- Norway

- /

- Marine and Shipping

- /

- OB:HAUTO

Höegh Autoliners (OB:HAUTO): Deep Discount to Fair Value Challenges Bearish Margin Narrative

Reviewed by Simply Wall St

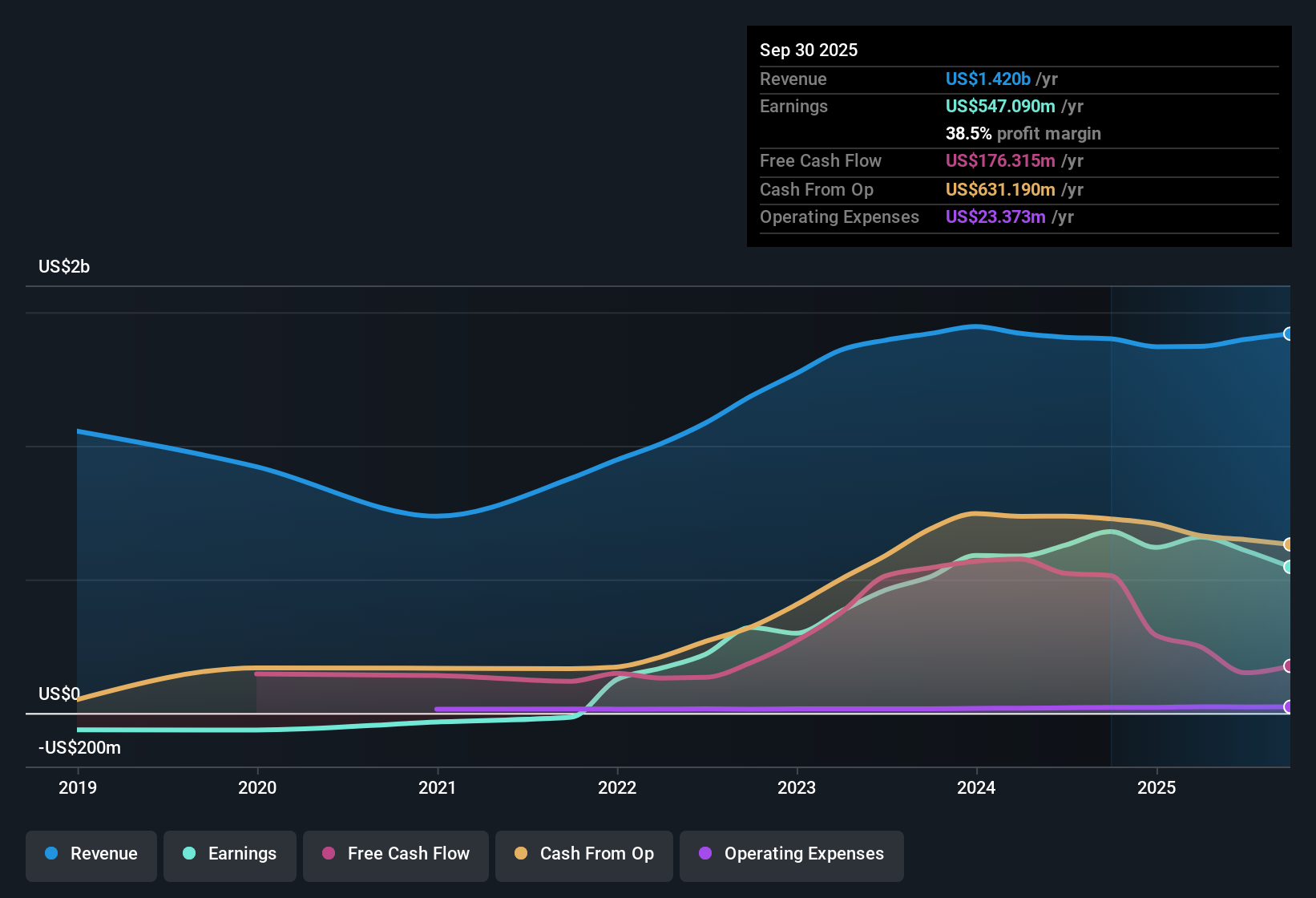

Höegh Autoliners (OB:HAUTO) is facing a challenging outlook, with revenue projected to fall by 3.1% each year and earnings anticipated to decrease sharply by 35.4% per year over the next three years. While net profit margins remain high at 43.5%, only a slight dip from last year’s 44.7%, the company’s shares currently trade at a notable discount to estimated fair value. The price-to-earnings ratio of 2.8x also stands out as well below peer and industry averages. For investors, the mix of high-quality historic earnings and deep value multiples is promising, but these positives are offset by persistent concerns over financial stability and the outlook for shrinking profits.

See our full analysis for Höegh Autoliners.Next, let’s see how these numbers compare to the most popular narratives in the market. Some perspectives may be confirmed, while others might get a reality check.

See what the community is saying about Höegh Autoliners

Margin Erosion as Cost Pressures Mount

- Net profit margins of 43.5% are expected to drop significantly. Analysts forecast a fall to 20.0% within three years, a drop driven by rising tariffs, fuel costs, and regulatory headwinds rather than just softer demand.

- Analysts’ consensus view highlights that while the company’s fleet renewals and sustainability initiatives could help offset some cost increases, industry overcapacity and shifts to local production may compound these pressures and curb margins further.

- Consensus narrative notes the combination of higher operating costs and regulatory changes is likely to sustain downward pressure on net margins and slow growth.

- Despite ongoing investments in efficiency, external industry dynamics point to continued margin contraction that could test the company’s earnings resilience.

- To see how the latest results fit into the bigger industry picture, check out the full consensus outlook for Höegh Autoliners. 📊 Read the full Höegh Autoliners Consensus Narrative.

Fleet Modernization Offers a Buffer

- Höegh Autoliners is investing heavily in new Aurora class vessels. These ships are expected to be more fuel-efficient and compliant with stricter emissions rules, which could lower per-unit costs as older ships are replaced.

