Do Telenor’s (OB:TEL) Asian Challenges Signal a Shift in Its Growth Strategy?

Reviewed by Sasha Jovanovic

- Telenor ASA recently reported third-quarter 2025 results, revealing sales of NOK 20,304 million and basic earnings per share from continuing operations of NOK 2.21, while guiding for 2–3% organic growth in Nordic service revenues for the full year 2025.

- While the Nordic region delivered steady growth, management highlighted headwinds in Asia, including foreign exchange challenges and spectrum-related costs, as well as a key regulatory step in the sale of Telenor Pakistan.

- We'll examine how concerns around the performance and outlook for Telenor's Asian businesses influence its broader investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Telenor's Investment Narrative?

Being a shareholder in Telenor right now means believing in the stability and growth potential of its Nordic operations while recognizing the complexity of its Asian exposure. The latest quarter’s results confirmed solid Nordic growth and reaffirmed guidance, yet shares dropped after an EBITDA miss tied mostly to currency and spectrum costs in Asia. These short-term pressures now take the spotlight as the key risk, especially with management cautioning that Asian earnings could see further foreign exchange headwinds in coming quarters, a risk not fully reflected in prior analysis. On the catalyst side, successful execution on the Pakistan sale and the Vodafone partnership could strengthen the investment case, but it’s clear that for now, the Asian business is a swing factor that could color the overall story more than before, at least in the immediate term.

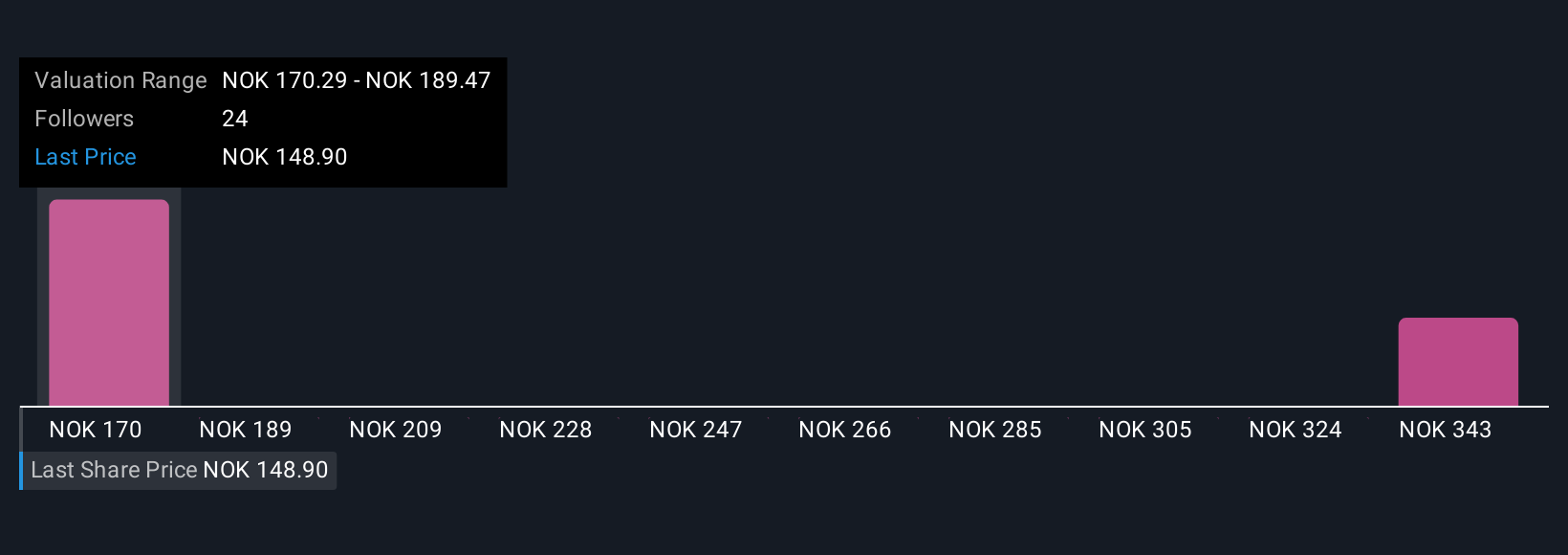

But with foreign exchange in Asia suddenly more critical, investors should watch for more volatility. Despite retreating, Telenor's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on Telenor - why the stock might be worth just NOK171.00!

Build Your Own Telenor Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telenor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Telenor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telenor's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telenor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:TEL

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives