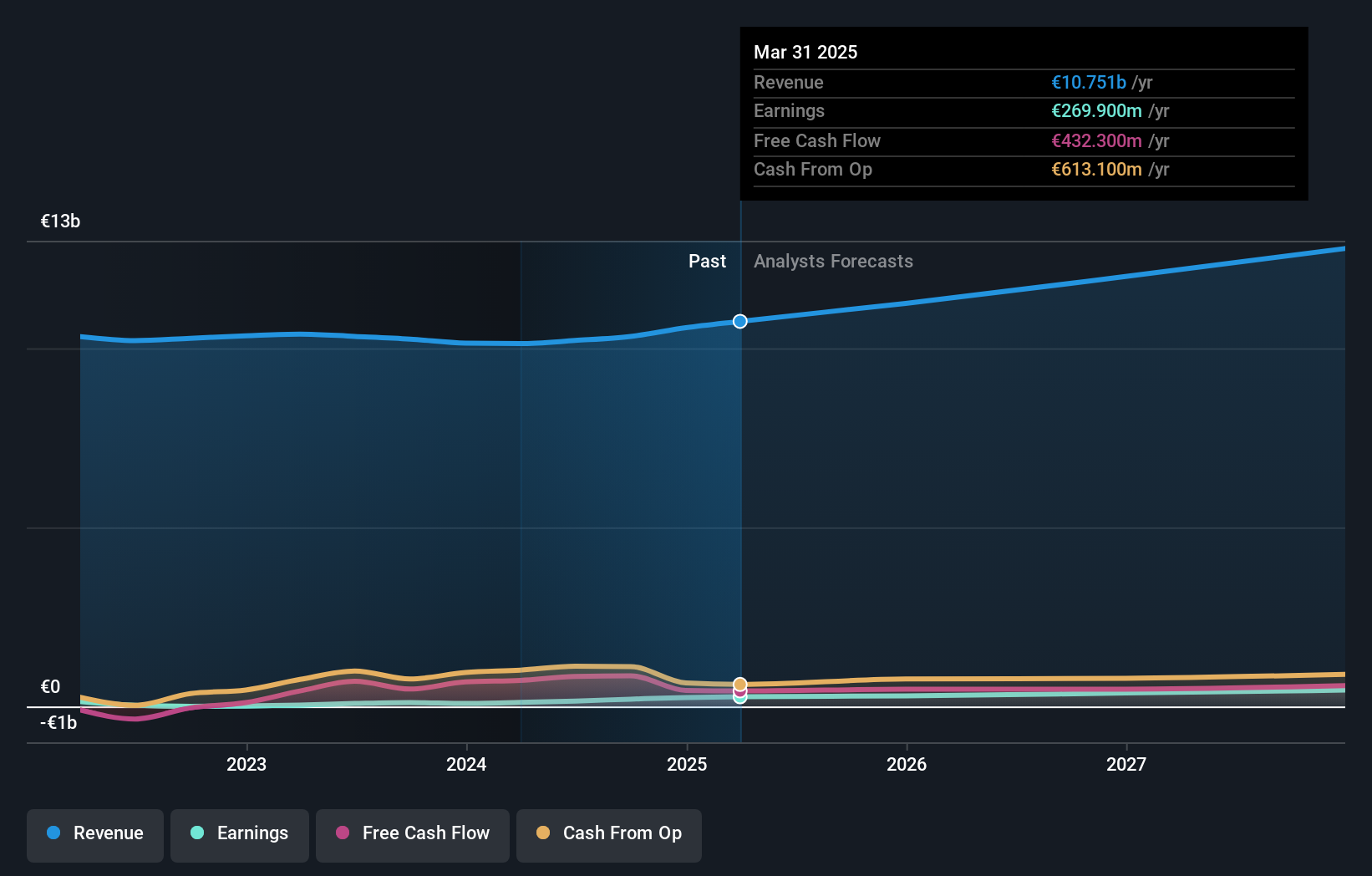

Overview: Zalando SE operates an online platform for fashion and lifestyle products both in Germany and internationally, with a market capitalization of approximately €5.74 billion.

Operations: The company's revenue is primarily derived from its B2C segment, generating €10.58 billion, and its B2B segment, contributing €1.04 billion.

Insider Ownership: 10.3%

Earnings Growth Forecast: 24.6% p.a.

Zalando, with substantial insider ownership, is poised for growth despite recent earnings challenges. The company reported a Q3 2025 net income of €14.8 million, down from €44.3 million the previous year. However, its revenue is forecast to grow at 9.1% annually, outpacing the German market's 6.2%. A share repurchase program worth €100 million aims to support employee option programs and management incentives as Zalando continues expanding its e-commerce ecosystem across Europe.

- Delve into the full analysis future growth report here for a deeper understanding of Zalando.

- Upon reviewing our latest valuation report, Zalando's share price might be too pessimistic.

Summing It All Up

- Navigate through the entire inventory of 200 Fast Growing European Companies With High Insider Ownership here.

- Contemplating Other Strategies? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Besqab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BESQAB

Besqab

AROS Bostadsutveckling AB engages in green field development of residential buildings and conversion of commercial real estate into residential premises.

High growth potential and slightly overvalued.

Market Insights

Community Narratives