- Analysts’ consensus view contends that this modernization, along with robust contract backlogs, positions the company for resilience even as market headwinds persist.

- Consensus narrative notes strong sustainability efforts and an average contract backlog of 3.3 years give the company revenue and earnings visibility amid uncertain industry supply and demand.

- With global supply constrained by slow fleet growth, newbuilds arriving over the next few years could help maintain utilization and mitigate some risk from falling margins.

Share Price at a Deep Discount to DCF Fair Value

- The current share price of NOK90.85 trades dramatically below the DCF fair value of NOK389.11, offering a discount of more than 75%. The industry average PE and analyst targets also point to a market undervaluing the company’s long-term prospects.

- Analysts’ consensus view suggests that although downside risks persist due to profit compression and industry change, today’s price leaves room for long-term appreciation if even some margin and revenue assumptions hold.

- Consensus narrative notes that agreement among analysts is far from universal, but the depth of the current discount stands out versus both peers and historical valuation levels.

- Given analyst expectations that shares would need to rerate to a PE of 8.9x (from well below the current 2.8x), upside exists if the company delivers on modernization and cost management.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Höegh Autoliners on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Bring your insights to life and shape a narrative of your own in just minutes: Do it your way

A great starting point for your Höegh Autoliners research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Explore Alternatives

While Höegh Autoliners presents attractive value metrics, the outlook is clouded by shrinking margins alongside persistent pressure on earnings and financial strength.

If you want to avoid companies facing margin and stability hurdles, use solid balance sheet and fundamentals stocks screener (1983 results) to discover others with stronger financial foundations and less downside risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Höegh Autoliners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:HAUTO

Höegh Autoliners

Provides ocean transportation services within the roll-on roll-off (RoRo) cargoes on deep sea and short sea markets in Norway.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives