Should Telenor (OB:TEL) and Vodafone’s Procurement Alliance Prompt a Fresh Look at Cost Efficiency?

Reviewed by Sasha Jovanovic

- On October 1, 2025, Telenor Group and Vodafone Group announced a new partnership between their global procurement organizations, aiming to leverage a combined annual spend of over €26 billion (NOK 300 billion) and serve more than 550 million customers across 23 countries.

- This collaboration seeks to generate value through joint purchasing power, supply chain resilience, and a focus on responsible and sustainable business practices.

- With an emphasis on unlocking savings through shared procurement scale, we'll explore how this partnership shapes Telenor's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Telenor's Investment Narrative?

To own Telenor shares right now, you need to believe in the company’s ability to extract value from both operational improvements and large-scale partnerships such as the recently announced Vodafone alliance. This procurement collaboration aims to boost margins and fortify the supply chain, which could support profit stability, one of the most important current catalysts. While the new Gothenburg store demonstrates ongoing retail commitment, it likely won’t have a material impact on near-term financials. The Vodafone partnership, however, may shift the risk profile somewhat, given its potential to deliver cost savings and unlock short-term synergies, but also introduce integration risks and heightened execution complexity. With steady but modest revenue and earnings growth reported, coupled with a rising dividend, the core issues remain debt levels, the relatively high P/E ratio, and board inexperience. Recent news tilts the risks and catalysts more toward operational execution than before.

However, uncertainty around the board’s experience remains important for investors to watch.

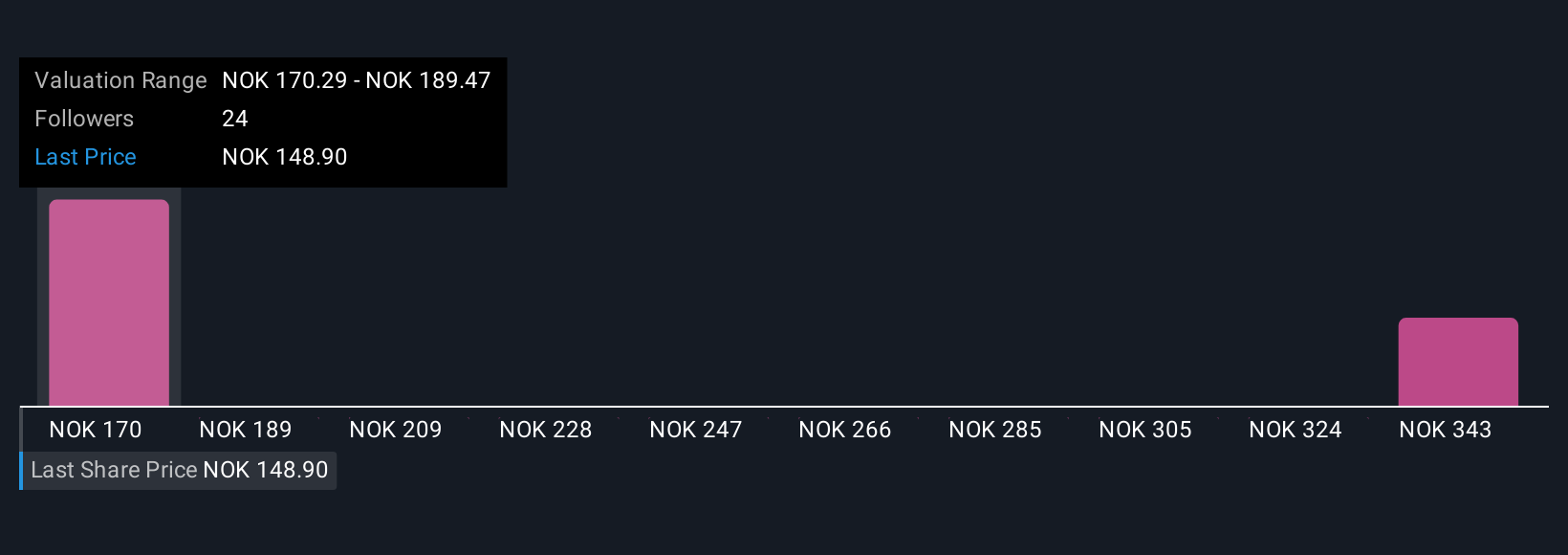

Telenor's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Telenor - why the stock might be worth just NOK168.94!

Build Your Own Telenor Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telenor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Telenor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telenor's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telenor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:TEL

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives