As the European market grapples with concerns over inflated AI stock valuations and shifting interest rate expectations, the pan-European STOXX Europe 600 Index recently saw a decline of 2.21%, reflecting broader market unease. Despite these challenges, opportunities remain for discerning investors who can identify stocks with robust fundamentals and growth potential amid fluctuating economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Freetrailer Group | 0.01% | 23.13% | 31.09% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.27% | 22.67% | ★★★★★☆ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Ion Beam Applications (ENXTBR:IBAB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ion Beam Applications SA designs, produces, and markets solutions for cancer diagnosis and treatments in Belgium, the United States, and internationally with a market cap of €316.67 million.

Operations: Ion Beam Applications generates revenue primarily through its cancer diagnosis and treatment solutions. The company's financial performance is influenced by its ability to effectively manage production and operational costs, impacting its net profit margin.

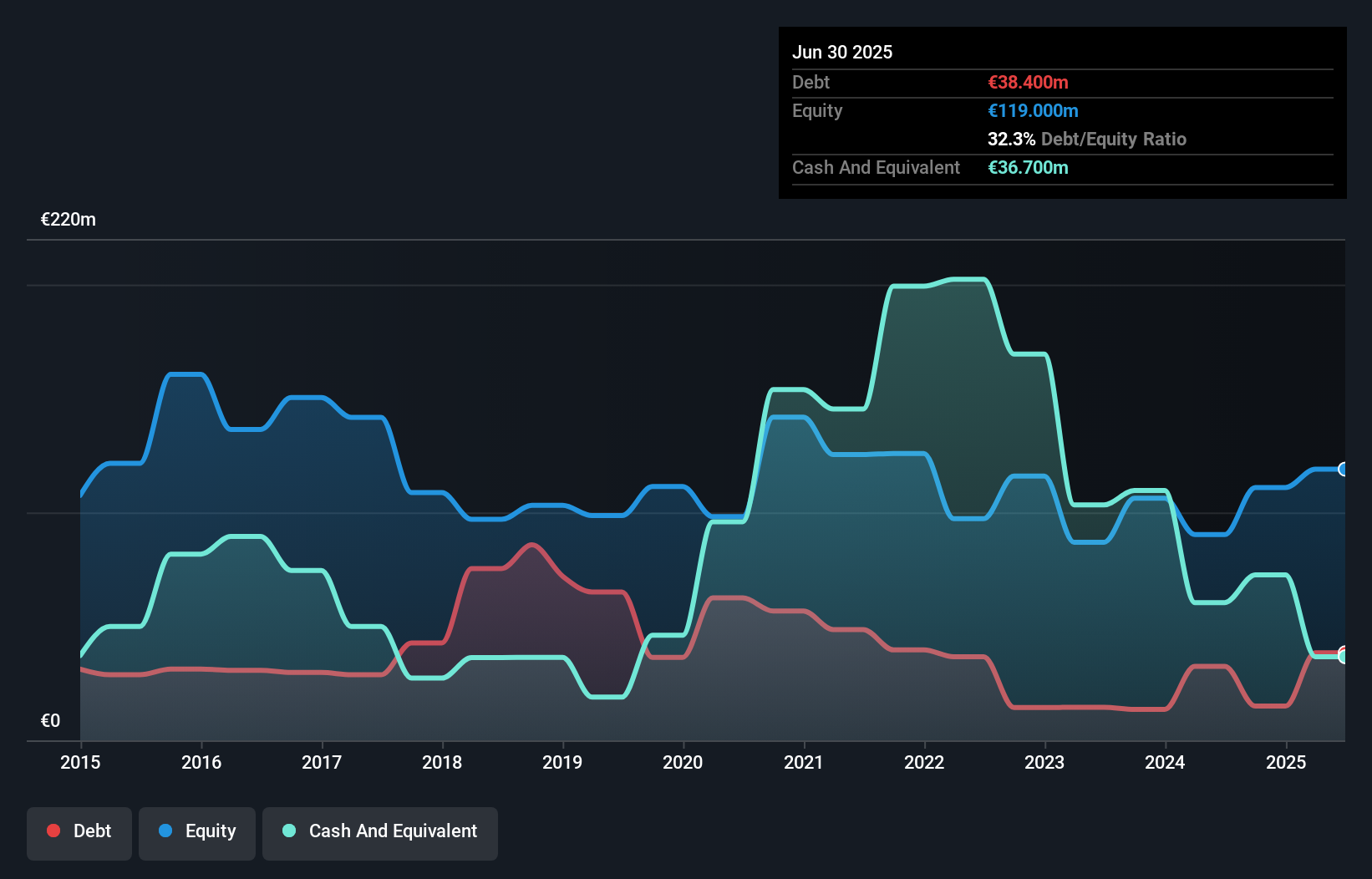

Ion Beam Applications (IBA) is carving out a niche in the medical equipment sector, trading at 61% below estimated fair value. The company's earnings surged by 115.9% last year, outpacing the industry's 7.8%. IBA's debt to equity ratio has impressively dropped from 63.7% to 32.3% over five years, indicating strong financial management. Recent expansions include a new Asia HQ in Beijing, enhancing its footprint in China and strengthening ties with local institutions. With a €6.9 million share buyback completed recently and solid earnings guidance for 2025, IBA seems poised for further growth amidst industry challenges.

Medistim (OB:MEDI)

Simply Wall St Value Rating: ★★★★★★

Overview: Medistim ASA develops, produces, services, leases, and distributes medical devices for cardiac and vascular surgery globally, with a market cap of NOK 4.55 billion.

Operations: Medistim generates revenue primarily from its Medistim Products segment, contributing NOK 567.87 million, and Third-Party Products segment, adding NOK 100.74 million.

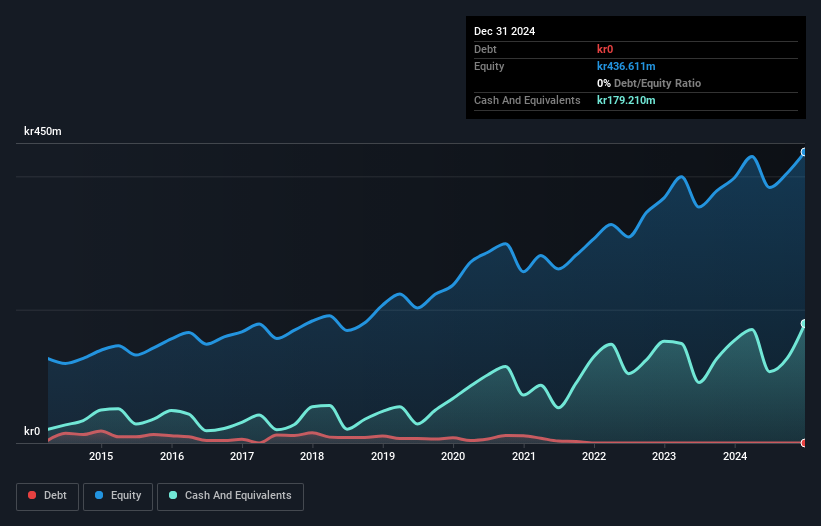

Medistim, a nimble player in the medical device sector, has shown impressive financial health with its debt-free status and 40% earnings growth over the past year. The company's net income for Q3 reached NOK 34.71 million, up from NOK 23.43 million last year, reflecting robust performance and high-quality earnings. Free cash flow remains positive, supporting ongoing innovation and market expansion efforts in regions like China and India. Despite these strengths, potential risks such as industry shifts towards less invasive procedures may impact future prospects; current share prices (NOK 262) exceed analyst targets (NOK 230), hinting at possible market overvaluation.

Norbit (OB:NORBT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Norbit ASA offers technology solutions across various industries and has a market capitalization of NOK 11.32 billion.

Operations: Norbit ASA generates revenue primarily from its Oceans segment at NOK 933.50 million, followed by the Product Innovation and Realization (PIR) segment at NOK 826.90 million, and Connectivity at NOK 575.90 million.

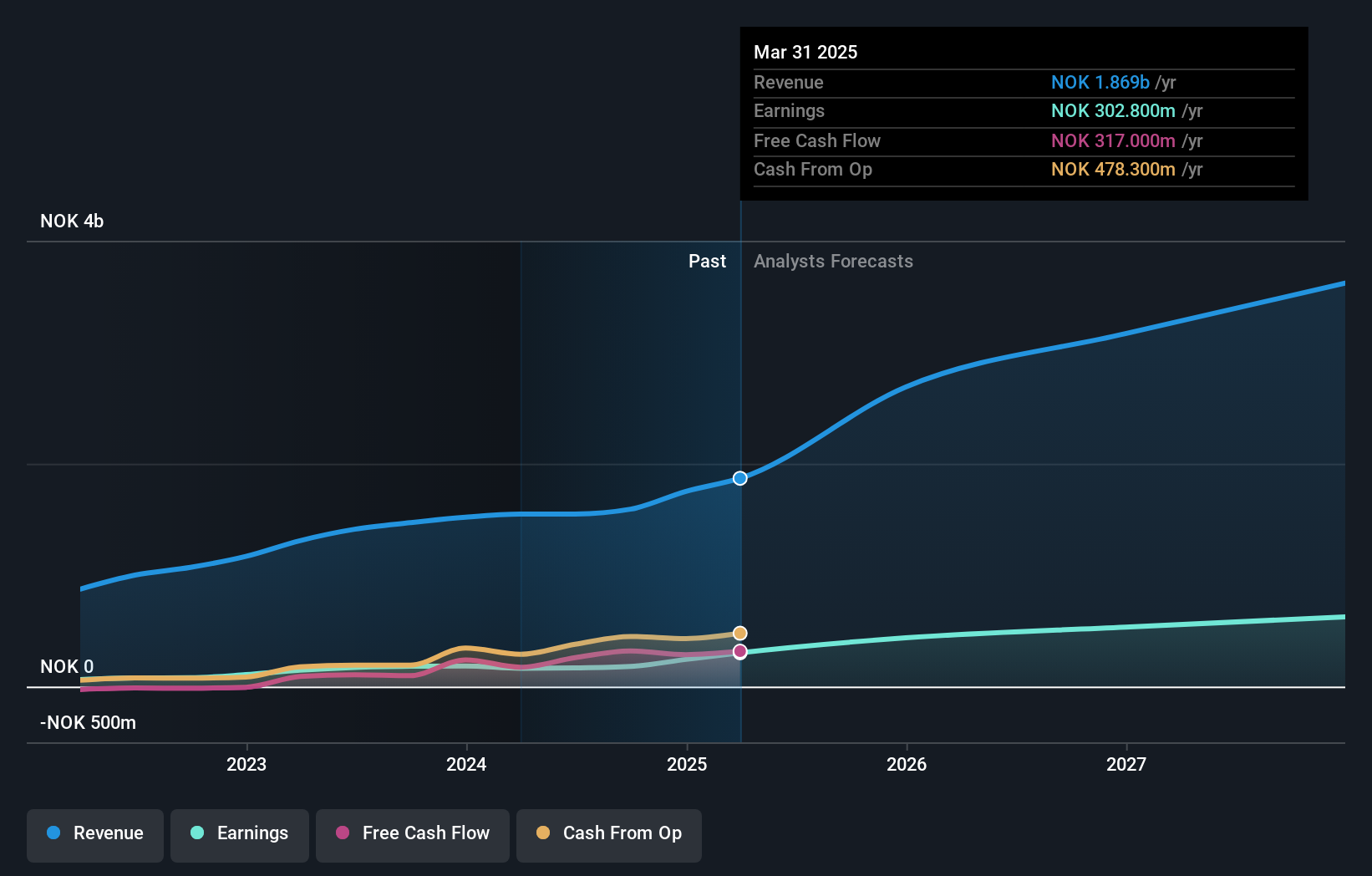

Norbit, a nimble player in the tech arena, is making waves with its innovative sonar and IoT solutions. The company has reported impressive earnings growth of 110% over the past year, outpacing its industry peers. Its debt to equity ratio stands at a manageable 25.6%, ensuring financial stability while trading at 13% below estimated fair value suggests potential upside for investors. Recent highlights include securing a NOK 160 million order from Toll4Europe and projecting full-year revenues between NOK 2.5 billion and NOK 2.6 billion with an EBIT margin of up to 25%. With these developments, Norbit seems poised for continued success amidst market challenges.

Turning Ideas Into Actions

- Click this link to deep-dive into the 312 companies within our European Undiscovered Gems With Strong Fundamentals screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norbit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NORBT

Norbit

Provides technology solutions to customers in a range of industries.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives