- Norway

- /

- Tech Hardware

- /

- OB:TECH

Here's Why Techstep (OB:TECH) Can Afford Some Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Techstep ASA (OB:TECH) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Techstep

What Is Techstep's Net Debt?

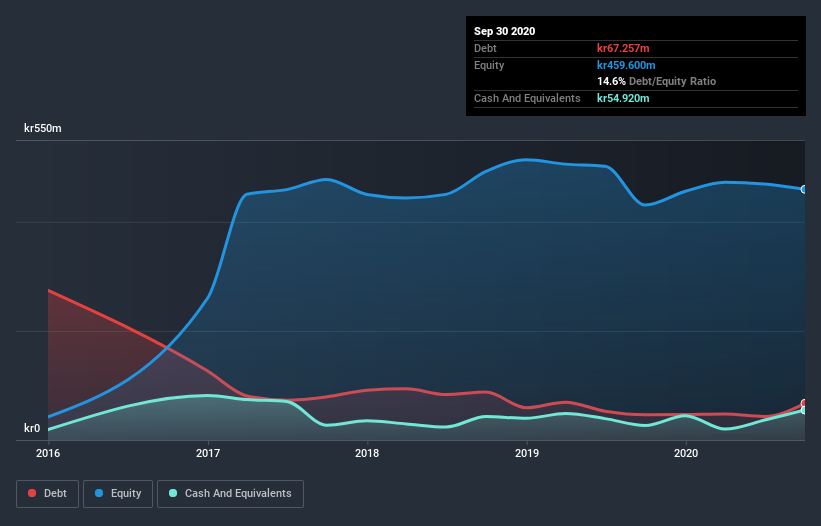

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Techstep had kr67.3m of debt, an increase on kr46.3m, over one year. However, it also had kr54.9m in cash, and so its net debt is kr12.3m.

How Healthy Is Techstep's Balance Sheet?

We can see from the most recent balance sheet that Techstep had liabilities of kr279.1m falling due within a year, and liabilities of kr103.5m due beyond that. Offsetting this, it had kr54.9m in cash and kr142.5m in receivables that were due within 12 months. So it has liabilities totalling kr185.2m more than its cash and near-term receivables, combined.

This deficit isn't so bad because Techstep is worth kr898.1m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. Carrying virtually no net debt, Techstep has a very light debt load indeed. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Techstep will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Techstep made a loss at the EBIT level, and saw its revenue drop to kr1.1b, which is a fall of 3.3%. That's not what we would hope to see.

Caveat Emptor

Importantly, Techstep had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost kr19m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. However, it doesn't help that it burned through kr51m of cash over the last year. So suffice it to say we consider the stock very risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 4 warning signs we've spotted with Techstep (including 1 which is is potentially serious) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Techstep, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Techstep might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OB:TECH

Techstep

Operates as a mobile technology company in Norway, Sweden, Denmark, and Poland.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

From Tasers to SaaS: Axon’s Quiet Platform Transformation

Oracle: The AI Infrastructure Story Hiding in Plain Sight

Near zero debt, Japan centric focus provides future growth

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks