Does Winning New 1800 MHz Spectrum Accelerate Telenor's Nordic Network Ambitions (OB:TEL)?

Reviewed by Sasha Jovanovic

- Earlier this week, Tele2 AB and Telenor, via their joint venture Net4Mobility, secured new 1800 MHz spectrum in Sweden for SEK 465,850,000, aimed at enhancing 4G and 5G network capacity, coverage, and resilience nationwide.

- This spectrum win is a crucial move to future-proof Telenor's infrastructure and highlights the company's commitment to delivering high-performance connectivity across Sweden.

- We'll examine how expanding network capacity through new spectrum helps shape Telenor's investment narrative in the competitive Nordic telecom market.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Telenor's Investment Narrative?

For Telenor shareholders, the big picture centers on the company's ability to grow its earnings steadily while navigating competition and investing in critical future infrastructure. The recent spectrum win in Sweden, alongside Tele2, strengthens Telenor’s network position, a development that could bolster its short-term narrative around capacity and resilience, this may influence the potential for incremental revenue within Sweden’s data-hungry telecom market. Relative to previous catalysts like revised earnings guidance and the IoT consolidation, this acquisition slightly enhances Telenor's competitive edge, making the upcoming quarters’ revenue performance a focal point. However, main risks remain: analysts have flagged Telenor’s slower forecasted revenue growth, high debt, and a board with limited tenure, alongside a payout ratio that puts some pressure on dividend sustainability. Given the current and forecasted profit growth rates, the spectrum deal adds some support, but does not fundamentally alter the main risk-reward profile identified before this news.

On the flip side, high debt levels are still a key concern investors shouldn't overlook.

Exploring Other Perspectives

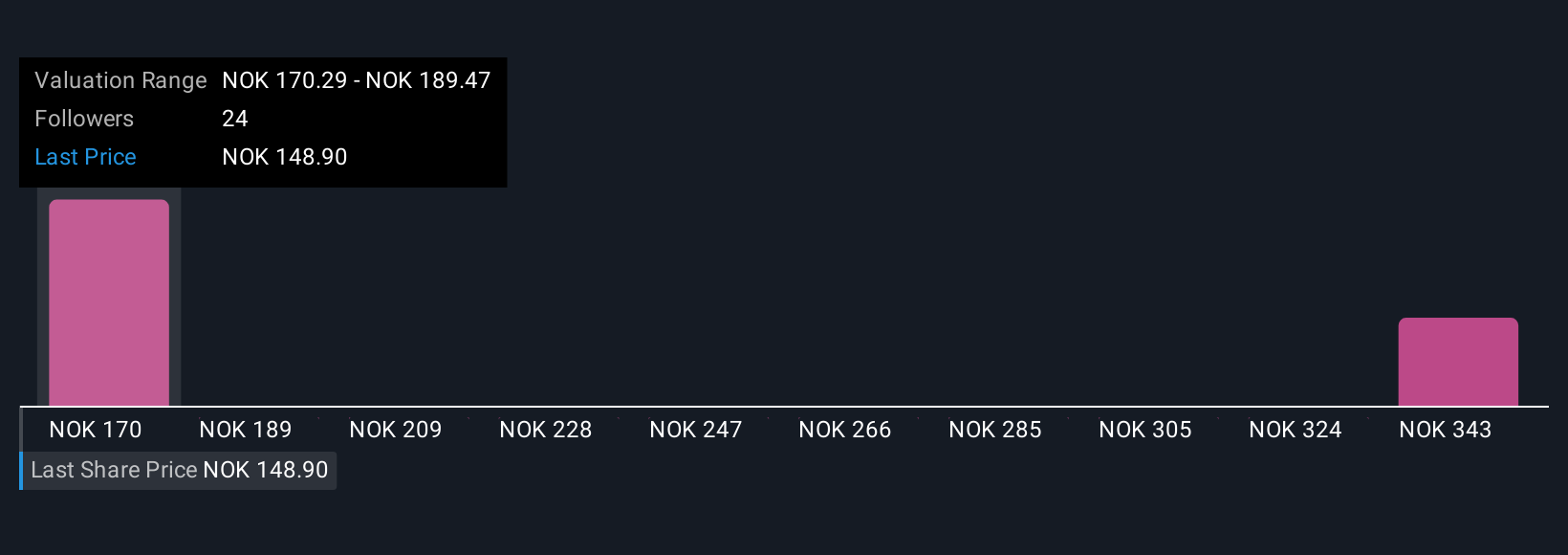

Explore 2 other fair value estimates on Telenor - why the stock might be worth over 2x more than the current price!

Build Your Own Telenor Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telenor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Telenor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telenor's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telenor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:TEL

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives